Daily technical highlights – (EPMB, CARIMIN)

kiasutrader

Publish date: Wed, 16 Nov 2022, 09:21 AM

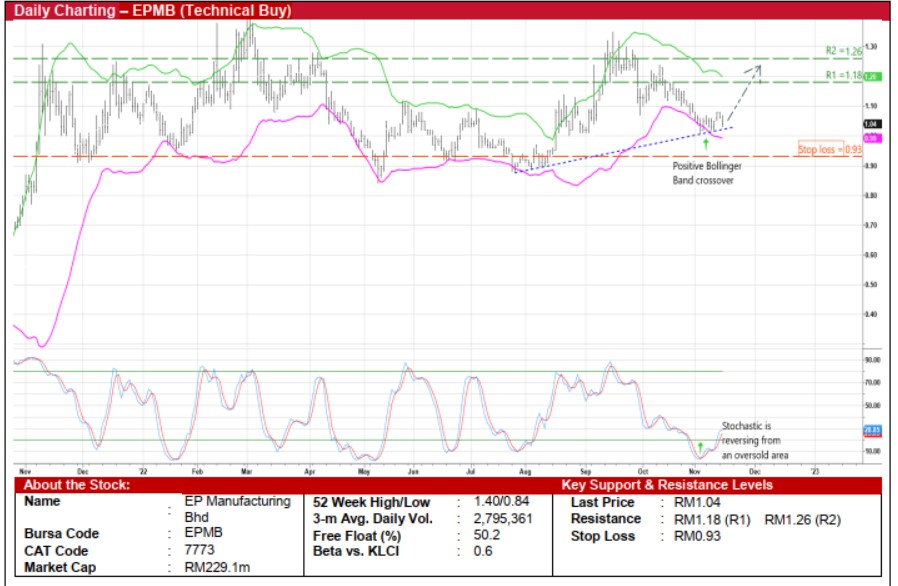

EP Manufacturing Bhd (Technical Buy)

• After sliding from a recent high of RM1.35 in mid-September 2022 to a low of RM1.01 early this month, a subsequent bounce up from a positive sloping trendline suggests that EPMB shares might have found an intermediate bottom already.

• An upward bias is anticipated backed by bullish technical signals arising from the share price crossing back above the lower Bollinger Band and an ongoing reversal from the oversold position by the stochastic indicator.

• With that said, the stock will probably climb towards our resistance thresholds of RM1.18 (R1; 13% upside potential) and RM1.26 (R2; 21% upside potential).

• We have pegged our stop loss price level at RM0.93 (which represents a downside risk of 11% from yesterday’s close of RM1.04).

• From a fundamental perspective, EPMB is mainly involved in the manufacturing and supply of automotive parts (such as metal body panels, chassis parts, rear axles, brake systems and fuel tanks) with a diverse customer base that includes Perodua, Proton, Honda, Mazda and Toyota.

• Earnings-wise, the group narrowed its net loss to RM1.7m in 2QFY22 (from -RM5.0m previously), bringing 1HFY22 net loss to RM1.3m (versus 1HFY21’s net loss of RM3.8m).

• In terms of Price/Book valuation, the stock is currently trading at a multiple of 0.79x (or around 1 SD above its historical mean) based on its book value per share of RM1.32 as of end-June 2022.

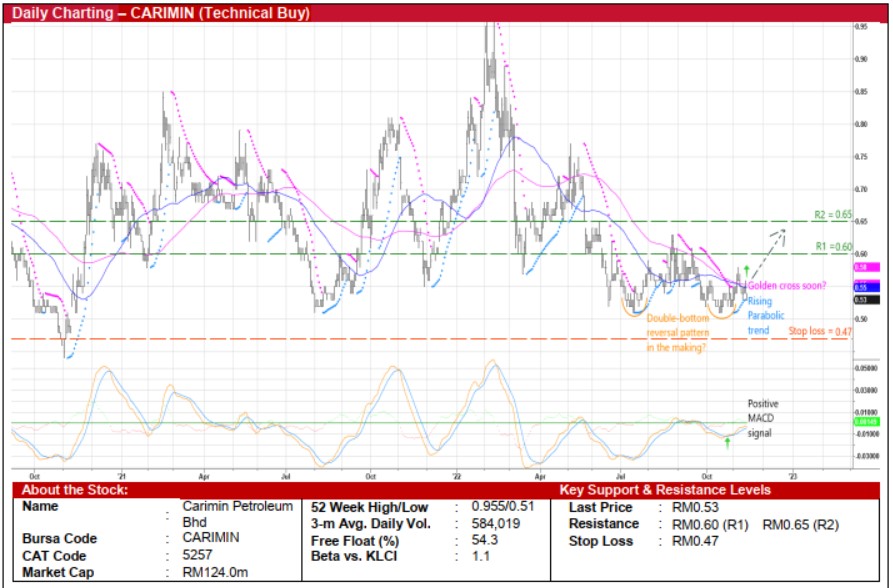

Carimin Petroleum Bhd (Technical Buy)

• An intermediate double-bottom reversal pattern could be in the making for CARIMIN’s share price after rebounding twice from a trough of RM0.51 in mid-July and mid-October this year.

• With the Parabolic SAR showing a rising trend and the MACD cutting above the signal line, the upward trajectory is expected to continue as the 50-day SMA is currently on the verge of staging a golden cross above the 100-day SMA.

• Riding on the positive momentum, the stock will probably advance to challenge our resistance targets of RM0.60 (R1) and RM0.65 (R2), translating to upside potentials of 13% and 23%, respectively.

• Our stop loss price level is set at RM0.47 (or a downside risk of 11%).

• Business-wise, CARIMIN is involved in the provision of technical and engineering support services in the oil & gas industry in Malaysia, focussing mainly on integrated maintenance, rejuvenation, hook-up & commissioning (HUC) of onshore/offshore facilities and the provision of sub-sea underwater inspections, repair, maintenance works & services (IRM) for oil majors.

• The group registered a strong net profit of RM3.5m (+58% YoY) in 4QFY22, ending FY June 2022 with net earnings of RM6.8m (-49% YoY).

• Its balance sheet is backed by net cash & short-term investments of RM66.4m (representing 28.4 sen per share or slightly more than half of its current share price) as of end-June 2022.

Source: Kenanga Research - 16 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024