Daily technical highlights – (SWIFT, MAYBULK)

kiasutrader

Publish date: Tue, 04 Oct 2022, 09:07 AM

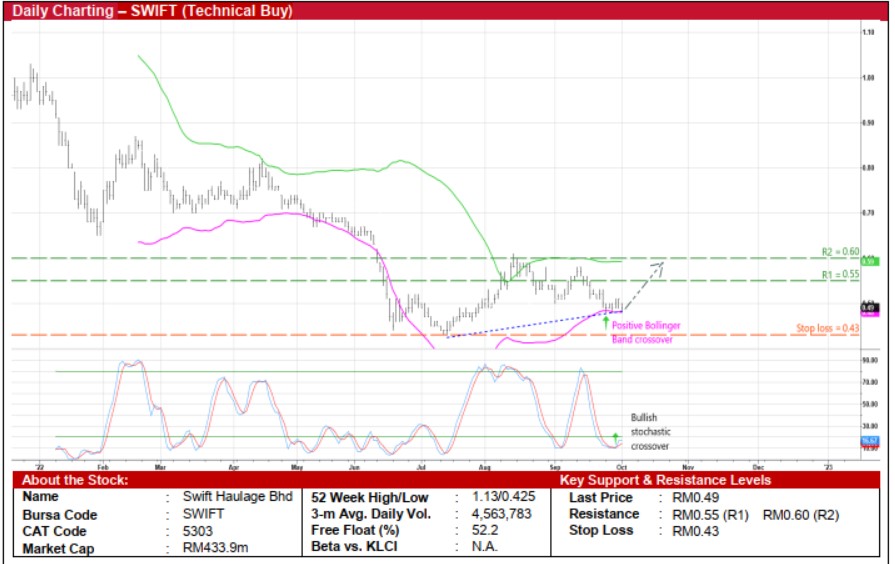

Swift Haulage Bhd (Technical Buy)

• After bouncing off from a trough of RM0.425 in mid-July this year, SWIFT’s share price – which ended at RM0.49 yesterday – is poised to resume its ascending trajectory ahead.

• Technically speaking, an upward shift is currently anticipated following the crossing of the shares back above the lower Bollinger Band and the stochastic indicator’s %K line over the %D line in the oversold territory.

• On the way up, the stock could hit our resistance targets of RM0.55 (R1; 12% upside potential) and RM0.60 (R2; 22% upside potential).

• Our stop loss price level is pegged at RM0.43 (representing a 12% downside risk).

• A multimodal transport operator offering logistics solutions ranging from container haulage, land transportation, warehousing & container depot and freight forwarding services, SWIFT reported net profit of RM13.2m (+14% YoY) in 2QFY22 which then lifted 1HFY22 bottomline to RM27.5m (+23% YoY).

• According to consensus estimates, the group is forecasted to show net earnings of RM55.5m for FY December 2022 and RM62.4m for FY December 2023.

• Valuation-wise, this translates to forward PERs of 7.8x this year and 7.0x next year, respectively with its 1-year rolling forward PER currently hovering at 1SD below its historical mean.

Malaysian Bulk Carriers Bhd (Technical Buy)

• MAYBULK shares may have found an intermediate bottom following a recent pullback from a high of RM0.45 in late August this year to close at RM0.35 yesterday (or back to where it was in the second half of July 2022).

• On the chart, the share price is expected to stage a technical rebound in view of: (i) the bullish stochastic crossover (as the %K line has just cut above the %D line in the oversold area), (ii) the RSI indicator’s ongoing reversal from an oversold position, and (iii) the appearance of a bullish dragonfly doji candlestick.

• This could then lift the stock towards our resistance thresholds of RM0.40 (R1; 14% upside potential) and RM0.43 (R2; 23% upside potential).

• We have placed our stop loss price level at RM0.31 (or an 11% downside risk).

• Fundamentally speaking, MAYBULK – which is principally involved in international dry bulk shipping services – stands to benefit from rising dry bulk charter rates as tracked by the Baltic Dry Index (a composite of dry bulk time charter averages to measure the cost of transporting major raw materials by sea), which has earlier plunged from a peak of 5,650 in early October 2021 to a low of 965 in end-August this year before seeing a subsequent recovery of 88% to 1,760 currently.

• On the earnings front, the group logged net profit of RM61.1m (+91% YoY) in 2QFY22, taking 1HFY22 bottomline to RM69.5m (+48% YoY) as its overall performance was lifted mainly by higher average charter rates (up 26% YoY) and an exceptional gain (of RM50.1m) arising from the disposal of vessel which more than offset the reduced hire days during the period.

• In addition, its balance sheet is backed by net cash & cash equivalents amounting to RM274.4m (or 27.4 sen per share representing slightly more than three-quarter of its existing share price) as of end-June 2022.

• In terms of corporate development, MAYBULK has recently announced its plan to diversify into the grocery retail business via the acquisition of Tunas Manja Sdn Bhd (an operator of a chain of 85 supermarkets and grocery stores operating under the “TMG” brand mostly located in the east coast of Peninsular Malaysia) for a purchase consideration to be determined later.

Source: Kenanga Research - 4 Oct 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

MAYBULK2024-11-22

MAYBULK2024-11-22

MAYBULK2024-11-21

MAYBULK2024-11-20

MAYBULK2024-11-20

SWIFT2024-11-20

SWIFT2024-11-20

SWIFT2024-11-19

MAYBULK2024-11-18

MAYBULK2024-11-18

SWIFT2024-11-18

SWIFT2024-11-18

SWIFT2024-11-15

MAYBULK2024-11-15

MAYBULK2024-11-15

SWIFT2024-11-15

SWIFT2024-11-15

SWIFT2024-11-15

SWIFT2024-11-14

MAYBULK2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-14

SWIFT2024-11-13

MAYBULK2024-11-13

SWIFT2024-11-12

MAYBULKMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024