Daily technical highlights – (YBS, YEWLEE)

kiasutrader

Publish date: Thu, 20 Apr 2023, 09:04 AM

YBS International Bhd (Technical Buy)

• Following a breakout from its immediate resistance line of RM0.545 on 26 January 2023, YBS’ share price has traded in anupward channel, bouncing off from the bottom of the channel recently to close at RM0.67 yesterday.

• The stock is poised to swing higher on the back of the following positive technical signals: (i) an emerging Parabolic SARuptrend, (ii) the MACD has crossed above the signal line, and (iii) rising buying interest as suggested by the Stochasticindicator.

• This could then push the stock towards our resistance targets of RM0.75 (R1; 12% upside potential) and RM0.82 (R2; 22%upside potential).

• Our stop loss price level is pegged at RM0.59 (representing a downside risk of 12%).

• YBS – which is involved in the engineering and manufacturing of high precision moulds, tools and dies – registered a netprofit of RM0.6m in 3QFY23 (-38% QoQ), which brought its 9MFY23 cumulative bottomline to RM3.7m (+5.7% YoY).

• Valuation-wise, the stock is currently trading at a Price / Book Value multiple of 2.3x based on its book value per shareRM0.29 as of end-December 2022.

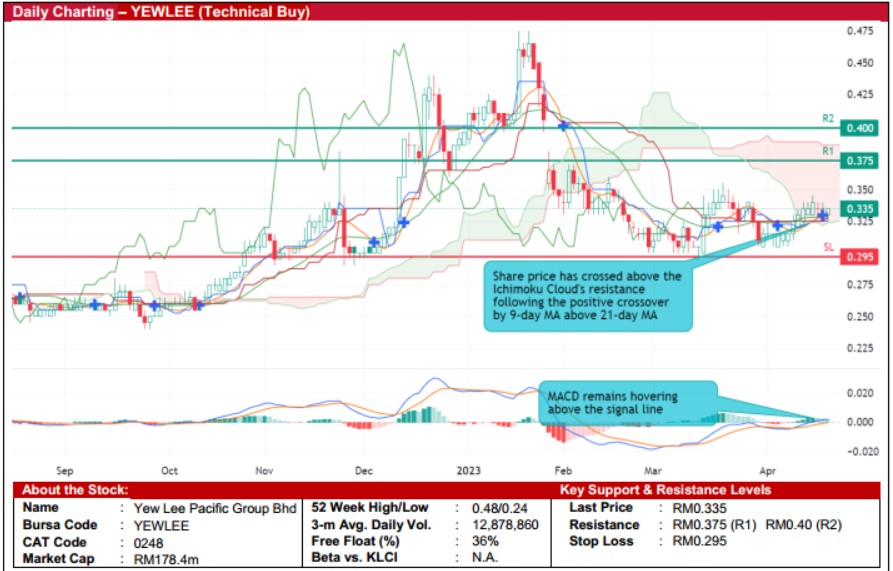

Yew Lee Pacific Group Bhd (Technical Buy)

• After gapping down from the prior day’s closing of RM0.405 in late-January 2023 to plunge further to as low as RM0.30 on 28Feb 2023, YEWLEE’s share price has subsequently moved sideways before closing at RM0.335 yesterday.

• Technically speaking, we believe the stock could stage a breakout ahead to fill the price gap as the share price has crossedabove the Ichimoku Cloud’s resistance following the positive crossover by the 9-day MA above the 21-day MA while theMACD continues to hover above the signal line.

• Hence, the stock could rise to challenge our resistance thresholds of RM0.375 (R1; 12% upside potential) and RM0.40 (R2;19% upside potential).

• Our stop loss price level is set at RM0.295 (representing a downside risk of 12%).

• YEWLEE is principally engaged in the manufacturing and trading of industrial parts, such as industrial brushes, machineryparts and hardware products in Malaysia.

• The group posted a net loss of RM1.1m in 4QFY22 (compared to net profit of RM0.8m in 3QFY22), which brought its FY22full-year bottomline to a net loss of RM1.5m (no prior year comparison was available as the Company was listed on 7 June2022).

• Based on its book value per share of RM0.14 as of end-December 2022, the stock is currently trading at a Price / Book Valuemultiple of 2.4x.

Source: Kenanga Research - 20 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024