Daily technical highlights – (INSAS, SDS)

kiasutrader

Publish date: Wed, 28 Dec 2022, 09:17 AM

Insas Bhd (Technical Buy)

• INSAS slid from a peak of RM1.22 in November 2021 to as low as RM0.75 in October this year before rebounding sincethen to close at RM0.84 yesterday. Following that, the formation of a double-bottom pattern has set the stage for furtherrecovery.

• From a technical perspective, a continuation of the rising momentum may be on the horizon backed by the Stochasticindicator which is set to climb out from the oversold area and 12-day moving average still hovering above the 26-day movingaverage following the MACD golden-cross in late October.

• With that, we expect the stock to rise and test our resistance thresholds of RM0.93 (R1; 11% upside potential) and RM1.00(R2; 19% upside potential).

• Conversely, our stop-loss price has been identified at RM0.75 (representing a 11% downside risk).

• Fundamentally, INSAS is an investment holding company which owns stock-broking company M&A Securities and 12.1%-owned semiconductor service provider Inari Amertron with other businesses in investment holding, trading, car rental, andproperty investment & development.

• Earnings-wise, the group reported a net profit of RM16.6m in 1QFY23 compared with a net profit of RM26.7m in 1QFY22mainly due to higher unrealised loss on fair value changes of financial assets at fair value.

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 0.25x (or approximately at 1.0SD belowits historical mean) based on its book value per share of RM3.35 as of end-September 2022.

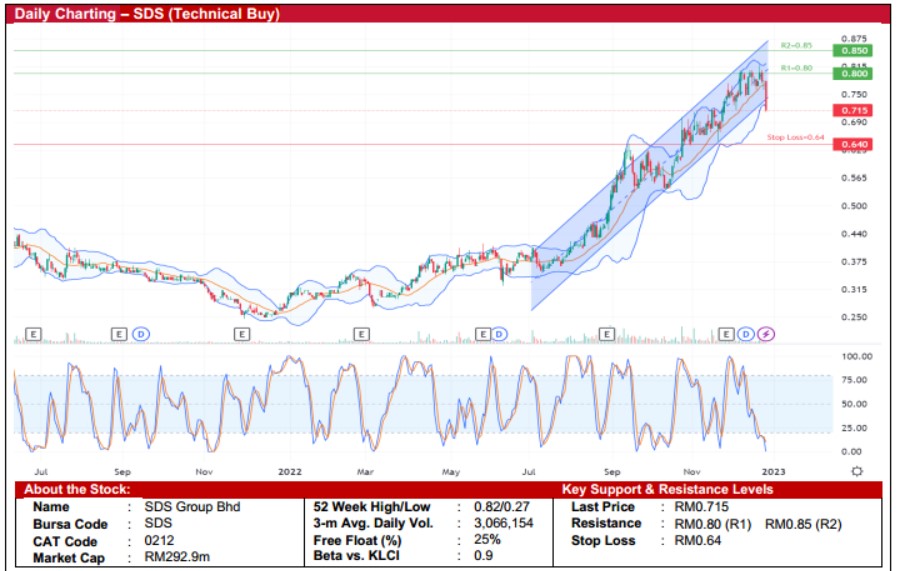

SDS Group Bhd (Technical Buy)

• SDS has surged 208% since late December to as high as RM0.82 and closed at RM0.715 yesterday. With the share pricecurrently hovering near the lower end of the price channel, a continuous upward trajectory is expected.

• The share price is expected to continue its upward momentum backed by: (i) the Stochastic indicator climbing out from theoversold zone, and (ii) the stock price being on the verge of bouncing from the lower Bollinger Band.

• A technical breakout could then lift the stock to challenge our resistance levels of RM0.80 (R1; 12% upside potential) andRM0.85 (R2; 19% upside potential).

• Our stop-loss level is pegged at RM0.64 (representing a 11% downside risk).

• Fundamentally-speaking, SDS is involved in the manufacturing and distribution of bakery products (such as Top Baker andDaily’s) through its retail and wholesale networks.

• Earnings-wise, the group reported a net profit of RM8.7m in 2QFY23 (compared with a net profit of RM0.6m in 2QFY22)mainly driven by the sale of Mid-Autumn Festive products and expansion of customer base and delivery fleet in wholesalesegment. This took 1HFY23 earnings to RM13.2m (versus net profit of RM0.1m previously).

• Based on consensus forecasts, SDS’s net earnings are projected to come in at RM28.1m in FY March 2023 and RM35.7min FY March 2024, which translate to forward PERs of 10.4x and 8.2x, respectively.

Source: Kenanga Research - 28 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024