But recently SEEK's offering of takeover Jobstreet Pte Ltd, which includes most of Jobstreet.com sites in Asean countries offer us an opportunity to relook.

First, the offering is around RM1,740mil, company offer around RM1,700mil payback to shareholders via dividend. According to proforma IV , it will become around 707,953,000 share outstanding after some share offering to gain back Jobstreet filipino's minority, and also some ESOS shares.

Thus, by calculation, it is near RM2.40 on this dividend paying back to shareholders after the deal goes through. Recently, it has announced another dividend of 0.5sens.

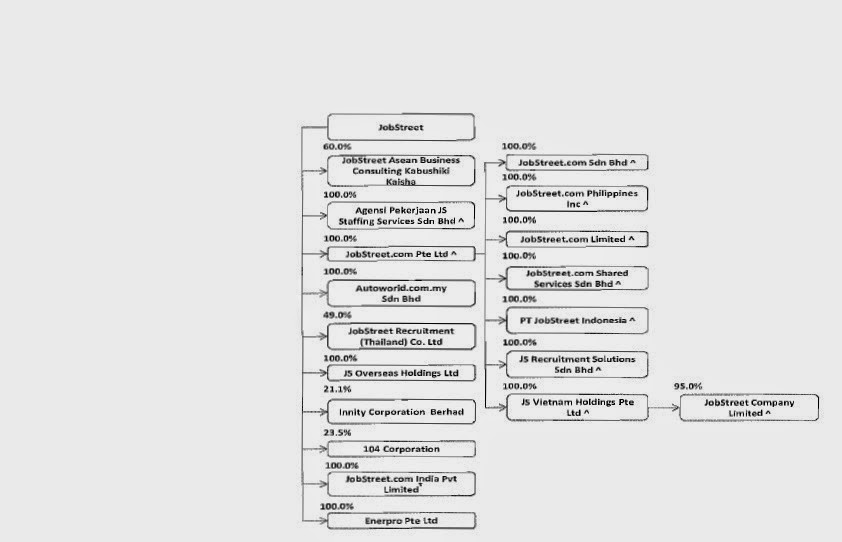

Well, the question lies in where is the golden goose? Look at what are assets left over after takeover offering by SEEK.

Do some studies, refer to pg100.

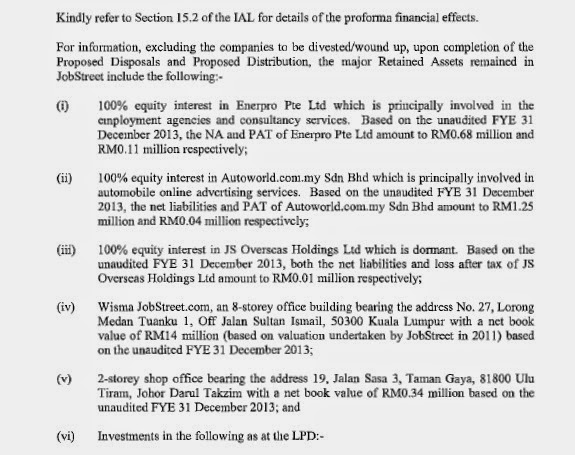

Actually, Wisma Jobstreet bring my attention most, because it is around prime area, and it is physical object I can see and touch. Wisma Jobstreet in Sultan Ismail valued RM14mil during 2011. So by dividing RM14mil/707.95mil(proforma IV S/O)=RM0.02/share

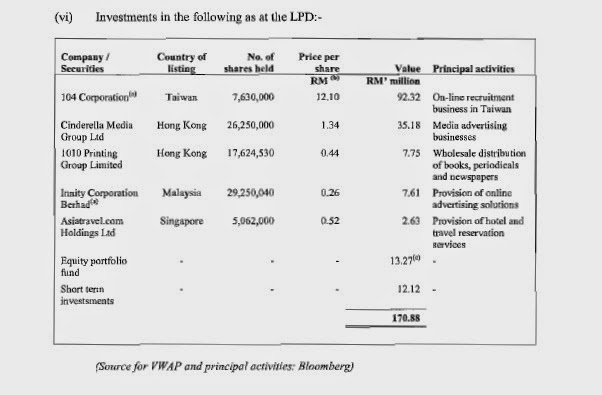

Building alone worth us the cost of investing now @ RM2.42. Look at listed companies shares they own:-

I have done some background check on their prices and also earning quality of these companies.Out of all, 104 Corporation in Taiwan provide stable profit, same to 1010 printing Group. A quick study on prices, I've valued all these companies near RM129mil. Dividing this to Proforma IV, RM0.18 is my valuation on assets. Also, 1 thing to note is Cinderella Media is undergoing some corporate action of dividend in species to distribute their 1010 printing shareholding. Also, Cinderella Media's recent profit is deteriorating as well, thus I would rather not give it any value moving forward.

---------------------------------------------------------------------------------------------

One important thing to note is company is not allowed to be involved in the same industry of Jobstreet.com-which is recruitment and some related businesses once the deal went through for 2 years. Thus the minor Jobstreet.com I think either will have to cease operation or be sold soon.

And company will fall into PN17 for sure without any core businesses while they have sometimes to find a new core businesses for the company. The name "Jobstreet" cannot be used also in future as SEEK bought the copyright of Jobstreet also.

But looking back at the founders' profile, I have confident this management can create more value to shareholders in future. And to be honest, I think there will be nothing to lose even buying at current price. If deal does not go through, we still keep a growing company, expanding into the regional almost covering whole Asia except in China which is no present yet, with some minor efforts in Japan, Thailand etc.

If deals goes through, you have the building as the back-up. If management fails to seek any core business(which I think impossible), they will sell all things and return the funds to shareholders. Building alone worth RM0.02. So it is almost risk free now.

Most encouraging part came on below announcement:-

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1673365

http://www.bursamalaysia.com/market/listed-companies/company-announcements/1665889

"Subject to an agreement on any adjusted terms of the JobStreet SSA with SEEK Asia Investments Pte Ltd and fulfilment of all conditions precedent under the JobStreet SSA, the Proposed Disposals are expected to be completed in the third quarter of 2014."

benson911

What will be the risk if deal is fails?

2014-07-22 17:55