Daily technical highlights – (MYEG, DAYANG)

kiasutrader

Publish date: Tue, 08 Feb 2022, 08:53 AM

My E.G. Services Bhd (Trading Buy)

• A share price rebound could be underway for MYEG after reversing from a recent trough of RM0.89 in late January this year to close at RM0.97 yesterday.

• This follows the bullish technical signals generated by: (i) the stock crossing back above the lower Bollinger Band; (ii) the RSI indicator’s reversal from an oversold position; (iii) the MACD cutting above the signal line in the oversold zone; and (iv) a price bounce-up from an ascending trendline that stretches back to mid-April 2020.

• An upward shift could then propel the share price to challenge our resistance thresholds of RM1.08 (R1; 11% upside potential) and RM1.15 (R2; 19% upside potential), climbing back to its November 2021’s high of RM1.15. We have pegged our stop loss price at RM0.87 (or a 10% downside risk).

• A provider of electronic government (e-government) services with a presence in Malaysia, Philippines, Bangladesh and Indonesia, MYEG made net profit of RM235.4m (+22% YoY) in 9MFY21.

• Consensus is currently forecasting the group will register net earnings of RM325m in FY Dec 2021, RM391m in FY Dec 2022 and RM405m in FY Dec 2023, which translate to forward PERs of 18.3x this year and 17.7x next year, respectively.

• This also suggests that MYEG is poised to surpass its pre-pandemic net profit of RM303.1m for the 15-month financial period ended December 2019 (following a change in FYE from September to December) when its FY21 full-year results are released later this month.

• In addition, the group’s financial position is healthy with a balance sheet that is backed by net cash holdings of RM229.9m (or 3.1 sen per share) as of end-September last year.

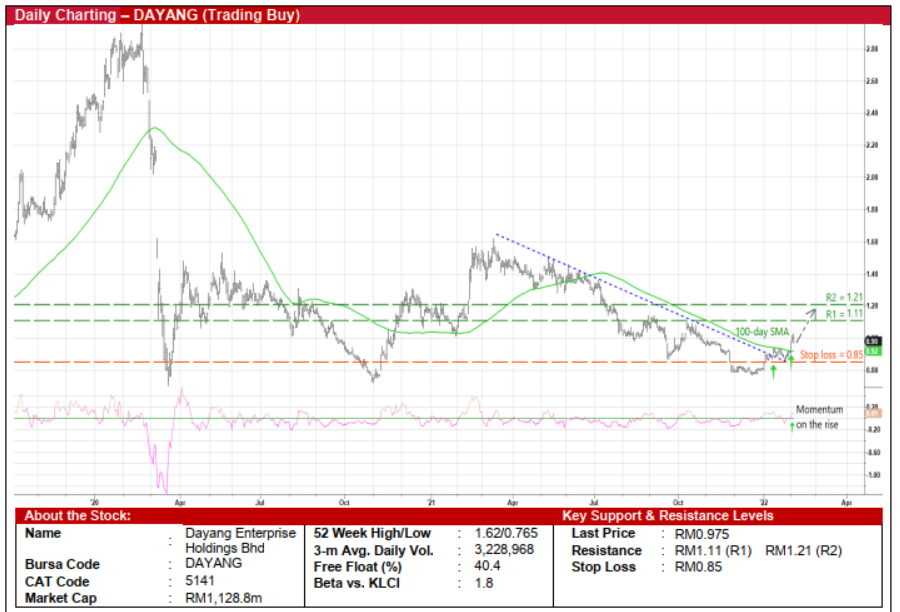

Dayang Enterprise Holdings Bhd (Trading Buy)

• DAYANG shares – after jumping from a 52-week low of RM0.765 in the second half of December last year – could be in the midst of an upward reversal pattern following its breakout from a negative sloping trendline (that stretches back to mid-March last year).

• Coupled with a crossover above the 100-day SMA and the momentum indicator on the increase (after cutting above the zero line), a near-term share price run-up is anticipated.

• On the chart, the stock will probably advance towards our resistance thresholds of RM1.11 (R1; 14% upside potential) and RM1.21 (R2; 24% upside potential).

• Our stop loss price level is pegged at RM0.85 (representing a 13% downside risk from yesterday’s close of RM0.975).

• Business-wise, DAYANG is involved in the provision of marine support services for the oil & gas industry, including maintenance services for topside structures, fabrication operations, hook-up & commissioning services as well as the chartering of marine vessels.

• The group posted net profit of RM19.0m (-47% YoY) in 3QFY21, narrowing its 9MFY21’s net loss to RM30.4m (versus 9MFY20’s net profit of RM44.4m) as its overall performance was hit by lumpy impairment loss, delayed work orders and higher operation costs.

• Based on consensus estimates, DAYANG is forecasted to make net earnings of RM9.1m in FY Dec 2021, RM70.4m in FY Dec 2022 and RM107.9m in Dec 2023. This implies forward PERs of 16.0x this year and 10.5x next year, respectively.

Source: Kenanga Research - 8 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

DAYANG2024-11-23

MYEG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

MYEG2024-11-21

DAYANG2024-11-21

MYEG2024-11-21

MYEG2024-11-21

MYEG2024-11-21

MYEG2024-11-21

MYEG2024-11-21

MYEG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANGMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024