Daily technical highlights – (KAB, ELSOFT)

kiasutrader

Publish date: Wed, 08 Feb 2023, 09:40 AM

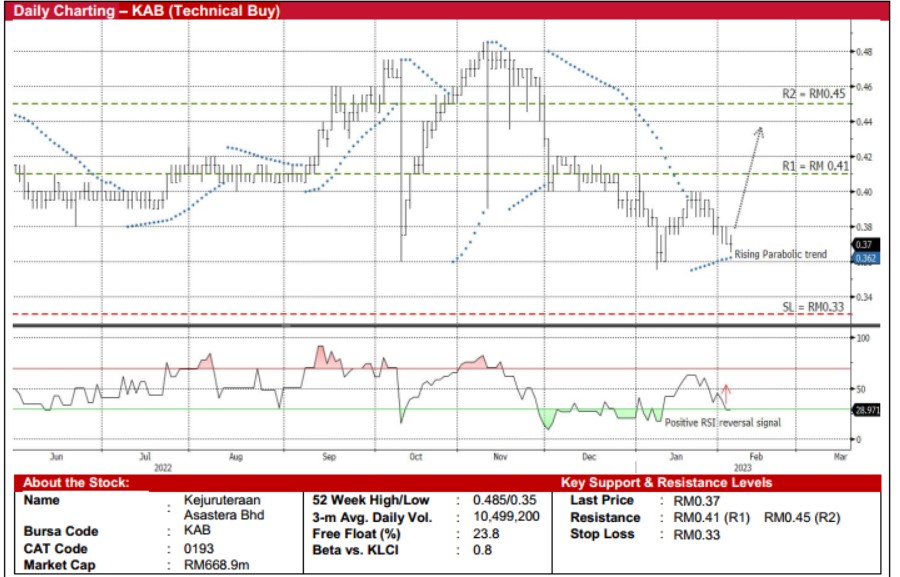

Kejuruteraan Asastera Bhd (Technical Buy)

• A technical rebound may be in the making for KAB shares after plunging from a recent high of RM0.485 in the first half of November 2022 to as low as RM0.355 in early January this year.

• Its share price – which ended at RM0.37 amid heavy trading interest yesterday – is anticipated to shift higher ahead as the Parabolic SAR is signalling a rising trend while the RSI indicator is in the midst of climbing out from the oversold zone.

• That being the case, the stock could be on its way to challenge our resistance targets of RM0.41 (R1; 11% upside potential)and RM0.45 (R2; 22% upside potential).

• Our stop loss price level is pegged at RM0.33 (representing an 11% downside risk).

• KAB is primarily involved in the business of providing: (i) electrical and mechanical engineering services for both commercial and residential buildings, and (ii) energy-efficient and renewable energy solutions.

• The group reported higher net profit of RM1.0m in 3QFY22 (up from RM0.2m in 3QFY21), which brought 9MFY22 bottomline to RM2.3m (-27% YoY).

• Based on its book value per share of RM0.07 as of end-September 2022, the stock is presently trading at a Price/Book Value multiple of 5.29x (or marginally above the minus 1SD level from its historical mean).

Elsoft Research Bhd (Technical Buy)

• After finding support around the RM0.56 level since mid-October last year that was followed by a price breakout above the descending trendline in the beginning of January this year, a trend reversal could be in the works for ELSOFT shares.

• With the Parabolic SAR signalling a positive trend and the MACD indicator on the rise, the share price will likely plot an upward trajectory ahead.

• On the chart, the stock could climb towards our resistance thresholds of RM0.71 (R1) and RM0.75 (R2), translating to upside potentials of 15% and 21%, respectively.

• We have placed our stop loss price level at RM0.54 (or a downside risk of 13% from the last traded price of RM0.62).

• Business-wise, ELSOFT is principally involved in the research, design, development and manufacturing of automated test equipment (ATE), burn-in systems and application specific embedded control systems for the semiconductor and optoelectronics sectors (catering mostly to the automotive, smart devices and general lighting industries). It is also planning to diversify into the medical device-related business (by developing control boards for renal care medical equipment).

• For 3QFY22, the group posted net profit of RM3.6m (+21% YoY), which consequently lifted cumulative net earnings to RM11.6m (+117% YoY) for 9MFY22.

• Financially healthy, ELSOFT’s debt-free balance sheet is backed by cash holdings & unit trusts / quoted shares investments of RM74.9m (or 11.1 sen per share which accounts for almost one-fifth of its existing share price) as of end-September 2022.

• The stock is presently trading at a Price/Book Value multiple of 3.65x (or at 1SD below its historical mean) based on its book value per share of RM0.17 (as of end-September 2022).

Source: Kenanga Research - 8 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Dec 30, 2024

Created by kiasutrader | Dec 27, 2024

Created by kiasutrader | Dec 27, 2024

Created by kiasutrader | Dec 23, 2024

Created by kiasutrader | Dec 23, 2024