Daily technical highlights – (GTRONIC, CTOS)

kiasutrader

Publish date: Tue, 15 Mar 2022, 08:50 AM

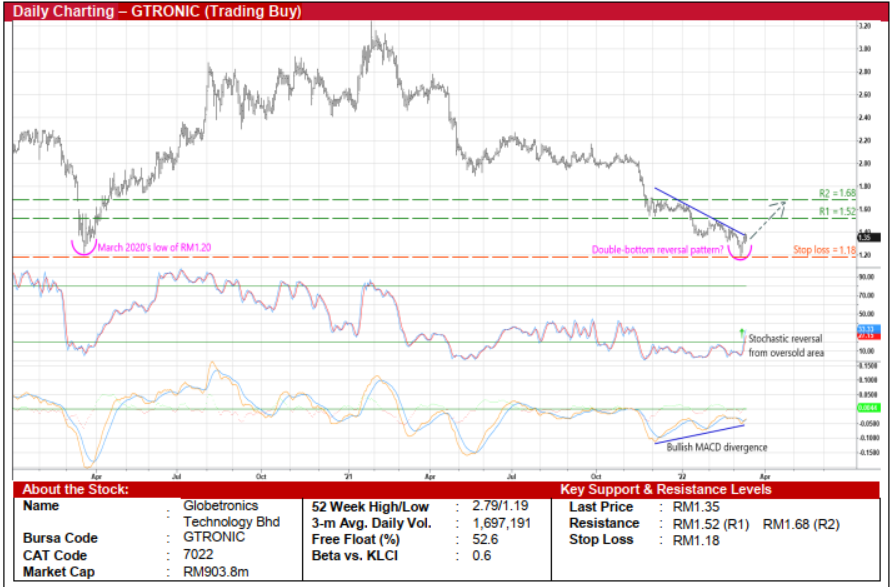

Globetronics Technology Bhd (Trading Buy)

• A price reversal could be underway for GTRONIC shares following a recent bounce from a trough of RM1.19 on 8 March, which mirrored its previous low of RM1.20 during the Covid-19-triggered sell-off in March 2020.

• Following which, the formation of a double-bottom reversal pattern appears to be on the cards as the share price is expected to shift higher based on the positive technical signals generated by: (i) the existence of a bullish MACD divergence (after rising in the oversold zone while the price was dropping), and (ii) the unwinding of the stochastic indicator from an oversold position.

• On the chart, the stock could be making its way towards our resistance thresholds of RM1.52 (R1; 13% upside potential) and RM1.68 (R2; 24% upside potential).

• Our stop loss price level has been placed at RM1.18 (or a 13% downside risk from the last traded price of RM1.35).

• In the business of manufacturing, assembly and testing of semiconductor components such as integrated circuits and sensors, GTRONIC saw its latest quarterly net profit rising to RM17.9m in 4QFY21 (+6% YoY / +10% QoQ), bringing the full year’s bottomline to RM52.9m (+4% YoY). The company has also declared total DPS of 7.5 sen in FY21.

• Going forward, consensus is projecting the group to show an increase in net earnings to RM55.5m in FY December 2022 and RM62.9m in FY December 2023. This translates to forward PERs of 16.3x this year and 14.4x next year respectively, which stand at approximately 0.5 – 1.0 SD below its historical mean.

• An added appeal is GTRONIC’s prospective dividend yields of 5.2% - 5.9% based on consensus DPS estimates of 7.0 sen for FY22 and 7.9 sen for FY23, which are backed by a debt-free balance sheet with cash holdings of RM195.1m (or 29.1 sen per share) as of end-December last year.

CTOS Digital Bhd (Trading Buy)

• The recent price weakness of CTOS shares – down from a high of RM2.09 in early October last year to as low as RM1.33 last Tuesday – offers a buying opportunity. The stock has since rebounded with the formation of a bullish belt hold (as illustrated by a long white candlestick) last Wednesday before finishing at RM1.49 yesterday.

• With the Parabolic SAR currently showing an uptrend, the positive technical signals triggered by the stochastic indicator (which saw its %K line crossing over the %D line) and the MACD indicator (which has overcome the signal line) in their oversold zones are also pointing to an upward price bias ahead.

• That said, the stock could climb to challenge our resistance targets of RM1.66 (R1; 11% upside potential) and RM1.76 (R2; 18% upside potential).

• We have pegged our stop loss price at RM1.35, representing a 9% downside risk from the last traded price of RM1.49. The stock is currently hovering below the closing price of RM1.62 on the first day of its Main Market listing on 19 July last year (versus an IPO offer price of RM1.10).

• A provider of credit information and analytics digital solutions on companies and consumers, CTOS reported net profit of RM43.0m (+10% YoY) in FY21.

• Going forward, based on consensus forecasts, the group is expected to post net profit of RM81.6m in FY December 2022 and RM95.1m in FY December 2023, translating to forward PERs of 42.2x this year and 36.2x next year, respectively.

• This is broadly in-line with CTOS management’s guidance for an internal net profit target of circa RM75m - RM80m for FY December 2022.

• In terms of recent corporate development, CTOS has announced a placement exercise involving 110.0m new shares at an issue price of RM1.58 per share to raise RM173.8m to partially fund its RM205.8m acquisition of a 49% stake in fintech specialist Juris Technologies, which is expected to contribute positively to the group’s immediate earnings.

Source: Kenanga Research - 15 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

GTRONIC2024-11-22

CTOS2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-22

GTRONIC2024-11-21

GTRONIC2024-11-21

GTRONIC2024-11-18

CTOS2024-11-15

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOSMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024