Daily technical highlights – (APB, KPJ)

kiasutrader

Publish date: Fri, 11 Mar 2022, 10:03 AM

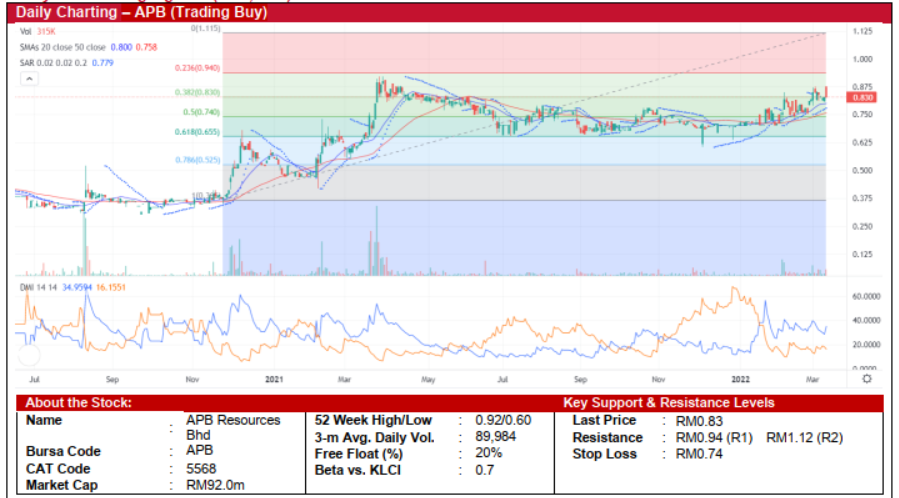

APB Resources Bhd (Trading Buy)

• Chart-wise, APB’s share price moved in an upward trajectory beginning late November 2020 to reach a peak of RM0.92 in March 2021. Thereafter, the shares slipped by 29% to a low of RM0.655 in July 2021 before trending sideways and started to climb higher again in February 2022.

• Based on the following technical indicators, the current upward trend is likely to continue as: (i) the 20-day SMA – which is trending above the 50-day SMA – is signaling a share price positive bias, (ii) the Parabolic SAR indicator is trending higher, and (iii) the DMI Plus is treading above the DMI Minus with their gap widened further recently.

• Thus, based on the Fibonacci extension lines, the stock could rise to challenge our resistance levels of RM0.94 (R1; 13% upside potential) and RM1.12 (R2; 35% upside potential).

• We have pegged our stop loss at RM0.74, which represents a downside risk of 11%.

• APB is involved in three business segments, namely: (i) fabrication of specially designed and manufacturing of engineering equipment, (ii) the provision of non-destructive testing services, and (iii) investment holding and other miscellaneous activities.

• For 1QFY22, the group’s revenue rose by 8% to RM15.9m from RM14.8m in 1QFY21. However, the provision of doubtful debts resulted in the group’s core net profit plunging from RM0.93m in 1QFY20 to a core net loss of RM2.3m.

KPJ Healthcare Bhd (Trading Buy)

• After reaching a peak of RM1.21 in October 2021, KPJ shares slid by 23% to a low of RM0.945 on 8 March 2022.

• We believe the stock has hit a bottom and a technical rebound is forthcoming based on: (i) the stock crossing back above the lower boundary of the Keltner Channel, and (ii) both the RSI and stochastic indicators are bouncing off from the oversold region.

• As such, the stock could rise to challenge our resistance levels of RM1.11 (R1; 12% upside potential) and RM1.15 (R2; 16% upside potential).

• On the downside, our stop loss has been set at RM0.91, which translates to a downside risk of 8%.

• Business-wise, the group provides healthcare services such as a variety of surgical disciplines, medical specialties and hospital clinical services and facilities. The group also owns assets in the form of hospitals and retirement centers in Malaysia, Indonesia, Thailand, Bangladesh and Australia.

• Earnings-wise, the group’s revenue for FY21 rose by 10% to RM2.6b from RM2.4b in FY20, thanks to a higher number of patients who came for treatments during the period. Despite the rise in revenue, the group’s core PATAMI dropped by 54% to RM51.0m in FY21 from RM110.4m in FY20 mainly due to high costs (such as staff costs and maintenance costs) which had adversely affected the group’s margins.

• Going forward, consensus is forecasting the group to post a core PATAMI of RM144.0m and RM176.7m for FY22 and FY23, respectively. This translates to forward PERs of 30.0x (in FY22) and 24.2x (in FY23).

Source: Kenanga Research - 11 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

KPJ2024-11-22

KPJ2024-11-22

KPJ2024-11-21

KPJ2024-11-21

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-20

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-19

KPJ2024-11-18

KPJ2024-11-18

KPJ2024-11-15

APB2024-11-15

APB2024-11-15

APB2024-11-15

KPJ2024-11-15

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-14

KPJ2024-11-13

KPJ2024-11-13

KPJ2024-11-12

KPJ2024-11-12

KPJ2024-11-12

KPJMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024