30 Investing Tips & Tricks You Won’t Learn At School

Tan KW

Publish date: Sun, 18 May 2014, 12:32 AM

There’re basically two movies you should watch before you jump into the world of investment, especially the stock market. The two movies are “The Wolf of Wall Street” and “Inside Job”, released in 2013 and 2010 respectively. Sure, there’re tons of investing books in the market but frankly, you won’t learn as much from those books as from these awesome movies. Besides, it’s too time consuming reading books.

The Wolf of Wall Street was funded by Malaysia PM Najib Razak’s stepson, Riza Aziz. The film which starred “Titanic” hero Leonardo DiCaprio has achieved huge success with a worldwide gross of US$389.6 million, not bad for a US$100 million budget film. It also attracted criticisms as to how Riza managed to get such a huge funding, considering PM Najib administrationcorruption allegation.

With the exception of “569 fuck” words being used throughout the 179 minutes viewing, the film which is based on memoir of Jordan Belfort, a New York stock broker who conned his way to earning hundreds of millions in the 1990s, is pretty entertaining. Besides drugs, sex, prostitutes and whatnot, you should learn some (dirty) facts about wheelings and dealings in the real world of trading or investing in Wall Street.

While “The Wolf of Wall Street” was “fucking entertaining”, documentary film “Inside Job” was quite boring. Split into five parts, this US$2 million budget film actually grossed over US$7 million and won Academy Awards for “Best Documentary Feature”. It revealed how the 2008 subprime crisis was caused primarily by corruption in the United States financial system.

That’s right, just when everyone was fighting tooth and nail trying to rub shoulders with Obama during his recent trip to Malaysia, the President of the United States was an equally good liar, just like PM Najib. Barack Obama got into office due to his highly effective “Change” campaign, during which the 2008 great recession hit the country. Obama promised that era of greed, accounting frauds, irresponsibilities and irregularities of Wall Street will be changed – a huge bull.

Guess what, Obama administration’s so-called financial reforms have been not only weak but proves to be a mere marketing gimmick. To make things worse, the same set of people whom Obama criticised and blamed for causing the 2008 crisis during his campaign were appointed as top economic advisers into his own administration – scumbags like Timothy Geithner, William Dudley, Mark Patterson, Lewis Sachs, Rahm Emanuel, Feldstein, Larry Summers, Ben Bernanke and whatnot.

If the above are not enough to stimulate and awake you to the fact that Wall Street government is bigger than Obama government can chew, consider the following short facts that you won’t learn in any of the universities on planet Earth.

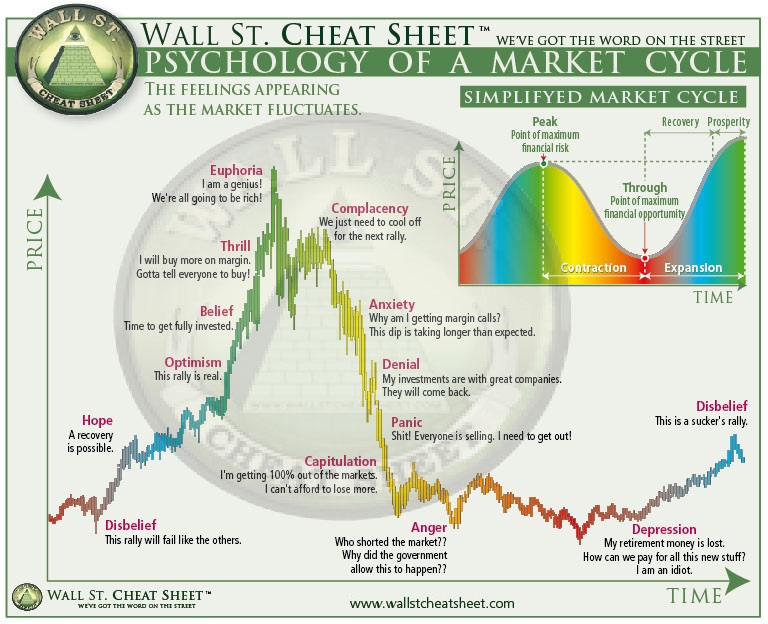

{ 1 } Markets go through at least one big pull-back every year, and one massive one every decade. Get used to it. It’s just what they do in order to make money. And if you can’t stomach this, don’t lay a finger in the world of investing.

{ 2 } The phrase “double-dip recession” was mentioned more than 10 million times in 2010 and 2011, according to Google. It never came. Surprisingly, there were virtually “no” mentions of “financial collapse” in 2006 and 2007, but it did come.

{ 3 } There will be 7 to 10 recessions over the next 50 years. Now that we have told you this, don’t act surprised or dumb when they come. If you like, call this the SOP (standard operating procedure) of investing.

{ 4 } The “Wisdom of Buffett” says: “First come the innovators, then come the imitators, then come the idiots.” Well, actually this does not only applies to stock investing, but also other businesses or scams, be it the Genneva Gold scams or Apple’s iPhone and iPad products.

{ 5 } Warren Buffett’s best returns were achieved when markets were much less competitive decades ago. It’s very doubtful anyone will ever match his 50-year record. Basically, there won’t be another Warren Buffett so stop dreaming you can become one, even though your Chinese name is “Wah Ren Bu Fei” (*grin*).

{ 6 } Some “legendary” investors whom we worship have barely beaten an index fund over their careers, with a small exceptions. Since there’s no other Warren Buffett, you can go learn from people like Daim Zainuddin or Chua Ma Yu on how to become “The Wolf of KLSE”. There’re more Wolfs than Warren in markets.

{ 7 } The more comfortable an investment feels, the more likely you are to be slaughtered. Remember the infamous Malaysian Genneva Gold and U.S. Bernard Madoff investments, which turn out to be nothing but ponzi scams?

{ 8 } Saying “I’ll be greedy when others are fearful” is much easier than actually doing it. The fact is when others are fearful, you’re doubly as fearful, and vice versa. It’s extremely difficult to buy for your clients when stocks are plunging, let alone putting your own money during the bear market.

{ 9 } Not a single person in the world knows what the market will do next – will it goes up, goes down or circles around. End of story. Watch “The Wolf of Wall Street” and listen how DiCaprio’s boss (Matthew McConaughey) advises him about making clients happy with profit on the paper while brokers make real money in commissions.

{ 10 } Mark Twain (Nov 1835 – Apr 1910) says this about truth: “A lie can travel halfway around the world while truth is putting on its shoes.”Like it or not, (Wall Street) big boys talk about lies more than the truth, everyday.

{ 11 } More than 10 years ago General Motors was on top of the world and Apple was laughed at. Today, the reverse is true. A similar shift will occur over the next decade, but no one knows to what companies.

{ 12 } Professional investors have latest information and faster computers than you do. You will never beat them short-term trading. Don’t even try. And if you manage to, that’s pure luck and chances are you will not be able to do it again.

{ 13 } If you’ve grand plan of trading penny stocks, do yourself a favour – just light your money on fire. Same for leveraged ETFs and perhaps Malaysian Unit Trust. Watch “The Wolf of Wall Street” and you will understand why this is so.

{ 14 } The analyst, fund manager or stock-broker who talks about his mistakes is the person you want to listen to. Avoid the person who doesn’t – his are much bigger.

{ 15 } When someone mentions charts, moving averages, head-and-shoulders patterns, resistance levels or whatnot, walk away. Run if you can, forget about your shoes.

{ 16 } The market doesn’t care how much you paid for a stock or what you think is a “fair” price. So, when stock brokers or investment banks publish analysis about “fair” price, you know what craps they are talking about. But that’s their job, so don’t blame them.

{ 17 } What markets do day to day is driven by random chance. Again, nobody knows what the markets will do – up, down or flat. Talking about stock movement is like bitching about 4-D or 5-D or lottery numbers.

{ 18 } The decline of trading costs is one of the worst things to happen to investors, because it made frequent trading possible. Do you know that Interactive Brokers only charges US$1 in commission for 100 shares or 1 stock option? Decades ago, high transaction costs used to cause people to think hard before they acted, and in the process save them from being slaughtered.

{ 19 } Most of what is taught about investing in school is theoretical nonsense. Proofs are in abundance. There are very few rich professors. To earn good money, they do mercenaries work. Dean of Columbia University Graduate School of Business, Glenn Hubbard, was paid US$150,000 by insurance arm of the Investment Company Institute for his academic paper. He also earned US$785,000 by serving on three corporate boards.

{ 20 } The best investors in the world have more of an edge in psychology than in finance. Ever wonder how small-time speculators or gamblers are being lured into stock market casino every day without fail by “big boys”? Go figure.

{ 21 } How much experience a money manager or fund manager has doesn’t tell you much. They can underperform the market for an entire career. And many have, but they still keep their job, because their job was not to make money for their clients (read: that’s you, dude).

{ 22 } However much money you think you’ll need for retirement, double it, or better still triple it. Now you’re closer to reality, if you’re lucky.

{ 23 } Professional investing is one of the hardest careers to succeed at, but it has lowest entry requirement and requires zero credentials. Evenfishmongers can become “stock specialists”. That creates battalions of so-called “experts” who have no idea what they are doing. People forget this because it doesn’t apply to many other fields.

{ 24 } The next recession is never like the last one. That makes recession interesting, and opportunities for Wall Street alligators. If you still don’t understand why recession happens by now, don’t waste your time reading financial columns, anymore.

{ 25 } The majority of market news is not only useless, but also harmful to your financial health. Despite the fact that you’ve access to information faster than it was 40 years ago, you still can’t become a fraction of Warren Buffett or beat the market makers, so go figure why.

{ 26 } If you have credit card debt and are thinking about investing in anything, stop and think again. You will never beat 18% to 36% annual interest, some on daily or monthly compounding.

{ 27 } The most boring companies - toothpaste, junk food, milk powder, toiletries – can make some of the best long-term investments. That makes you think twice about getting MBA in investing, no?

{ 28 } Stop thinking that your government, Central Bank, Federal Reserve, politicians and whatnot will solve your financial problems. They’ve bigger things to do – how to solve their economic mismanagement (quietly). It’s easier for you to focus more on your own well being instead of screwing it up, hoping and waiting for the government to step in to help you. And when government suddenly tells you the country’s fundamental is strong and urges you to trust them, you should start selling like crazy (*grin*).

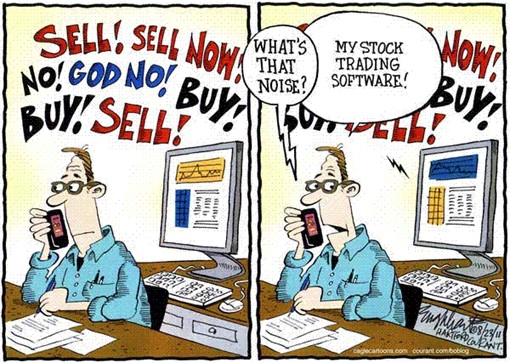

{ 29 } Trust no one who screams buy or sell, whether they are from CNBC or innovative stock trading software. When they tell you to buy, chances are “fucking high” they want to unload desperately. And when they tell you to sell, they want to buy every single shares that you’ve got. Plain and simple.

{ 30 } Don’t fall in love with companies you invest. Companies die and new ones emerge. Treat them as prostitute or gigolo whom you’re interested to get orgasm, nothing more than that.

There you have it – 30 simple but effective facts about investing, that could help you from being slaughtered on the trading floor. You may not like it but you’re on your own in the world of investing markets.

http://www.financetwitter.com/2014/05/thirty-investing-tips-tricks-you-wont-learn-at-school.html

More articles on Good Articles to Share

Created by Tan KW | Jul 24, 2024

Created by Tan KW | Jul 24, 2024

Created by Tan KW | Jul 24, 2024

Created by Tan KW | Jul 24, 2024

Created by Tan KW | Jul 24, 2024

Discussions

How true is this article!

The message is very clear. The person you have to trust most is you! And make sure you have the necessary mind set, knowledge and experience so that you don't disappoint yourself in the world of investing.

2014-05-07 12:33

Basically, it is the manipulation of 10% conscious mind/who knows against 90% unconscious mind those who are unprepared/Who dont know.Apparently quite true in financial market.

2014-05-07 15:13

The greed of the best 5% to exploit the fear of 95%. The difference is You see the BEST 5% will not be in fear. Whereas the rest 95% will either be in fear or greed.

2014-05-07 15:17

So we Only have ourselves to blame as I could not make it to the top Conscious mind, if not the figures will Not be SO BAD. IF the figure is 50:50 then we would have more stabilised financial market.

2014-05-07 15:38

not entirely agree with the article but 9 , 14 , 15 sound exactly why people should stay away from people like ooi teik bee...

2014-05-07 18:14

Disagree with point 26.

When I was young, I use cash advance from Credit Card to buy stocks due to lack of capital : O

And I am still around : )

2014-05-07 22:59

The end result of lending and borrowing must yield positive economics results than the cost itself then it is positive. We are watching the Biggest lender and Borrower all the time that is Banking and Property sector.

2014-05-08 08:10

{26 } If you have credit card debt and are thinking about investing in anything, stop and think again. You will never beat 18% to 36% annual interest, some on daily or monthly compounding.

I agree this. Let say I have credit cards debt of 30k, my monthly minimum payment should be 1.5k. At the same time, I have 30k cash to invest. If my average monthly return 1%(dont think this easy can get) so I get RM300 from investment and need another RM1200 from salary to pay credit cards debt. If I repeat this way, need 24 month to clear credit cards debt (include interest). How about I clear debt first and every month use RM1200 from my income to invest? Think this time 'invest' in fix deposit also win.

Just my opinion, coz I'm average performance investor.

2014-05-08 08:44

Thinking again. How can I get credit card debt of 30k? If I spending RM2000 & paying RM1500 every month, I need 5 years to build RM30k debt. This should be very bad habit rdy.....then I should agree {26}

2014-05-08 12:47

Icon8888 can survive High Interest rate exceptionally That does not mean that everybody can do it even at Low Interest rate/or even at free cash.

So market is at large enough to provide opportunity for everybody with different mindset, preference, different investment style and risk level. The market is diversified and Big enough to cater for so many type of investors ya.

Be conscious and knows that when you are wrong ya.

2014-05-08 18:07

Very important for young graduates to learn and keep learning in saving/Budget balancing and investment in Stock and property regardless of their profession.

I would suggest them the CASH FLOW GAME. IT has very important saving and INVESTMENT CONCEPT there. So you know that everybody can be Successful in regardless who you are Now.

2014-05-08 18:17

behind every stock, there are people with much better quality of information, tons of money and time, excellent psychological skills.

Before you put your hard earned money into work, consider the above.

2014-05-08 18:34

Let me put it this way.

Big boys knows at least 4 things 1) You cant stand the price volatility 2) You dont have the deep pocket 3) You are not patient enough. 4) Price tends to consolidates for sometimes and that bored you down/put you in self doubt.

That explains market always weed out the weak holders ya.

2014-05-09 01:39

So what should you do then? Dont keep fighting with the Darkness.IF you sense that the speculation is high, then walk away.

Switch on the Light and the Darkness is gone.

Keep focusing on Good Company Value and Invest with Business Perspective. Trusting the market mechanism and Invest with Higher Law in mind and learn to manage your cash and portfolio diversification ya.

2014-05-09 13:31

Those who make money in the stock market are those level headed people...those who think strait,make judgements based on company and market fundamentals,close their ears to all the rumblings around,make decisions to buy or sell when the calling is really tough,blame themselves for their decision and loses instead of others...

2014-05-09 20:39

Oh blame themselves for their decision and losses instead of others.....Yape just admit mistakes and move on. Beware of Big Ego and Heavy Pride.

2014-05-09 23:16

{ 16 } The market doesn’t care how much you paid for a stock or what you think is a “fair” price. So, when stock brokers or investment banks publish analysis about “fair” price, you know what craps they are talking about. But that’s their job, so don’t blame them.

{ 17 } What markets do day to day is driven by random chance. Again, nobody knows what the markets will do – up, down or flat. Talking about stock movement is like bitching about 4-D or 5-D or lottery numbers.

2014-05-10 19:38

it takes experience,and clear head. Caution, Diligence to make sure,keep learning ,anlyse mistakes. Remind yourself.Invest dont get carriedaway by the Excitement of gambling/speculating.It is picking the Besssst Honest Company, not believing what you want to believe. Very good Lesson here.Thanks KW Tan, for making the innocent aware of the slaughter house.

2014-05-16 20:59

Cant believe our Basic Financial Education is at this level. Everywhere is this pyramid scheme, gambling, speculating and punting...

I can imagine the financial education is like Buddhist climbing ten thousand steps to pagoda, Muslim perform hajj at Mecca, Christian pilgrimage to Holy Land,....

2014-05-18 02:03

AyamTua { 16 } The market doesn’t care how much you paid for a stock or what you think is a “fair” price. So, when stock brokers or investment banks publish analysis about “fair” price, you know what craps they are talking about. But that’s their job, so don’t blame them.

{ 17 } What markets do day to day is driven by random chance. Again, nobody knows what the markets will do – up, down or flat. Talking about stock movement is like bitching about 4-D or 5-D or lottery numbers.

------

Ayam Tua, some writers r bias. Dah suap? Some talk kok! If their TP tat chun they huat2 @ klse lol, no need 9-5 job. Kikiki!

2014-05-18 06:33

fireball

LoL..but a timely reminder to all...

2014-05-07 12:27