Daily technical highlights – (MHB, COASTAL)

kiasutrader

Publish date: Wed, 07 Sep 2022, 09:14 AM

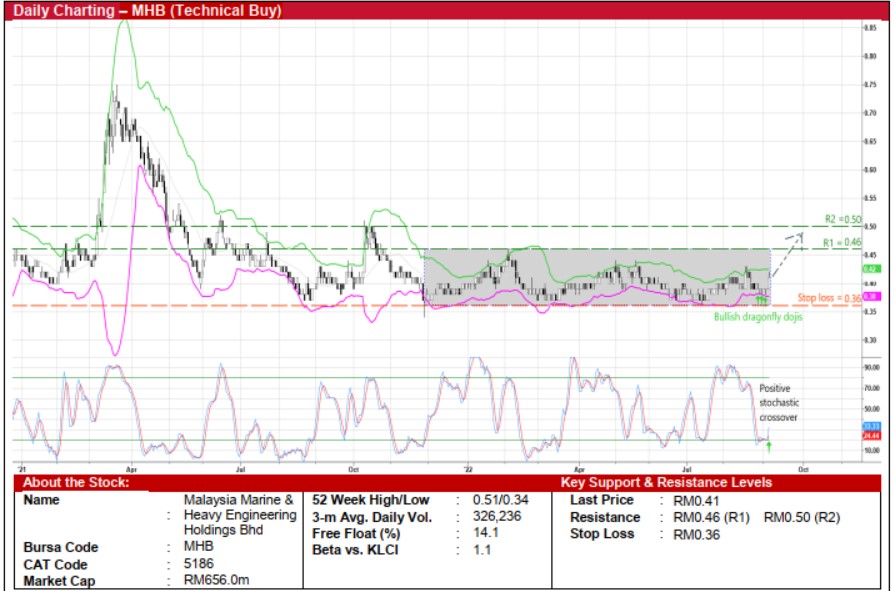

Malaysia Marine And Heavy Engineering Holdings Bhd (Technical Buy)

• After swinging up and down inside a rectangle pattern since early December last year, MHB’s share price (up 5.1% yesterday) is poised to shift higher and strive to break out from its sideway formation next.

• A positive trajectory is currently anticipated backed by bullish technical signals arising from: (i) the price crossing back above the lower Bollinger Band, (ii) the stochastic crossover in the oversold zone, and (iii) the sighting of several dragonfly dojis lately.

• Riding on the price strength, the stock is expected to advance towards our resistance thresholds of RM0.46 (R1) and RM0.50 (R2), which represent upside potentials of 12% and 22%, respectively.

• Our stop loss price level is set at RM0.36 (or a 12% downside risk from yesterday’s close of RM0.41).

• Business-wise, MHB is an energy industry and marine solutions provider for a wide range of heavy engineering facilities and vessels, including offshore conversion services, liquefied natural gas carrier (LNGC) repair and dry docking.

• The group has turned around with a reported net profit of RM22.0m in 2QFY22 (from 2QFY21’s net loss of RM34.4m), bringing 1HFY22 bottomline to RM24.7m (versus net loss of RM138.7m previously).

• Going forward, consensus is projecting MHB to log net earnings of RM11.5m in FY December 2022 and RM30.1m in FY December 2023.

• In terms of valuation, this translates to forward PERs of 57.0x this year and 21.8x next year, respectively with its 1-year forward rolling PER currently hovering at the minus 1SD level from its historical mean.

• In addition, the group’s financial position is underpinned by net cash holdings of RM601.4m (which works out to 37.6 sen per share or slightly more than 90% of its existing share price) as of end-June 2022.

Coastal Contracts Bhd (Technical Buy)

• COASTAL’s share price – which jumped 4.4% to RM1.91 amid heavy trading volume yesterday – could continue its upward trajectory after climbing from a recent low of RM1.65 in the second half of August.

• On the chart, an extended run-up is anticipated in view of the prevailing Parabolic SAR uptrend and the DMI Plus crossing over the DMI Minus recently.

• With that said, the stock will probably rise towards our resistance thresholds of RM2.18 (R1; 14% upside potential) and RM2.30 (R2; 20% upside potential).

• We have placed our stop loss price level at RM1.64 (or a downside risk of 14%).

• COASTAL – which derives its income primarily from shipbuilding, ship repair, vessel chartering and trading of marine support vessels via its services to clients in the offshore oil & gas industry, mining and commodities sectors – posted net profit of RM104.4m in 4QFY22 (up more than 5-fold YoY) to take its bottomline to RM182.5m in FY June 2022 (an increase of more than 5-fold YoY)

• Based on consensus expectations, the group is forecasted to make net earnings of RM146.3m in FY23 and RM127.7m in FY24, which imply forward PERs of 6.9x this year and 7.9x next year, respectively (with its 1-year forward rolling PER presently standing around its historical mean).

Source: Kenanga Research - 7 Sept 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024