Daily technical highlights – (SCIENTX, SAMCHEM)

kiasutrader

Publish date: Wed, 11 May 2022, 09:51 AM

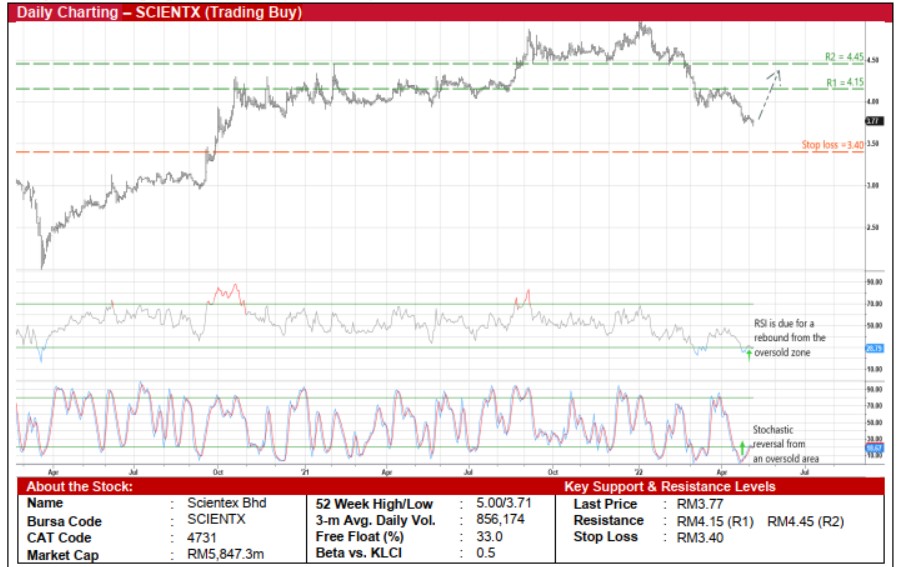

Scientex Bhd (Trading Buy)

• Following a price retracement from a high of RM5.00 in early January this year to an intra-day low of RM3.71 yesterday (or back to where it was in December 2020), a technical rebound could be on the cards for SCIENTX shares.

• This comes as both the RSI and stochastic indicators are poised to climb out from their oversold positions.

• Riding on the renewed technical strength, the stock will probably rise to challenge our resistance levels of RM4.15 (R1; 10% upside potential) and RM4.45 (R2; 18% upside potential).

• Our stop loss price level is set at RM3.40 (representing a downside risk of 10% from yesterday’s close of RM3.77).

• Business-wise, SCIENTX is: (i) one of the world's top manufacturers of stretch film and an end-to-end flexible plastic packaging producer with a presence across the packaging value chain – from stretch films, base films and printed films to bags and multi-layered flexible plastic packaging solutions used in industrial and consumer packaging, and (ii) a property developer of affordable homes in Malaysia.

• The group posted net profit of RM93.7m (-16% YoY) in 2QFY22, bringing 1HFY22’s bottomline to RM196.6m (-4% YoY).

• Going forward, consensus is projecting SCIENTX to make net earnings of RM438.2m for FY July 2022 and RM538.1m for FY July 2023. This translates to forward PERs of 13.3x and 10.9x, respectively.

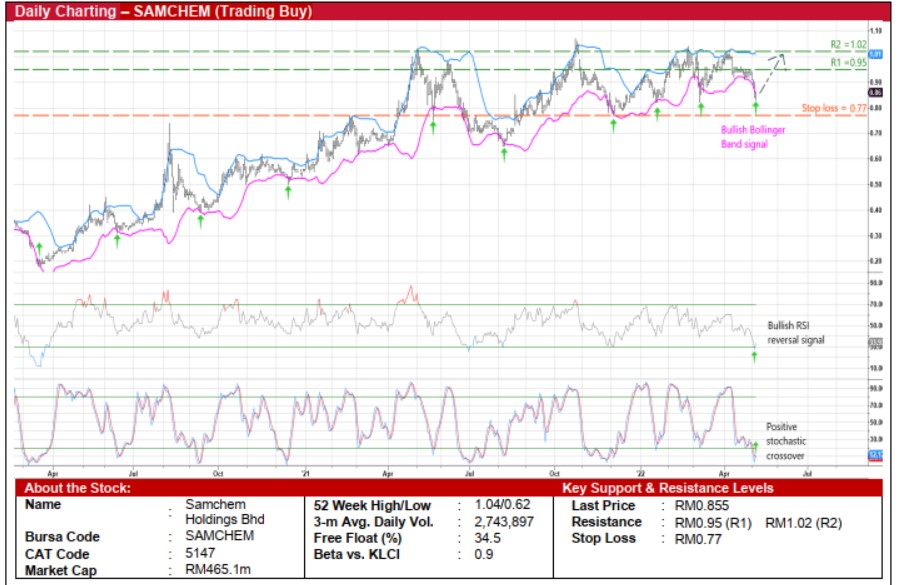

Samchem Holdings Bhd (Trading Buy)

• Presently hovering near the bottom part of an ascending price channel, SAMCHEM shares could shift higher to extend the uptrend pattern ahead.

• Technically speaking, a continuation of the upward trajectory is anticipated as the share price has just crossed back above the lower Bollinger Band while both the RSI and stochastic indicators are in the midst of reversing from their oversold positions.

• With that, the stock is expected to climb towards our resistance thresholds of RM0.95 (R1) and RM1.02 (R2). This translates to upside potentials of 11% and 19%, respectively.

• We have placed our stop loss price level at RM0.77 (or a 10% downside risk).

• A leading industrial chemicals and lubricants distributor in Malaysia and South East Asia, SAMCHEM supplies about 500 different petrochemicals and services to more than 7,000 clients from industries such as automotive, paints & inks, oil & gas and agriculture across the region (mainly in Malaysia, Indonesia, Vietnam and Singapore).

• After registering net profit of RM75.0m (+84% YoY) in FY December 2021, on the back of the reopening of economic sectors across the region, the group’s robust earnings momentum has carried over to 1QFY22 with net profit coming in at RM19.6m (+3% YoY).

Source: Kenanga Research - 11 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

SCIENTX2024-11-22

SAMCHEM2024-11-19

SCIENTX2024-11-18

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-14

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTX2024-11-13

SCIENTXMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024