Daily technical highlights – (DUFU, JFTECH)

kiasutrader

Publish date: Wed, 18 Jan 2023, 09:57 AM

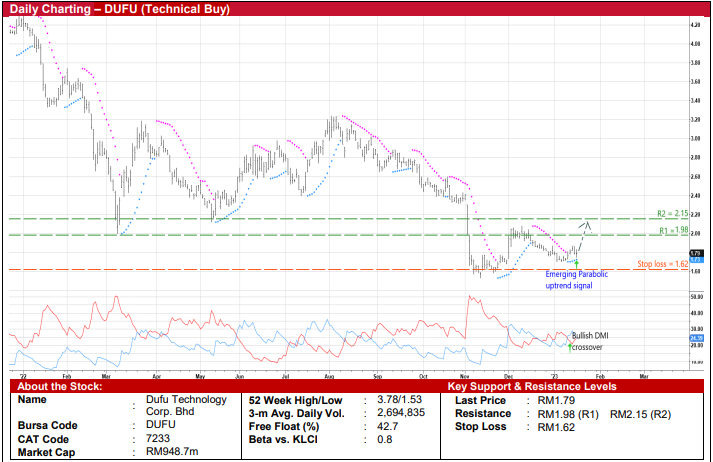

Dufu Technology Corp. Bhd (Technical Buy)

• After sliding from a recent high of RM3.27 in early August last year to as low as RM1.53 on 10 November 2022, DUFU’s share price – which has since recovered to close at RM1.79 yesterday – is expected to carry on its rebound momentum.

• On the chart, an ensuing upward shift is anticipated as the DMI Plus has crossed above the DMI Minus while the Parabolic SAR is signalling an uptrend.

• An extended run-up could then propel the stock to challenge our resistance targets of RM1.98 (R1; 11% upside potential) and RM2.15 (R2; 20% upside potential).

• Our stop loss price level is pegged at RM1.62 (representing a downside risk of 9%).

• Business-wise, DUFU is a specialist in the design, development and manufacturing of high precision machining parts and components for HDD (hard disk drive), industry safety and sensor, telecommunication, consumer electronics, medical, automotive and office equipment.

• The group made net profit of RM16.4m (-19% YoY) in 3QFY22, which took 9MFY22 bottomline to RM64.0m (+15% YoY).

• In terms of Price / Book Value rating, the stock is presently trading at a multiple of 2.8x (or around 1.5SD below its historical mean) based on its book value per share of RM0.64 as of end-September 2022.

• Additionally, the group’s balance sheet is backed by net cash holdings of RM41.2m (or 7.8 sen per share) as of endSeptember 2022.

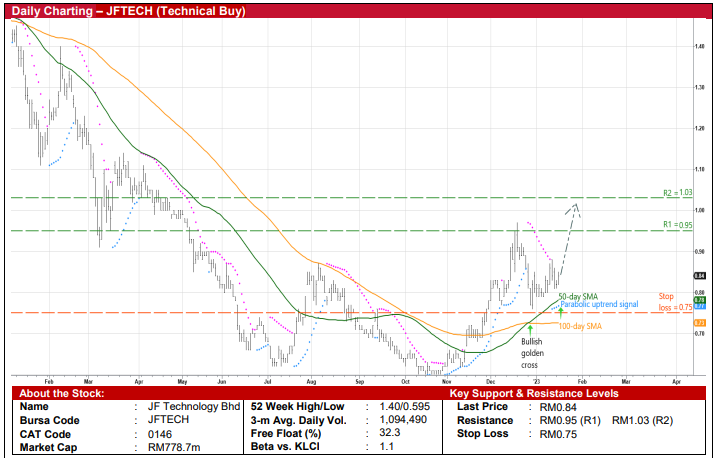

JF Technology Bhd (Technical Buy)

• A resumption of the price rebound for JFTECH shares – which started to climb from a trough of RM0.595 in late October last year – is probable after its recent retracement from a high of RM0.965 on 19 December 2022.

• This comes as the share price (which jumped 3.1% to close at RM0.84 yesterday) is expected to shift higher following the golden cross by the 50-day SMA above the 100-day SMA while the Parabolic SAR is signalling a positive bias.

• With that said, the stock could be on its way to reach our resistance thresholds of RM0.95 (R1) and RM1.03 (R2), which translate to upside potentials of 13% and 23%, respectively.

• We have pegged our stop loss price level at RM0.75 (representing a downside risk of 11%).

• A leading manufacturer of high-performance test contacting solutions for global integrated circuit (IC) makers, JFTECH logged net profit of RM4.4m (-12% YoY) in 1QFY23 after posting net earnings of RM17.2m (+14% YoY) in FY June 2022.

• Valuation-wise, the stock is currently trading at a Price / Book Value multiple of 6.0x (or slightly below the minus 1SD level from its historical mean) based on its book value per share of RM0.14 as of end-September 2022.

• Financially sound, the group is in a net cash position of RM78.9m (or 8.5 sen per share) as of end-September 2022.

• Meanwhile, JFTECH’s listing status has been transferred from the ACE Market to the Main Market effective 19 December last year, which could boost its investment appeal to a broader range of investors.

Source: Kenanga Research - 18 Jan 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024