Daily technical highlights – (KPJ, EDGENTA)

kiasutrader

Publish date: Mon, 21 Feb 2022, 10:27 AM

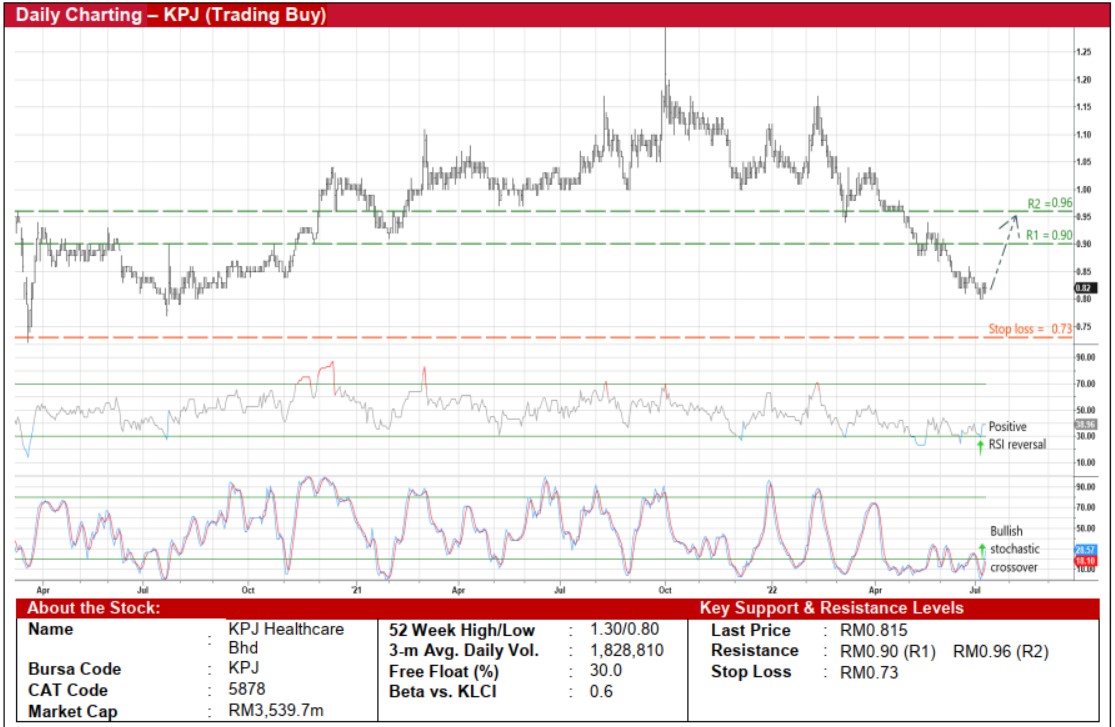

KPJ Healthcare Bhd (Trading Buy)

• Following a fall from a high of RM1.17 in mid-February this year to a trough of RM0.80 last Wednesday (its lowest level since mid-August 2020), KPJ shares may be due for a technical rebound.

• An upward shift in the share price is now anticipated as both the RSI and stochastic indicators are in the midst of reversing from the oversold territory.

• With that, the stock could be making its way to challenge our resistance thresholds of RM0.90 (R1; 10% upside potential) and RM0.96 (R2; 18% upside potential).

• We have set our stop loss price level at RM0.73 (representing a 10% downside risk from yesterday’s close of RM0.815).

• A healthcare services provider which manages a network of specialist hospitals, KPJ reported net profit of RM51.0m (-54% YoY) in FY December 2021 that was followed by quarterly net earnings of RM22.2m (+71% YoY) in 1QFY22.

• Going forward, consensus is forecasting the group’s bottomline to come in at RM128.8m in FY22 and RM170.8m in FY23. This translates to forward PERs of 27.5x this year and 20.7x next year, respectively.

UEM Edgenta Bhd (Trading Buy)

• After sliding from a peak of RM3.50 in the beginning of October 2019 to a trough of RM1.26 at the end of June this year (or back to where it was in October 2012), EDGENTA’s share price has been drifting sideways since then to settle at RM1.28 yesterday, possibly hit an intermediate bottom already.

• A technical bounce-up could be forthcoming triggered by the appearance of: (i) a bottom failure swing by the RSI indicator (which has formed higher bottoms in the oversold zone as the price was drifting lower), (ii) the MACD crossing above the signal line in an oversold area, and (iii) a bullish dragonfly doji candlestick.

• Following which, the stock will probably climb towards our resistance thresholds of RM1.39 (R1; 9% upside potential) and RM1.50 (R2; 17% upside potential).

• Our stop loss price level is pegged at RM1.18 (or a downside risk of 8%).

• On the fundamental front, EDGENTA’s core business activities are in the provision of: (i) healthcare support (comprising both concession and commercial segments, serving over 300 hospitals in Malaysia, Singapore, Taiwan and India), (ii) property & facility solutions, (iii) infrastructure services (covering expressways and rails), and (iv) asset consultancy.

• Earnings-wise, after registering net profit of RM42.0m (+226% YoY) in FY December 2021, the group’s bottomline subsequently increased to RM9.4m (+40% YoY) in 1QFY22.

• According to consensus estimates, its net earnings is expected to rise to RM81.4m in FY22 and RM111.4m in FY23, which translate to forward PERs of 13.1x this year and 9.6x next year, respectively.

• EDGENTA shares also offer decent annual dividend yields of 5.1%-5.5% based on consensus DPS expectations of 6.5 sen for FY22 and 7.1 sen for FY23, respectively.

• Its financial ability to pay dividends is supported by a balance sheet strength that is backed by net cash holdings & short-term investments amounting to RM111.4m (or 13.4 sen per share) as of end-March this year.

Source: Kenanga Research - 13 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

KPJ2024-11-22

KPJ2024-11-22

KPJ2024-11-21

KPJ2024-11-21

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-18

KPJ2024-11-18

KPJ2024-11-15

KPJ2024-11-15

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-13

KPJ2024-11-13

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024