Daily Technical Highlights - (HHGROUP, UMC)

kiasutrader

Publish date: Tue, 16 May 2023, 12:31 PM

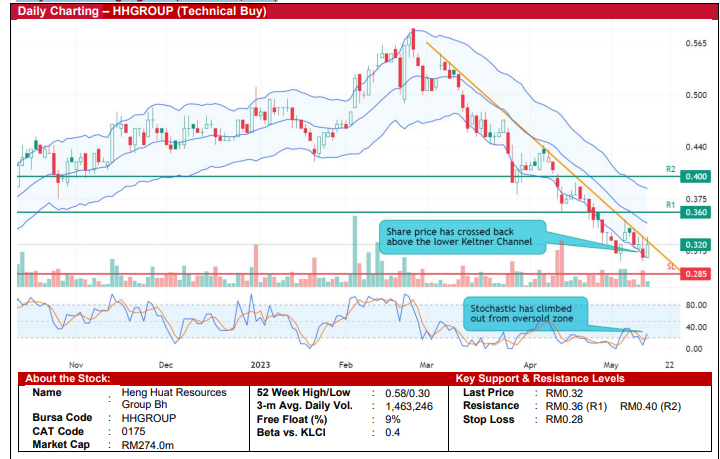

Heng Huat Resources Bhd (Technical Buy)

• Following a retracement of 48% from the peak of RM0.58 in late-February 2023 to as low as RM0.30 on 5 May 2023, HHGROUP might have found an intermediate support before it rose to challenge the descending immediate resistance of RM0.32 yesterday.

• A breakout could be on the cards, backed by the bullish technical indicators of the stochastic indicator that has climbed out from oversold territory and further supported by the share price bouncing up to cross back above the lower Keltner Channel.

• Ergo, the stock could rise to challenge our resistance thresholds of RM0.36 (R1; 13% upside potential) and RM0.40 (R2; 25% upside potential).

• On the other hand, we have pegged our stop loss price at RM0.28 (representing a 13% downside risk from the closing price of RM0.32 yesterday).

• HHGROUP – which is involved in the manufacturing and trading of biomass materials (i.e. coconut fibre and oil palm empty fruit bunch fibre), mattress and other related products – reported a net profit of RM9.5m (+70% QoQ) in 3QFY23, which lifted its 9MFY23 cumulative net earnings to RM17.4m (+149% YoY).

• Valuation-wise, the stock is currently trading at Price/Book Value multiple of 1.6x, based on its book value per share of RM0.20 as of end-December 2022.

Umedic Group Bhd (Technical Buy)

• UMC’s share price has been trading sideways, forming higher lows and higher highs since 21 November 2022 before it retraced back to lower range of the upward channel to close at RM0.76 yesterday.

• Chart-wise, a technical rebound could be on the horizon in view of: (i) the 21-day EMA crossing above the 21-day MA, and (ii) the stock price crossing back above the lower Bollinger Band.

• An upward shift could then propel the stock to advance towards our resistance targets of RM0.855 (R1; 13% upside potential) and RM0.94 (R2; 24% upside potential).

• Our stop loss level is pegged at RM0.665 (representing a 12% downside risk).

• Business-wise, UMC is a healthcare and medical devices manufacturer and distributor serving a wide scope of healthcare facilities in Malaysia and overseas.

• The group reported a net profit of RM2.9m (+45% QoQ) in 2QFY23 and cumulative 1HFY23 earnings of RM4.9m (+7% YoY).

• Based on consensus estimates, UMC is expected to deliver higher net profit of RM9.9m in FY July 2023 and RM13.3m in FY July 2024, which translate to forward PERs of 28.7x and 21.4x, respectively.

Source: Kenanga Research - 16 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Dec 23, 2024

Created by kiasutrader | Dec 23, 2024