Daily technical highlights – (MSC, RGTBHD)

kiasutrader

Publish date: Tue, 06 Dec 2022, 09:02 AM

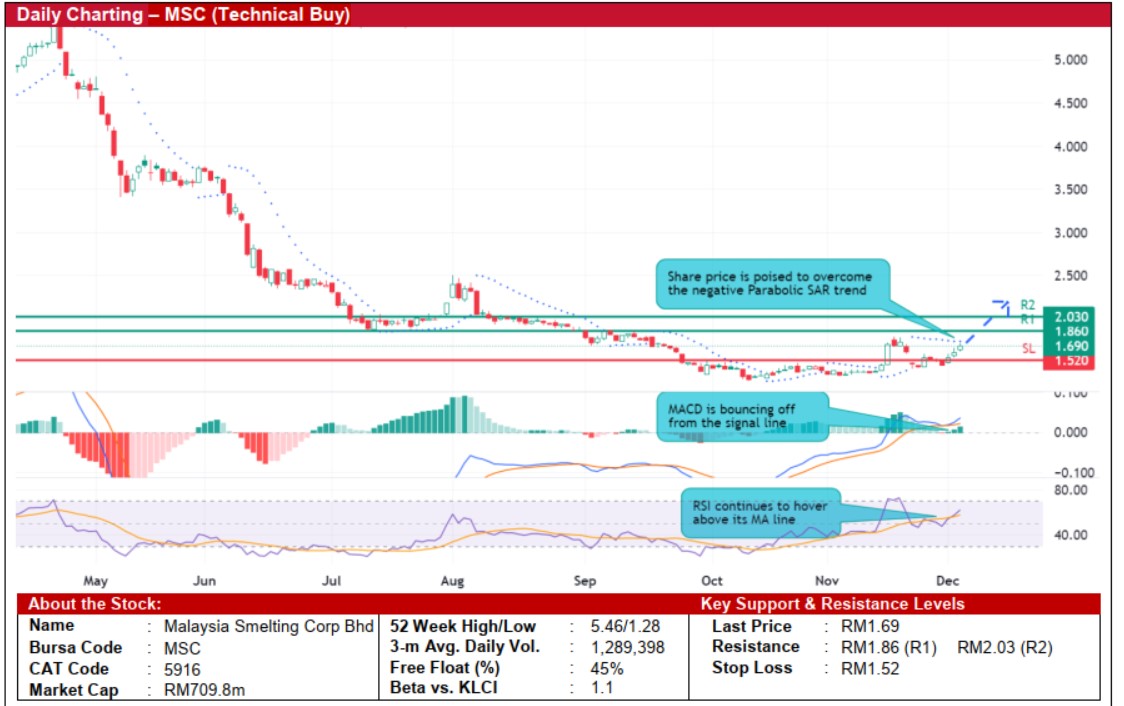

Malaysia Smelting Corporation Bhd (Technical Buy)

• Following a sharp fall from RM5.44 on 22 April 2022 to the trough of RM1.28 in mid-October this year, MSC consolidated in a sideway channel before staging a breakout and pulled away from the resistance line before closing at RM1.69 yesterday.

• The stock is expected to extend its rebound momentum on the back of the following indicators: (i) the share price is on the verge of overcoming the Parabolic SAR downtrend, (ii) the RSI continues to hover above its MA line, and (iii) the MACD is poised to bounce off from its signal line.

• Riding on the bullish indicators, the stock could climb towards our resistance targets of RM1.86 (R1; 10% upside potential) and RM2.03 (R2; 20% upside potential).

• We have set our stop loss price level to RM1.52 (representing a 10% downside risk).

• As a global integrated tin mining and smelting group, MSC is a proxy to soaring tin prices. Global tin prices have jumped 33% since beginning of November this year to USD23,500/MT currently in tandem with the recovery demand for tin following the China easing its zero-Covid policy and gradually reopening its borders.

• With exposure covering both the upstream (i.e., tin mining) and downstream (namely tin smelting) activities of the tin value chain, the group saw its bottomline sink to losses of RM31m in 3QFY22 (-179% QoQ) in tandem with the sharp fall of tin price that stretches back to a peak of USD50,000/MT in March 2022 to as low as USD20,750/MT on end of September this year which then brought its cumulative net profit to RM72.5m for 9MFY22.

• Our consensus is projecting the MSC to record a net profit of RM87.6m in FY December 2022 and RM87.9m in FY December 2023, and it translates to forward PERs of 8.1x for both this and next year, respectively.

RGT Bhd (Technical Buy)

• After a formation of cup-and-handle pattern, RGTBHD has set to breakout from the upper trend line of the handle last week and closed at RM0.415 yesterday.

• Technically speaking, a continuation of the rising momentum may be on the horizon based on the positive signals triggered by: (i) higher lows of RSI while hovering above its MA line, (ii) existence of a golden cross in the MACD, and (iii) positive Parabolic SAR indicators.

• Hence, the stock is poised to challenge our resistance thresholds of RM0.46 (R1; 11% upside potential) and RM0.50 (R2; 20% upside potential).

• Our stop loss price level is pegged at RM0.37 (or an 11% downside risk from yesterday’s close of RM0.415).

• As an integrated, one-stop solution manufacturer of hygiene care and air care products – such as soap, sanitizer, and fragrance dispenser - RGTBHD offers exposure to the growing demand for these products which are widely used to prevent and control the spread of the Covid-19 virus.

• After posting a net profit of RM2.3m (+10% YoY) in 1QFY23, the stock is currently trading at 2.8x PBV based on a book value per share of RM0.15 from valuation standpoint.

Source: Kenanga Research - 6 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024