Daily technical highlights – (TALIWRK, YTLPOWR)

kiasutrader

Publish date: Tue, 07 Dec 2021, 09:28 AM

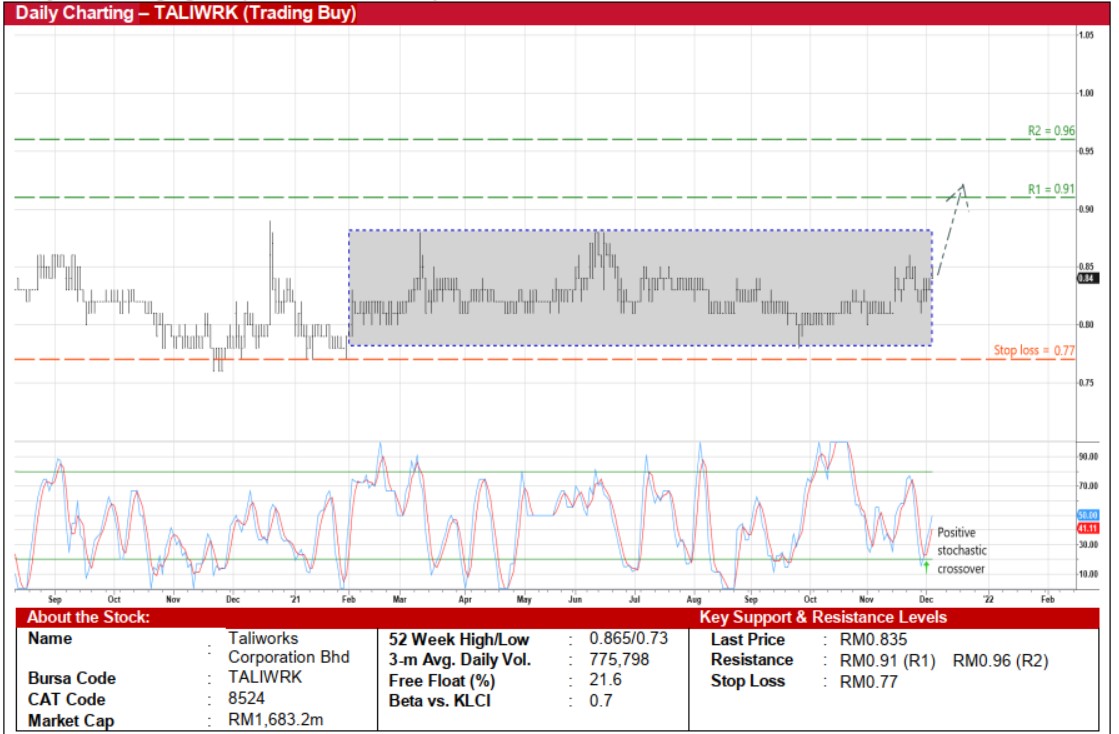

Taliworks Corporation Bhd (Trading Buy)

• An infrastructure group with businesses in operation & maintenance of water treatment plant, highway & toll management, waste management, renewable energy and construction & engineering, TALIWRK announced last Thursday that it has been awarded a contract by Pengurusan Air Selangor for the proposed development of Sg. Rasau water treatment plant and water supply scheme (Phase 1) valued at RM293.9m.

• On account of the group’s ability to generate recurring cashflows, TALIWRK has been rewarding its shareholders with consistent annual DPS incomes (of between 4.8 sen to 6.6 sen in the last five years). Going forward, with consensus projecting DPS of 6.7 sen each for FY December 2022 and FY December 2023, the stock offers appealing prospective dividend yields of 8.0% p.a.

• Its visibility to make constant dividend payouts is also backed by a healthy balance sheet with net cash holdings & investments of RM95.6m (or 4.7 sen per share) as of end-September 2021.

• Earnings-wise, after posting net profit of RM66.3m (+51% YoY) in 9MFY21, the group is forecasted to make net earnings of RM78.0m for FY December 2021 and RM67.1m for FY December 2022, which translate to forward PERs of 21.6x this year and 25.1x next year, respectively.

• From a technical perspective, following the positive signal triggered by the stochastic indicator (with the %K line crossing over the %D line in the oversold area), TALIWRK shares may attempt to break out from an existing rectangle pattern.

• If so, then the stock could advance towards our resistance thresholds of RM0.91 (R1; 9% upside potential) and RM0.96 (R2; 15% upside potential).

• Our stop loss price level is pegged at RM0.77 (or an 8% downside risk from the last traded price of RM0.835).

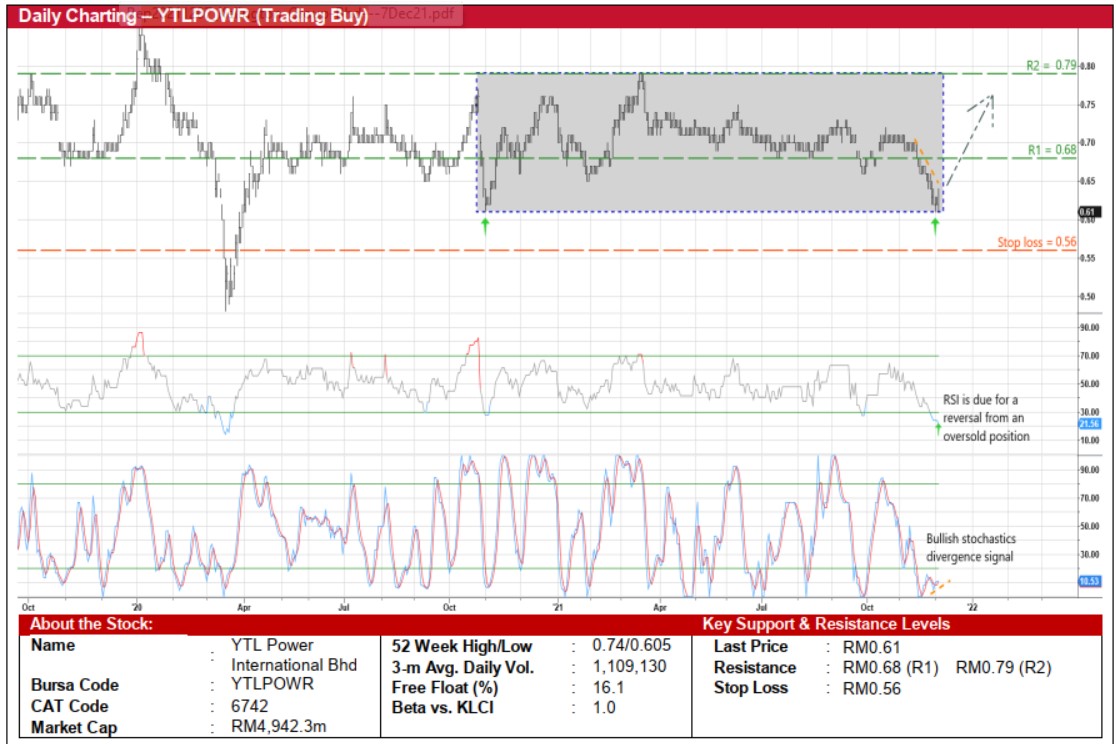

YTL Power International Bhd (Trading Buy)

• After sliding from a recent high of RM0.715 in the second half of October to RM0.61 currently, YTLPOWR’s share price could stage a technical rebound ahead.

• On the chart, the stock – which is presently hovering at its lowest level since late January this year and near the bottom of a rectangle pattern – could shift higher given: (i) the occurrence of a bullish stochastic divergence pattern (as the %D line has formed two rising bottoms in the oversold zone while the share price drifted lower), and (ii) an anticipated reversal of the RSI indicator from an oversold position.

• On the way up, the shares will probably climb towards our resistance thresholds of RM0.68 (R1; 11% upside potential) and RM0.79 (R2; 30% upside potential).

• Our stop loss price level is set at RM0.56 (which represents an 8% downside risk).

• An international multi-utility group with diversified businesses in power generation, water & sewerage and telecommunications spread across Malaysia, Singapore, the United Kingdom, Indonesia, Australia and Jordan, YTLPOWR reported a net loss of RM146.5m for FY ended June 2021 (versus FY20’s net profit of RM67.6m) that was followed by net earnings of RM35.4m (-54% YoY) in 1QFY22.

• Going forward, consensus is projecting the group to show net profit of RM354.1m for FY June 2022 and RM439.2m for FY June 2023, which translate to forward PERs of 14.0x and 11.3x, respectively.

• At the current price level, the stock offers attractive prospective dividend yields of 6.9%-7.2% based on consensus DPS estimates of 4.2 sen in FY22 and 4.4 sen in FY23, respectively.

Source: Kenanga Research - 7 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024