Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

kiasutrader

Publish date: Mon, 13 May 2024, 11:09 AM

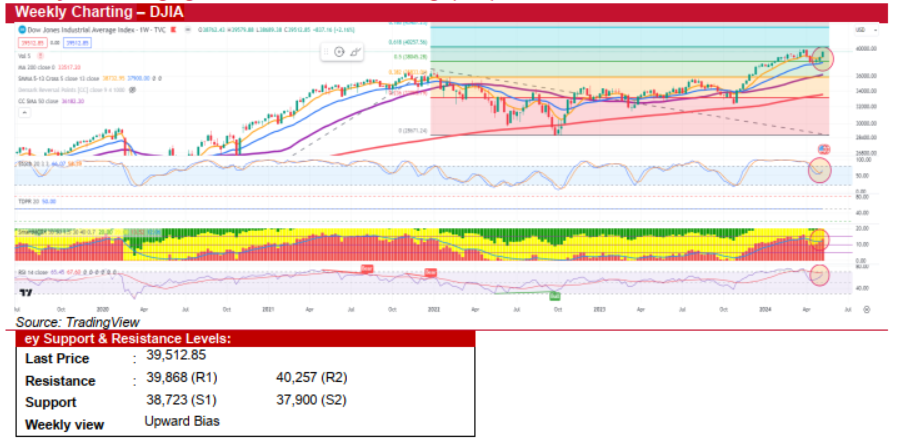

Dow Jones Industrial Average (DJIA) (Upward Bias)

- As expected, US stock indexes rose for the third consecutive week as earnings season nears its end, with the DJIA, S&P 500 and NASDAQ increasing by approximately 2.1%, 1.9%, 1.1%, respectively. The surge brought the benchmark indices close to record high, fuelled by better-than-expected earnings reports that suggest continued economic and profit growth. About 90% of S&P 500 companies have reported their 1QCY24 earnings, beating estimates by 8.5%—the biggest surprise since 3QCY21, with earnings up 5.5% from last year. This performance underpinned the strong market gains and indicates potential for a 10% annual earnings growth. Recent data suggest that economic growth and the labour market might be softening. However, when viewed through the lens of the Fed, a gradual slowdown could help bring inflation to a 2% target.

- This week, the focus will on the inflation-related economic indicators with key reports like Tuesday’s Producer Price Index (PPI), Wednesday’s Consumer Price Index (CPI), and retail sales data. March's CPI indicated a rise to 3.5% year-over-year, up from 3.2%, with core inflation at 3.8%. The outcomes of these reports could potentially steer the markets to new highs or trigger a downturn, depending on whether the data align with expectations or exceed them, signalling hotter inflation trends.

- Technically, the DJIA has sustained its uptrend, confirming a bullish outlook by firmly closing above its 5-week SMA. The bullish signal is reinforced by the weekly Stochastic indicator crossing above the %D line and the RSI trending upward, nearing its 14-week SMA.

- In short, we expect trading to continue its upward trend this week. A solid break above the all-time high of 39,868 would further strengthen the bullish outlook, with the next immediate resistance level at 40,257. Conversely, slipping below the 5- week SMA support at 38,723 could see the index testing its next crucial support level at 37,900. Failure to hold this level would suggest the onset of a downtrend.

Source: Kenanga Research - 13 May 2024

More articles on Kenanga Research & Investment

Malaysia Manufacturing PMI - Reverted to Below Threshold Level in June Amid Muted Demand

Created by kiasutrader | Jul 02, 2024

Indonesia Consumer Price Index - Price Pressure Eases in June as Food Prices Moderate Further

Created by kiasutrader | Jul 02, 2024

Malaysia Manufacturing PMI - Reverted to Below Threshold Level in June Amid Muted Demand

Created by kiasutrader | Jul 01, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments