Daily technical highlights – (KHJB, SCGBHD)

kiasutrader

Publish date: Tue, 13 Dec 2022, 08:56 AM

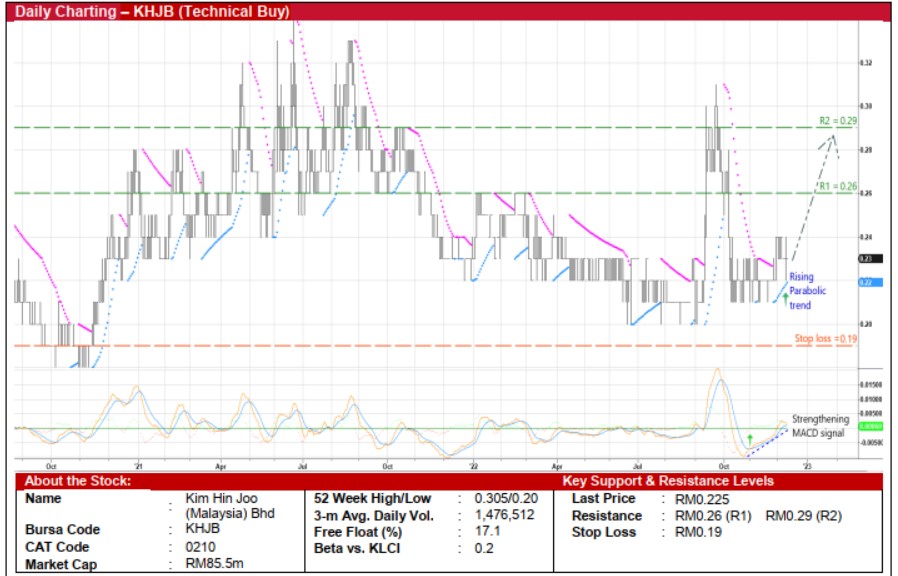

Kim Hin Joo (Malaysia) Bhd (Technical Buy)

• KHJB shares could have found an intermediate bottom already after tumbling from a high of RM0.305 in the second half of September to as low as RM0.21 during most parts of October and November. The share price has since rebounded marginally to close at RM0.225 yesterday.

• From a technical angle, driven by the prevailing rising Parabolic SAR trend and the strengthening MACD signal, the stock is expected to climb further ahead.

• On the chart, the share price will probably shift higher to challenge our resistance thresholds of RM0.26 (R1; 16% upside potential) and RM0.29 (R2; 29% upside potential).

• Our stop loss price level is set at RM0.19 (which translates to a downside risk of 16%).

• A leading retailer of baby, children and maternity products in Malaysia under the Mothercare brand with a network of more than 530 distribution points, KHJB is a proxy to the growing demand from an increasing number of young families in the country.

• Earnings-wise, the group reported net profit of RM1.1m (+142% YoY) in 3QFY22, which took 9MFY22 bottomline to RM4.3m (+89% YoY).

• Financially sound, KHJB’s debt-free balance sheet is backed by net cash holdings & short-term investments of RM18.9m (5.0 sen per share or almost a quarter of the existing share price) as of end-September 2022.

Southern Cable Group Bhd (Technical Buy)

• Presently hovering just above a recent trough of RM0.285 on 21 November this year (its lowest level since November 2020), SCGBHD’s share price may stage a technical rebound anytime soon.

• An upward shift in the shares is anticipated following the appearance of several bullish dragonfly doji candlesticks lately while the stochastic indicator has plotted a sequence of higher highs.

• On account of the bullish technical signals, the stock could advance towards our resistance targets of RM0.34 (R1) and RM0.38 (R2), translating to upside potentials of 17% and 31%, respectively.

• We have pegged our stop loss price level at RM0.25 (or a 14% downside risk from yesterday’s close of RM0.29).

• In the business of manufacturing cables and wires that are used for power distribution and transmission, communications as well as control and instrumentation applications, SCGBHD stands to benefit from an increased infrastructure spending (including 5G network rollouts) by utility players such as Tenaga Nasional, Telekom Malaysia and Petronas.

• The group reported net profit of RM3.8m (+172% YoY) in 3QFY22, which lifted its 9MFY22 bottomline to RM10.0m (+24% YoY).

• Forward earnings visibility will be underpinned by an existing order book of RM752.9m (which represents 1.14 times over the group’s FY21 revenue) to be recognized progressively until 2024.

Source: Kenanga Research - 13 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024