Daily technical highlights – (BETA, EDGENTA)

kiasutrader

Publish date: Wed, 08 Mar 2023, 09:45 AM

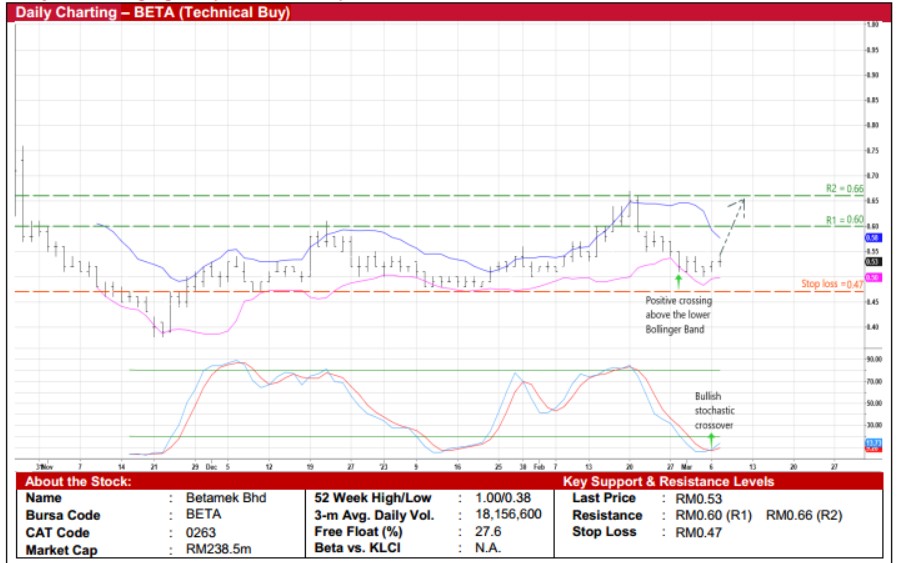

Betamek Bhd (Technical Buy)

• A technical rebound may be in the making for BETA shares following the slide from a high of RM0.67 on 20 February to aslow as RM0.50 last Friday before closing at RM0.53 yesterday.

• On the chart, the share price will likely climb further after crossing back above the lower Bollinger Band as the stochasticindicator unwinds from the oversold condition.

• Riding on the positive momentum, the stock could be on its way to reach our resistance thresholds of RM0.60 (R1; 13%upside potential) and RM0.66 (R2; 25% upside potential).

• Our stop loss price level is pegged at RM0.47 (representing a downside risk of 11%).

• Listed in late October last year at an IPO offer price of RM0.50, BETA is an electronics manufacturing services (EMS)provider specialising in the design & development, procurement and manufacturing of customised electronics andcomponents for the automotive industry (such as vehicle audio products and components).

• The group recorded net profit of RM1.7m in 3QFY23 (partly dragged by non-recurring listing expenses of RM2.9m), bringingcumulative net earnings to RM10.6m in 9MFY23.

• Based on its book value per share of RM0.30 as of end-December 2022 – which is backed by net cash holdings of RM32.7m(or 7.3 sen per share) – the stock is presently trading at a Price / Book Value multiple of 1.77x.

• In terms of recent corporate development, BETA has secured a contract worth RM123.5m from Perodua to supply variouselectronics parts for a new Perodua car model over a six-year period starting from 1QCY23.

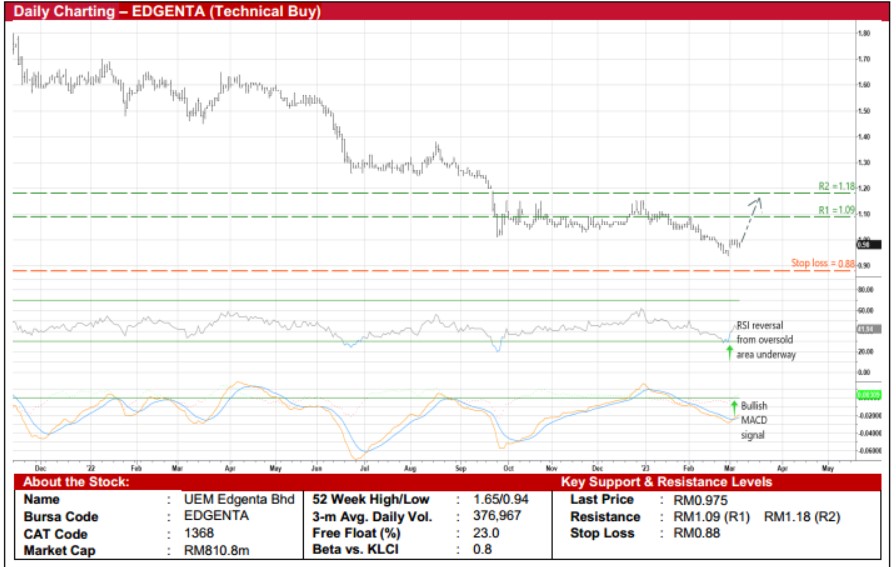

UEM Edgenta Bhd (Technical Buy)

• A recent lift-off from a 13½ -year low of RM0.94 in end-February this year could pave the way for EDGENTA shares – whichended at RM0.975 yesterday – to continue riding on the strengthening momentum.

• With the RSI indicator in the midst of reversing from an oversold position and the MACD cutting over the signal line, anupward shift in the share price is anticipated.

• That being the case, the stock will likely climb further to challenge our resistance targets of RM1.09 (R1; 12% upsidepotential) and RM1.18 (R2; 21% upside potential).

• We have placed our stop loss price level at RM0.88 (or a downside risk of 10%).

• Business-wise, EDGENTA’s core business activities are in the provision of: (i) healthcare support (comprising bothconcession and commercial segments, serving over 300 hospitals in Malaysia, Singapore, Taiwan and India), (ii) property &facility solutions, (iii) infrastructure services (covering expressways and rails), and (iv) asset consultancy.

• The group saw its bottomline inching up to RM21.0m (+5% YoY) in 4QFY22, taking full-year net profit to RM45.9m (+9%YoY) in FY December 2022.

• According to consensus expectations, EDGENTA’s net earnings is forecasted to jump to RM80.6m in FY23 and RM94.0m inFY23, which translate to forward PERs of 10.1x this year and 8.6x next year, respectively (with its 1-year rolling forward PERcurrently hovering marginally above the minus 2SD level from its historical mean).

• Financially steady, the group’s balance sheet is backed by net cash holdings & short-term investments of RM207.0m(translating to 24.9 sen per share or approximately one-quarter of its existing share price) as of end-December 2022.

• Meanwhile, EDGENTA has recently declared DPS of 4.0 sen (ex-date on 19 April and payment date on 18 May), implyingdividend yield of 4.1%. Going forward, based on consensus DPS estimates of 5.9 sen for FY23 and 7.3 sen for FY24, thestock offers prospective dividend yields of 6.1% and 7.5%, respectively.

Source: Kenanga Research - 8 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024