Telco battleground: Maxis vs Digi heads-up

Tan KW

Publish date: Fri, 10 Feb 2017, 02:56 PM

- Maxis outperforms Digi when it comes to the top and bottomline

- Digi edges Maxis when comes to attracting customers

MAXIS Bhd, one of the Malaysia's top mobile operator, announced its fourth quarter and 2016 financial results yesterday.

In short, the company managed to grow its full year revenue (marginally) and net profit by double-digits. The company's CEO Morten Lundal is certainly pleased with the results.

"2016 was a challenging yet a good year for us. Despite the intense price competition in the market, we performed well by focusing on offering our customers uniquely attractive value propositions," said Lundal in a statement.

"Our customers now enjoy a combination of lots of data at affordable prices on the best network, and we are proud to record all time high satisfaction. All in all, 2016 was a year of good progress with positive momentum heading into 2017."

While the overall numbers may look pleasant for Maxis, the key now is: how did the company performed against rival Digi.com Bhd?

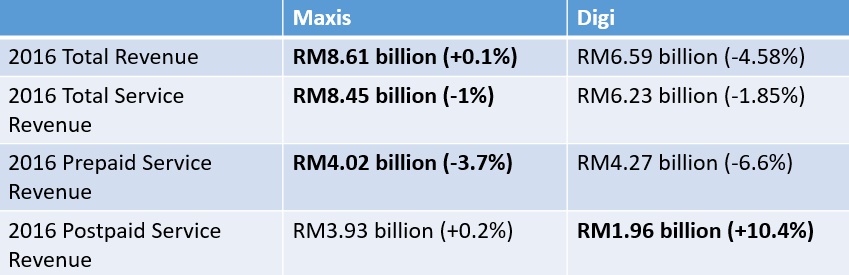

Below are some of the key data points:

For the full year ended December 31, 2016, Digi's total revenue, service revenue and even prepaid revenue declined by 4.58%, 1.85% and 6.6%, respectively. In contrast, Maxis' full year revenue increased marginally at RM8.61 billion.

Although Maxis also registered a decline in full year service revenue (-1%) and prepaid revenue (-3.7%), the declines were not as much as Digi's.

While Maxis may have higher postpaid revenue than Digi, it only managed to grow its postpaid revenue by a mere 0.2%. In contrast, Digi manage to outshine Maxis in the postpaid segment by registering a strong 10.4% growth during the year.

In 2016, Maxis managed to grow its net profit by a commendable 15% at RM2.01 billion, while Digi's net profit declined by 5% at RM1.63 billion. It also managed to grow its earnings before interest, tax, depreciation and amortisation by 5% at RM4.55 billion.

In contrast, Digi's full year Ebitda fell marginally (0.7%) at RM2.96 billion. Nevertheless, Digi managed to expand its Ebitda margin by 1.7 percentage points at 45%. Although Digi recorded a better margin improvements, it still has a lot of catching up to do before it reaches the 50% Ebitda margin level like Maxis.

https://www.digitalnewsasia.com/mobility/telco-battleground-maxis-vs-digi-heads

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-19

CDB2024-07-19

MAXIS2024-07-19

MAXIS2024-07-18

CDB2024-07-18

CDB2024-07-18

MAXIS2024-07-18

MAXIS2024-07-17

CDB2024-07-17

CDB2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-16

MAXIS2024-07-15

MAXIS2024-07-12

MAXIS2024-07-12

MAXIS2024-07-11

CDB2024-07-10

CDBMore articles on Good Articles to Share

Created by Tan KW | Jul 22, 2024

Created by Tan KW | Jul 22, 2024

Created by Tan KW | Jul 22, 2024