Daily technical highlights – (LGMS, TEXCHEM)

kiasutrader

Publish date: Wed, 14 Dec 2022, 09:23 AM

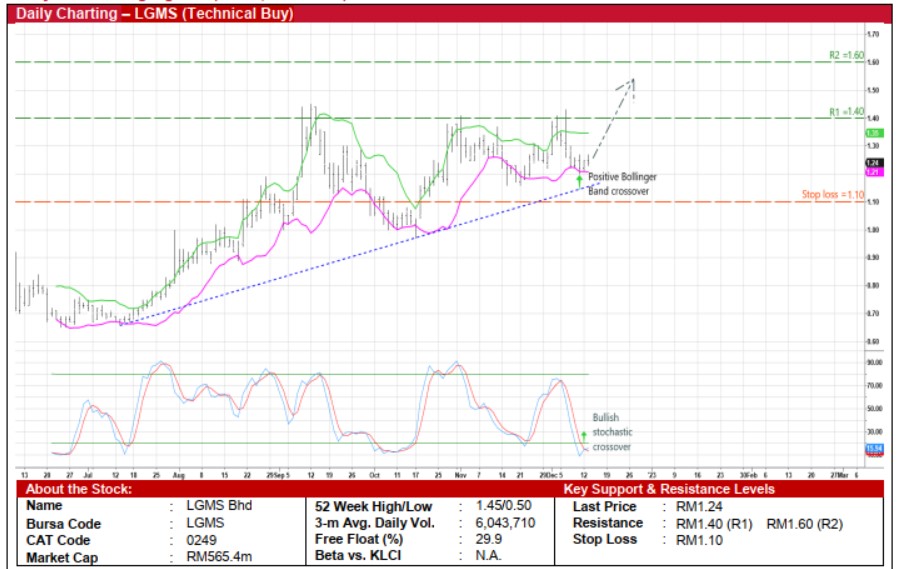

LGMS Bhd (Technical Buy)

• Listed in early June this year at an IPO offer price of RM0.50, LGMS shares subsequently hit a high of RM1.45 in mid September while plotting a sequence of higher lows along the way.

• On the chart, the share price – which ended at RM1.24 amid heavy trading interest yesterday – will probably bounce off from the ascending trendline ahead after moving back above the lower Bollinger Band while the stochastic indicator is on the verge of climbing out from the oversold territory.

• Riding on the positive technical signals, the stock is expected to resume its upward trajectory to challenge our resistance targets of RM1.40 (R1; 13% upside potential) and RM1.60 (R2; 29% upside potential).

• Our stop loss price level is set at RM1.10 (representing an 11% downside risk).

• Business-wise, LGMS is an independent provider of professional cybersecurity services, focussing on cybersecurity assessment and penetration testing, cyber risk management and compliance as well as the provision of digital forensics and incident response services.

• Post-listing, the group reported a maiden quarterly net profit of RM2.7m in 3QFY22, bringing 9MFY22 bottomline to RM8.3m.

• Based on fundamental analysis, Kenanga Research is projecting LGMS to register stronger net earnings of RM12.4m for FY December 2022 and RM16.0m for FY December 2023.

• In terms of valuation, this translates to forward PERs of 45.6x this year and 35.3x next year, respectively.

• Moreover, the group’s financial position is backed by net cash holdings of RM69.0m (or 15.1 sen per share) as of end September 2022.

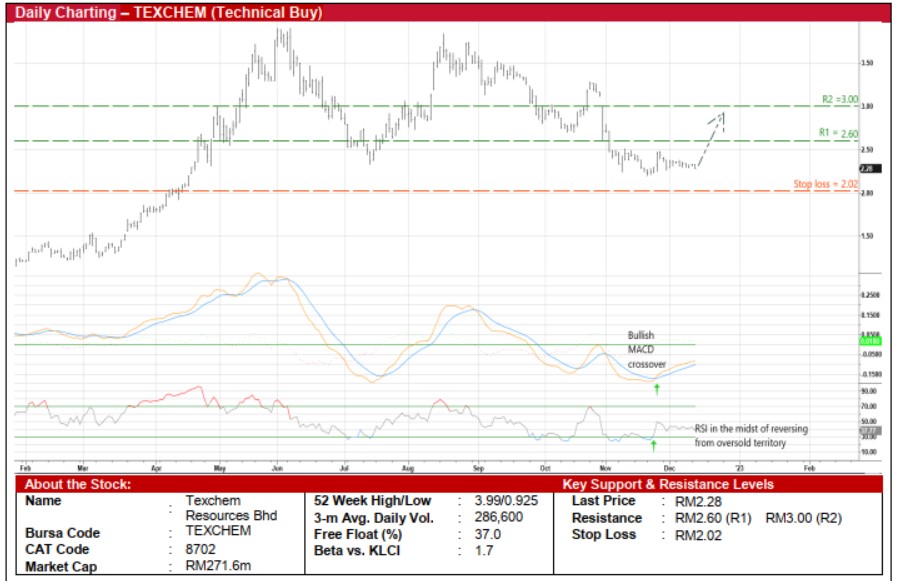

Texchem Resources Bhd (Technical Buy)

• Currently treading not far off from a low of RM2.20 in the second half of last month (which is where it was in mid-April this year), a technical rebound may be on the horizon for TEXCHEM shares after closing at RM2.28 yesterday.

• On the chart, an upward bias in the share price is anticipated as the MACD has crossed over the signal line while the RSI indicator has started to reverse from the oversold zone.

• With that said, the stock could be on its way to reach our resistance thresholds of RM2.60 (R1) and RM3.00 (R2), translating to upside potentials of 14% and 32%, respectively.

• We have placed our stop loss price at RM2.02 (or an 11% downside risk).

• From a fundamental standpoint, TEXCHEM – which has five core business segments, namely industrial, polymer engineering, food, restaurant and venture business – saw its quarterly net profit doubling to RM2.4m in 3QFY22, which took 9MFY22 bottomline to RM22.2m (+169% YoY).

• According to consensus estimates, the group is forecasted to post net earnings of RM41.0m for FY December 2022 and RM50.0m for FY December 2023. This implies forward PERs of 6.6x this year and 5.4x next year, respectively (with its 1-year rolling forward PER presently hovering at 1.5 SD below its historical mean).

Source: Kenanga Research - 14 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024