Cold Eyed (冷眼) 42 Stocks Picks - Portfolio Simulation

Tan KW

Publish date: Mon, 12 Aug 2013, 11:38 PM

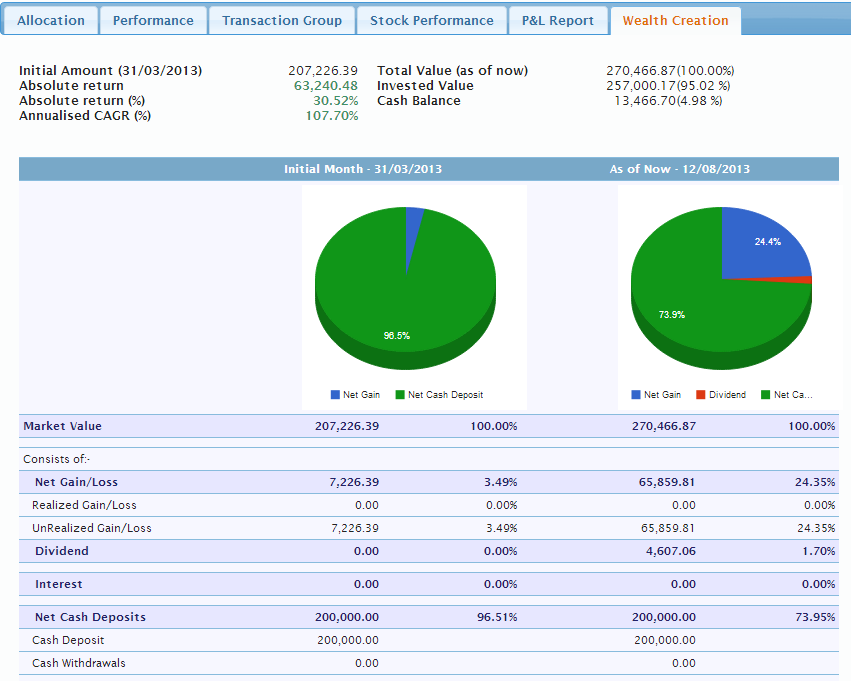

This morning, I created a simulation portfolio based on 5 Rules of Investing by Cold Eye Stock Selection by kcchongnz and the portfolio able to achieve 62.55% Annualized CAGR as of today result.

Cold Eyed pick 42 stocks during his presentation on 16-March-2013.

- >=5.00 http://klse.i3investor.com/servlets/pfs/14151.jsp

- 2.00 - 5.00 http://klse.i3investor.com/servlets/pfs/14152.jsp

- 1.00-2.00 http://klse.i3investor.com/servlets/pfs/14153.jsp

- <1.00 http://klse.i3investor.com/servlets/pfs/14154.jsp

If you would like to listen to Cold Eyed presentation, you can visit http://klse.i3investor.com/blogs/kianweiaritcles/26614.jsp

And I am wonder what will be the return if I follow exactly Cold Eyed stock pick?

I have create a simulation to buy 42 stocks that mentioned by him with following assumption:-

- Initial Portoflio Value - RM200K Cash

- Allocation - Equally Allocate to each stocks - 200k/42 = RM4762

- Transaction Commission - 0.1% with min RM8

- Buy Transaction based on the first market date (18-march-2103) open price after the stock selected by cold eyed on 16-March-2013 (http://klse.i3investor.com/blogs/kianweiaritcles/26614.jsp)

- All dividend will be recorded during the ex-Date

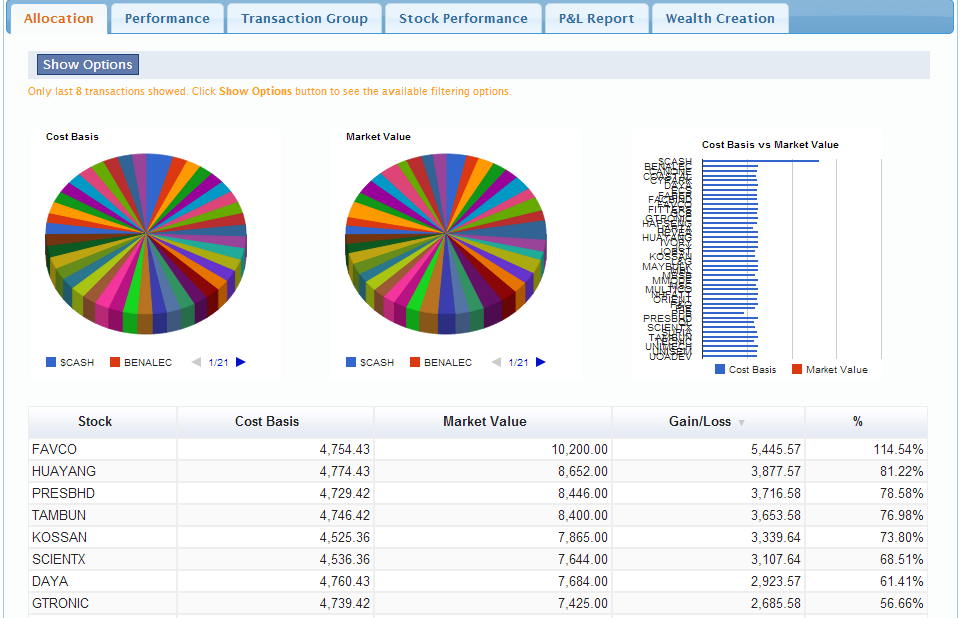

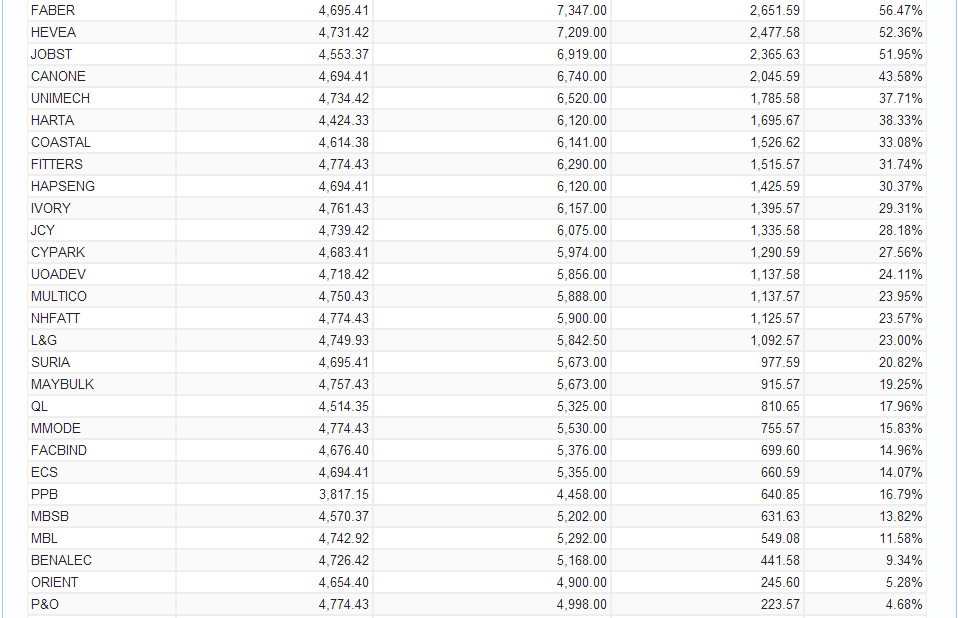

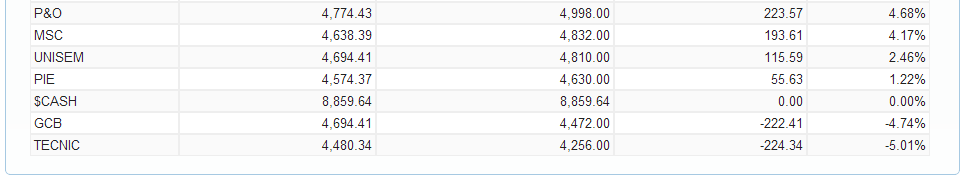

And below is the holding as of today - 12-Aug-2013

You can found that 2 out of 42 stocks was in red and 40 stocks is in green. And 11 stocks earn > 50%. Good?

Ok, let's look at the overall portfolio performance... very good...

| Absolute return (%) |

30.52% |

|---|

| Annualised CAGR (%) |

107.70% |

|---|

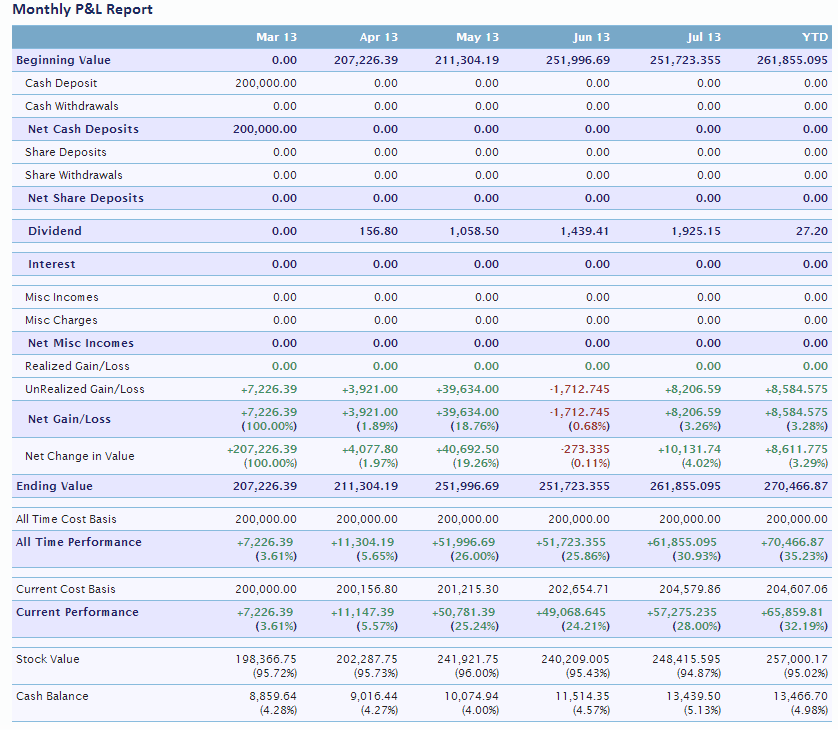

Montly Performance:-

Portoflio URL: http://klse.i3investor.com/servlets/pfs/19909.jsp

Further Readings:-

冷眼分享集 http://klse.i3investor.com/blogs/coldeye/blidx.jsp

新冷眼分享集 http://klse.i3investor.com/blogs/newcoldeye/blidx.jsp

冷眼分享锦集 http://klse.i3investor.com/blogs/coldeyedsharing/blidx.jsp

More articles on Good Articles to Share

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Created by Tan KW | Jan 14, 2025

Discussions

as of 12th August, KLCI was 1784, up 163 point or 10%, his "portfolio" outperform arround 20% lah?

2013-08-13 15:24

even though i don't agree with some stocks picked by cold eye but the results show that he is the best retail investor in malaysia! those so called malaysia warren buffett should learn from him!

2013-08-14 00:48

Again saw mr cold eye at giza mall. He stay in tropicana? Uncle ini dress like poor retired man but in actual fact, is a multi millionaire.

2013-08-14 13:31

in actual situation where we always keep a certain percentage of cash, total return for a portfolio will be lower.

2013-08-14 13:51

for someone like Warren Buffett or cold eye, investment is only a rich man game. like a poor student play online game, just to kill time or get satisfaction. what's the point of a multi millionaire wearing like a poor old man, to avoid kidnaping may be, hehehehe......

2013-08-14 13:56

1. you make billions but not willing to spend it, end of the day donate all to charities, you become a legacy

2. you make billions, live to the fullness of your life, sport car, big mansions, sexy models, etc..

mana satu u mau?

2013-08-14 14:23

the problem is sometimes when u make your 1st billion, you are already a 60 yo "look like retired" man, how to enjoy sport car and sexy models? unless you are facebook founder or playboy founder. :P

2013-08-14 14:27

Frankly, it's not easy to strike a balance. They are rich probably because of their frugal lifestyle since young. If they have 'drive sport cars, play model' mentality, they might not what they are today.

2013-08-14 14:33

that's why, unless you founded a "facebook" like Mark when you are 20 yo. ha ha

2013-08-14 14:35

cannot own a Porsche, than buy a beemer. cannot own a $1500sqf condo, buy a $800sqf, the difference of enjoyment is very slim indeed.

2013-08-14 14:39

may be that's the different with some of us and the frugal super rich, when we make 1 mil, we want to buy a beemer where the super rich reinvest the 1 mil and keep on driving their 10 years old car. :P

2013-08-14 14:42

I got one close friend also the same. He is a multi millionaire now, owns few bungalows, stocks and other assets in millions. All this while, he only buy 2nd hand car until he is almost 60 years old now :D

Sometimes, when you think of it, even though you are making 20k a month, is it worth to practically burn RM3K a month, just for the sake of a beemer car?

2013-08-14 14:49

If we use Robert Kiyosaki theory as a guideline, we shouldn't buy luxury car until our passive income is enough to pay for that car. An entry bmw 3 series cost around 250K, installment would be RM3K for 9 years loan. Passive income of RM3K= RM36K/yr. Assuming a yearly 6% return on the asset, you would need an asset worth RM36K/0.06 = RM600K.

So without an asset worth 600k generating 6% yield, you shouldn't buy a beemer. LOL.

2013-08-14 15:03

assumed it is spare cash to me.. I will keep invest till the day I really need the money

2013-08-14 15:05

super911, what is within that 9 years ur property yield dropped? sell ur beemer? ha ha

2013-08-14 15:08

Then you shouldn't use ngam ngam 600k & 6% yield. Buffer it higher to 800K yielding 8%. Then you are officially 'qualified' to own beemer cost RM250K ! LOL

2013-08-14 15:18

ok, from super911 culculation, now i know i will never ever own a new 3 series.

2013-08-14 15:22

2nd hand 3 series, is quite 'cheap'. beemer depreciate around 10%/yr for the first 3 years. Now a 3 years old beemer is around 150K. So installment would be around 1700, means yearly is around RM20K. So a portfolio of RM340K yielding 6% is enough for this LOL

2013-08-14 15:30

that if u keep trading on monthly basis, if you holding on it, it will not give u passive income on monthly basis

2013-08-14 15:30

Bear in mind, if you buy a 3 years old beemer, get ready to budget another 20K/yr to repair it once it reach 5-6 years old.

2013-08-14 15:31

Today's money is just fiat money made of paper with low intrinsic value...and the govt keeps printing them like no tomorrow

The full potential value of money can only be unlocked once it is SPENT either thru consumption or investment, otherwise the value got trapped in a piece of paper

2013-08-14 15:32

i like this. any accident happened, multi million will gone with the kancil. in fact Perodua should use him to advertise, Viva sure sell,hahaha .

2013-08-19 14:45

drive kancil less risk on kidnap and robbery ma, as long as u drive slow and steady and not go far far, he drives from Tropicana to giza only, accident risk lower

2013-08-19 14:58

Jimmy,

Enough of not very much depends on 2 things:

1. What's your average return that you can get from the 200k. 3% is 6k, 5% is 10k. Can you consistently make that profit margin?

2. What's your lifestyle now. It would be different if you have a fixed commitment of RM3k vs RM10k.

2013-10-12 11:34

lching

well done!

2013-08-13 12:41