Daily technical highlights – (NTPM, SIMEPLT)

kiasutrader

Publish date: Tue, 28 Sep 2021, 10:11 AM

NTPM Holdings Bhd (Trading Buy)

• After sliding from a high of RM0.85 in mid-December last year to as low as RM0.46 in mid-August, an ensuing rebound from the trough has reignited buying interest in NTPM shares (which rose 2% yesterday to close at RM0.50 as trading volume jumped 3-fold from the 3-month daily average).

• Following which, the stock is now on the verge of overcoming a descending trendline that stretches back to January this year. And with the stochastics indicator showing the %K line crossing over the %D line in the oversold zone, an upward bias in the share price is anticipated.

• Riding on the momentum, the stock could climb towards our resistance thresholds of RM0.57 (R1; 14% upside potential) and RM0.64 (R2; 28% upside potential).

• We have placed our stop loss price at RM0.44 (representing a 12% downside risk).

• Fundamentally, NTPM – which is involved in the manufacturing and distribution of tissue paper and personal care products – has shown resilience amid the challenging economic backdrop.

• After registering net profit of RM63.7m in FY April 2021 (up from FY20’s net profit of RM6.3m), the group has just released its 1QFY22 results with net earnings coming in at RM15.8m (+8% YoY / +182% QoQ).

• Going forward, consensus is forecasting NTPM to log net profit of RM35.0m for FY April 22 and RM48.0m for FY April 23, which translates to prospective PERs of 16.0x and 11.7x, respectively.

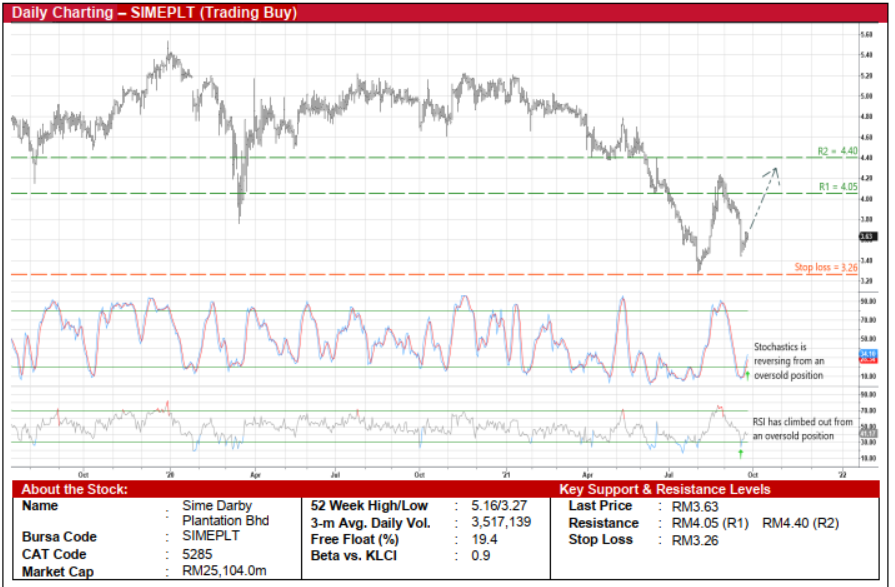

Sime Darby Plantation Bhd (Trading Buy)

• Following the recent sell-down, a price rebound could be underway for SIMEPLT shares, which plunged to as low as RM3.44 last Monday before recouping partially the initial loss to close at RM3.63 yesterday.

• Technically speaking, with both the stochastics and RSI indicators in the midst of climbing out from their oversold territories, the share price is expected to shift higher ahead.

• On the way up, the positive momentum will probably lift the stock to reach our resistance levels of RM4.05 (R1) and RM4.40 (R2). This translates to upside potentials of 12% and 21%, respectively.

• Our stop loss price is set at RM3.26 (or a 10% downside risk).

• From the fundamental viewpoint, SIMEPLT – a fully integrated global plantation company – has been delivering strong results on the back of rising CPO price (with the spot month futures price up 19% YTD to RM4,629 per MT currently).

• For the first half ended June 2021, the group’s bottomline jumped 39% YoY to RM1,179m, which was boosted by an average CPO price of RM3,422 per MT versus 1HFY20’s RM2,475 per MT.

• With CPO price likely to stay elevated in the near term, consensus is projecting SIMEPLT to make higher net profit of RM1,913m (+61% YoY) in FY December 21 before easing off to RM1,432m (-25% YoY) in FY December 22. This translates to forward PERs of 13.1x this year and 17.5x next year, respectively.

Source: Kenanga Research - 28 Sept 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-20

SDG2024-11-20

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-18

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-14

SDG2024-11-14

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-12

SDGMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024