Daily technical highlights – (AWANTEC, SLVEST)

kiasutrader

Publish date: Wed, 11 Jan 2023, 08:56 AM

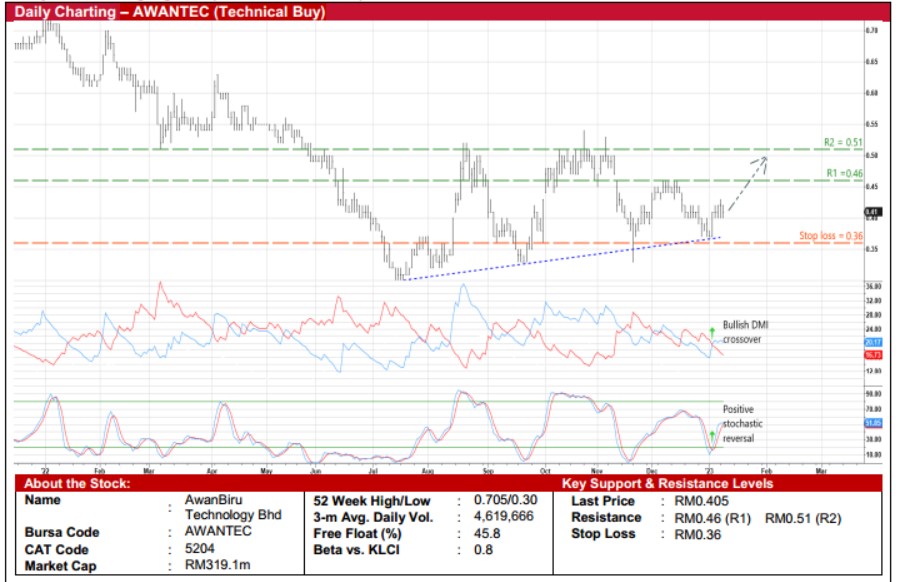

AwanBiru Technology Bhd (Technical Buy)

• A technical rebound may be on the cards for AWANTEC shares after tumbling from a peak of RM1.28 in February 2021 toas low as RM0.30 in mid-July 2022 that was followed by a subsequent recovery to close at RM0.405 yesterday.

• On the chart, a resumption of the rising trajectory is anticipated as the share price will likely pull away from the ascendingtrendline backed by the DMI Plus crossing over the DMI Minus and the stochastic indicator reversing from an oversoldposition.

• With that said, the stock could climb to challenge our resistance targets of RM0.46 (R1; 14% upside potential) and RM0.51(R2; 26% upside potential).

• We have pegged our stop loss price threshold at RM0.36 (representing an 11% downside risk).

• A leading technology and talent digitalisation enabler providing multi-cloud management services and lifelong learning talentlifecycle services, AWANTEC reported a narrower net loss of RM1.4m in 1QFY23 (versus 1QFY22’s net loss of RM1.7m).

• Going forward, consensus is projecting the group to turn in a net profit of RM3.8m for FY June 2023 and RM5.6m for FY June2024.

• In terms of Price/Book Value rating, the stock is currently trading at a multiple of 1.76x (or around the minus 1SD level from itshistorical mean) based on its book value per share of RM0.23 as of end-September 2022.

Solarvest Holdings Bhd (Technical Buy)

• After overcoming both the 50-day and 100-day SMAs recently to reach a high of RM0.905 in mid-December last year,SLVEST’s share price (which finished at RM0.855 yesterday) is on track to climb further ahead.

• The upward shift in the share price will likely be driven by the golden cross by the 50-day SMA above the 100-day SMA andthe strengthening MACD signal.

• Riding on the positive momentum, the stock could rise towards our resistance thresholds of RM0.95 (R1; 11% upsidepotential) and RM1.03 (R2; 20% upside potential).

• Our stop loss price level is set at RM0.76 (or a downside risk of 11%).

• A one-stop solar PV (photovoltaic) solution provider specialising in: (i) turnkey engineering, procurement, construction &commissioning (EPCC) jobs, (ii) operations & maintenance (O&M) services, and (iii) the development and ownership of solarPV assets, SLVEST made net profit of RM5.0m (up 4.9-fold YoY) in 2QFY23, bringing 1HFY23 bottomline to RM9.3m (up7.9-fold YoY).

• According to consensus estimates, the group is forecasted to post net earnings of RM20.4m for FY March 2023 andRM28.0m for FY March 2024.

• This translates to forward PERs of 28.0x this year and 20.4x next year, respectively (with its 1-year rolling forward PERpresently hovering marginally below its historical mean).

• An added investment merit is SLVEST’s steady balance sheet that is backed by net cash holdings of RM58.6m (or 8.8 senper share) as of end-September 2022.

Source: Kenanga Research - 11 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

SLVEST2024-11-22

SLVEST2024-11-21

AWANTEC2024-11-21

AWANTEC2024-11-21

AWANTEC2024-11-21

SLVEST2024-11-20

SLVEST2024-11-19

SLVEST2024-11-18

AWANTEC2024-11-18

AWANTEC2024-11-18

SLVEST2024-11-14

AWANTEC2024-11-14

AWANTEC2024-11-14

AWANTEC2024-11-13

SLVEST2024-11-13

SLVEST2024-11-13

SLVESTMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024