Daily technical highlights – (OPCOM, MYEG)

kiasutrader

Publish date: Thu, 19 Aug 2021, 09:26 AM

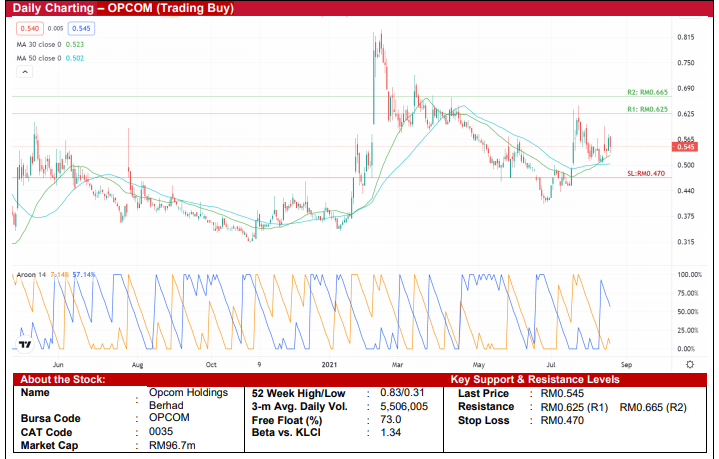

OPCOM Holdings Berhad (Trading Buy)

• On the daily chart, OPCOM has retraced by 51% from its 52-week high of RM0.83 (in mid-February 2021) to a low of RM0.405 (in end-June 2021). Since then, the stock has staged a recovery (up 34%) to close at RM0.545 yesterday.

• From a technical point of view, OPCOM’s share price is set to ride on an upward trajectory based on the following bullish signals: (i) the shorter-term 30-day moving average cutting above the longer-term 50-day moving average, and (ii) the Aroon Up line is currently above the Aroon Down line, which indicates bullish price behaviour.

• As the bullish momentum continues, the stock will likely test our immediate resistance target of RM0.625 (R1; 15% upside potential) and thereafter climb towards our next resistance target of RM0.665 (R2; 22% upside potential).

• Our stop loss price is set at RM0.47 (or 14% downside risk).

• Business-wise, OPCOM is engaged in the manufacturing of cable related products (such as fibre optic cables, HDPE tube & pipe and thixotropic compound) and the provision of engineering services.

• The group’s 4QFY21 revenue increased to RM22.7m (+116% QoQ), which filtered down to a net profit of RM4.0m (+225% QoQ), taking its full-year FY March 21’s bottom-line to RM2.6m (+133.7% YoY)

• In terms of recent corporate news, OPCOM has been awarded a contract worth RM8.4m in the beginning of August 2021 from Telekom Malaysia Berhad to supply optical fibre cables, which is expected to contribute positively to its earnings.

MY E.G. Services Berhad (Trading Buy)

• MYEG is appointed by the Malaysian government to offer a wide scope of electronic government services ranging from: (i) road tax renewal, (ii) checking and payment of various fines imposed by the authorities, and (iii) enabling users to undertake almsgiving duties.

• MYEG’s 1QFY21 revenue came in at RM171.5m (+41% QoQ) with a corresponding increase in net income to RM76.3m (+30% QoQ), which is attributable to higher contributions from its concession services and new commercial services.

• Going forward, consensus is expecting MYEG to report a net income of RM322.0m in FY Dec 21 and RM347.6m in FY Dec 22. This translates to forward PERs of 18.4x this year and 17.0x next year, respectively.

• On the chart, MYEG’s share price has plunged from a high of RM2.27 (at the beginning of March 2021) to as low as RM1.55 (at the beginning of August), representing a retracement of 31%.

• Since then, buying interest has gradually picked up as the shares climbed to close at RM1.65 yesterday.

• From a technical perspective, with the 7-day shorter-term moving average just cut above the longer-term 15-day moving average, the stock’s price is set to ride on an upward trajectory.

• In addition, a technical rebound may take place with the ROC indicator currently treading above the zero-line.

• This could pave the way for the stock to climb and challenge our resistance targets of RM1.86 (R1) and RM2.01 (R2), which represents upside potentials of 13% and 22%, respectively.

• On the downside, we have pegged our stop loss at RM1.48, which represents a downside risk of 10%

Source: Kenanga Research - 19 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024