Daily technical highlights – (LCTITAN, NCT)

kiasutrader

Publish date: Fri, 05 Aug 2022, 09:08 AM

Lotte Chemical Titan Holding Bhd (Trading Buy)

• LCTITAN’s share price has fallen 49% since May 2021 from RM3.54 to close at RM1.81 yesterday. With the share price currently fluctuating near its 52-week low of RM1.80, which represents an intermediate support level, a technical rebound could be anticipated.

• Chart-wise, the stock price is expected to reverse direction as both the stochastic and RSI indicators are set to climb out from the oversold zone.

• Hence, we expect the stock to move up and test our resistance thresholds of RM2.00 (R1; 10% upside potential) and RM2.10 (R2; 16% upside potential).

• Conversely, our stop loss price has been identified at RM1.62 (representing a 10% downside risk).

• Business-wise, LCTITAN is involved in two business activities: (i) the manufacture and sale of polyolefin products, and (ii) the manufacture and sale of olefins & derivative products.

• Earnings-wise, LCTITAN reported a net loss of RM145.9m in 2QFY22, compared with a net profit of RM382.3m in 2QFY21 due to an increase in feedstock costs and a decline in the results of associated company, Lotte Chemical USA Corp. This brought its 1HFY22 bottomline to a net loss of RM41.9m (from net profit of RM822.3m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 0.32x (which is below the minus 1 SD level from its historical mean) based on its book value per share of RM5.59 as of end-June 2022.

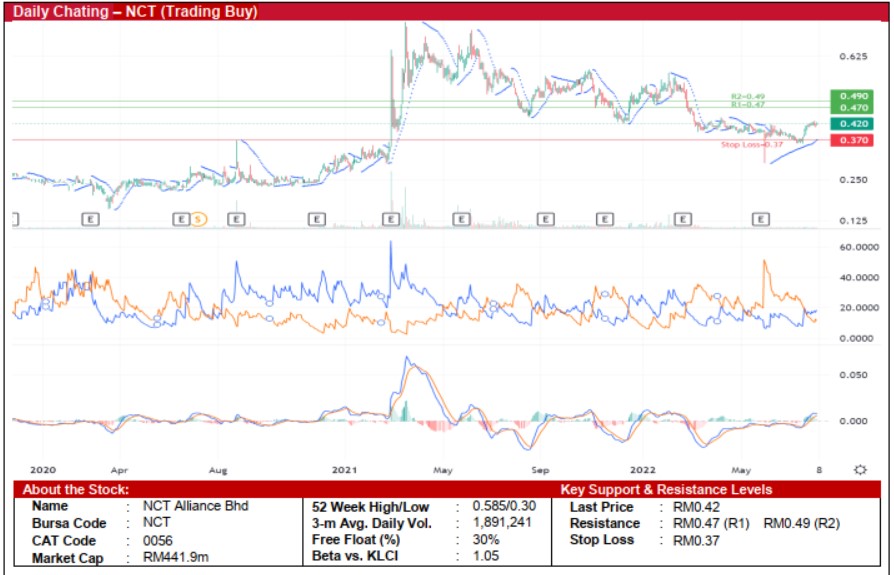

NCT Alliance Bhd (Trading Buy)

• The share price of NCT has trended downwards from the peak of RM0.73 in March 2021 before closing at RM0.42 yesterday.

• On the chart, the share price – which has bounced off from a low of RM0.36 recently – is expected to climb further due to: (i) the rising Parabolic SAR trend, (ii) the crossing of the DMI Plus above the DMI Minus, and (iii) the 12-day moving average still hovering above the 26-day moving average following the MACD golden cross in late July.

• Riding on the upward momentum, we expect the stock to shift higher and test our resistance thresholds of RM0.47 (R1; 12% upside potential) and RM0.49 (R2; 17% upside potential).

• Our stop loss level is pegged at RM0.37 (representing a 12% downside risk).

• Fundamentally speaking, NCT is a real estate developer which offers property development services for various housing projects with a geographical presence mainly in Genting Highlands and Penang.

• Earnings-wise, the group reported a net profit of RM8m in 1QFY22 (+10179% YoY) driven by stronger sales from new property launches as well as completed stocks.

• Valuation-wise, the stock is currently trading at Price/Book Value multiple of 0.92x (or approximately at minus 0.5 SD from its historical mean) based on its book value per share of RM0.455 as of end-March 2022.

Source: Kenanga Research - 5 Aug 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024

DividendGuy67

Hmmm ... if anyone had followed both "trading" calls on LCTITAN and NCT, that would be 2 out of 2 losses. I suppose the next trade might win or lose.

If technical trading profits is only a coin toss (50/50), isn't this a losing game after commissions? All that "technical analysis", time spent - isn't that just a waste of time?

Where's the LONG TERM proof that these "technical analysis" really makes monies, really grow your account after 5, 10 years?

2022-10-23 13:21