Case Study On Padini Bhd - Savwee

Tan KW

Publish date: Sat, 24 Jan 2015, 07:55 PM

|

|

Imagine if the income from your dividend alone can cover for all your expenses and more.

That would be financial freedom isn't it?

If you're looking for a stable investment with pretty high dividend payout. I think this is the company for you.

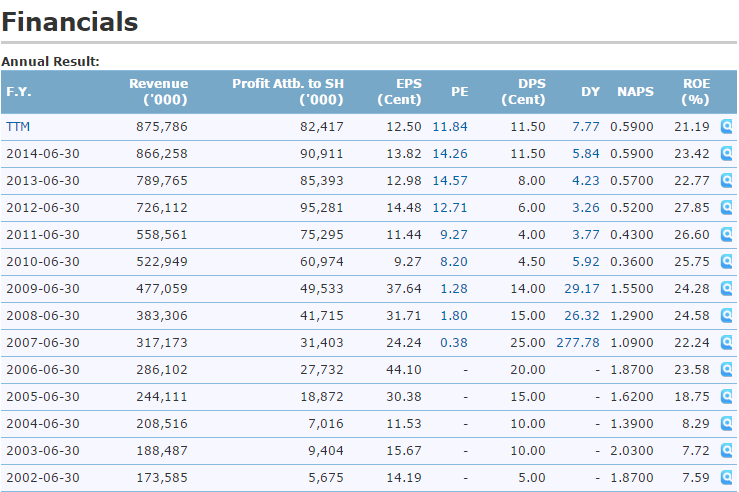

At current price of 1.48 per share. This company is giving out 10 cents dividend per share.

That amounts to 6.75% dividend yield. Which is an income of RM67,500 per year if you invest RM1,000,000. Enough for most people to stop working and start enjoying life.

The image above shows some of the brands carried under Padini.

SWOT Analysis:

Strength - Brand Name + Experienced Management

Weakness - Lack of Innovation

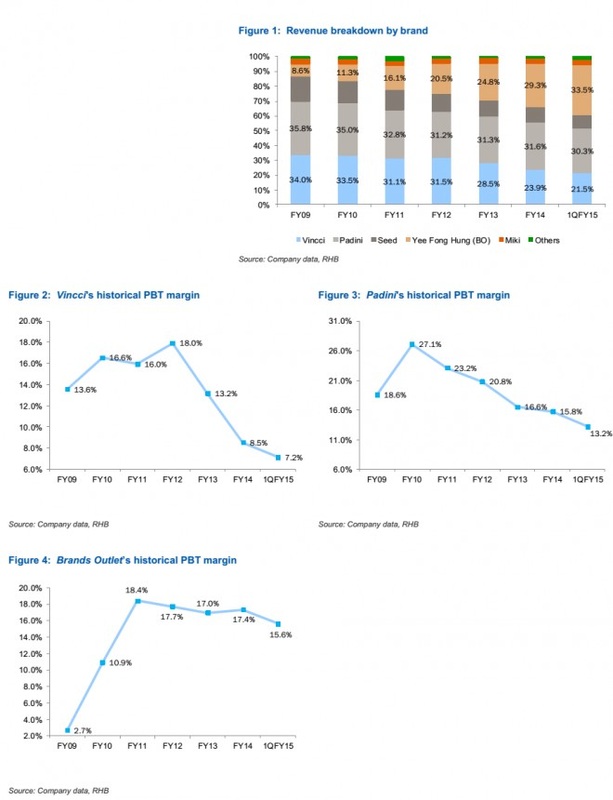

Opportunity - Brands Outlet promises ability to grow

Threat - Foreign Competitors like Uniqlo & H&M eating market shares + GST "knee jerk"reaction.

I think the management is smart and experienced. They know that Brands Outlet shows good potential and is now aggressively expanding it.

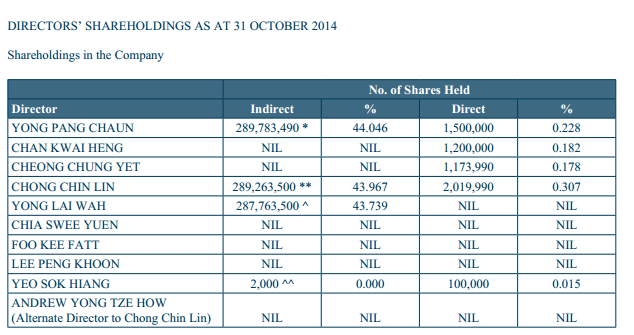

Just in case you don't know yet. The management is heavily invested in this company.

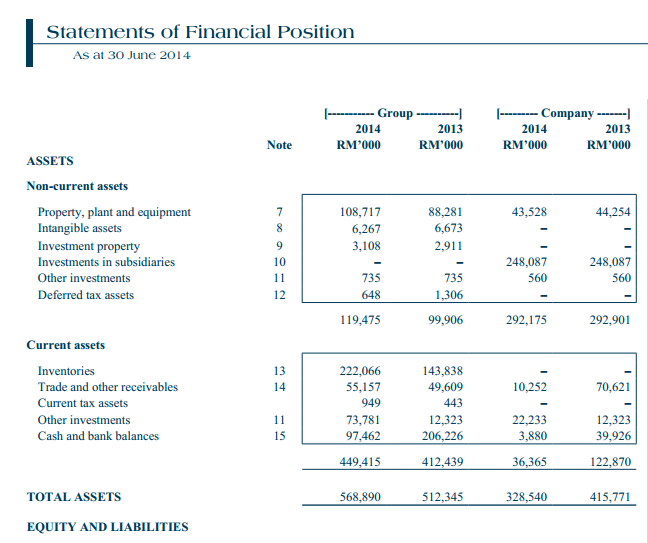

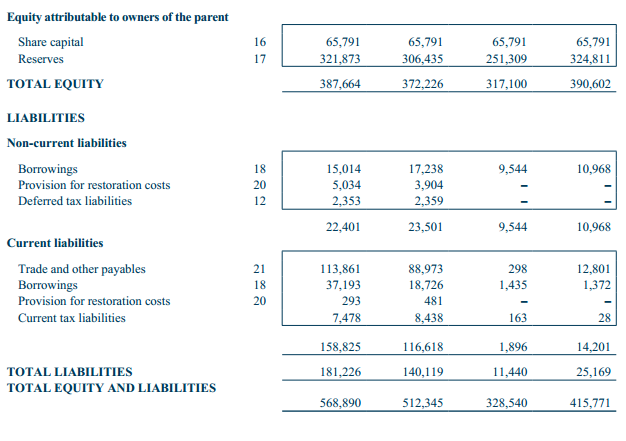

The amazing thing is this, this business is able to generate a ROE of more than 20% consistently.

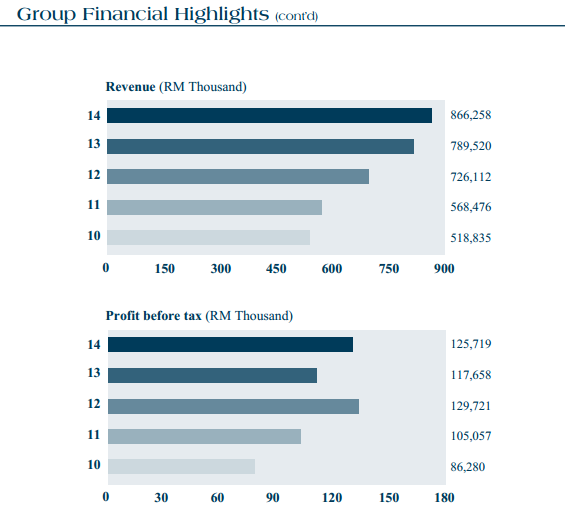

Look at the right column below.

My humble idea.

Is it a good deal now?

The thought was that it still yields almost 6% dividend yield and it is a growing business.

I made the mistake of not being able to sit quietly when there is no good deal to be made.

However, I am not saying this is a terrible investment. I am still getting a yield of almost 6% which is pretty okay and there is still a chance of capital appreciation (it's gonna take some time for this company to get back on track). It just isn't a very good investment when I bought it at that price.

Further growth will be uncertain. With GST coming in, it's going to be pretty challenging this year and the next.

So, the question is, is at current valuation.

PE of 11.81 & DY of 6.75% attractive enough for you?

(I'm sorry for I am unable to provide a clear valuation on this as I can't project the growth rate with any accuracy.. Used to value this using the PEG but it's obsolete now that the growth is distorted.)

When a share you own drop in price, you only need to ask yourself this question to decide if you should sell it.

"At this price, if I didn't own this share and if I have excess cash, will I buy it?"

If you answer, yes, then you shouldn't sell it.

For me, I am still holding this share.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Jan 03, 2025

Created by Tan KW | Jan 03, 2025

Discussions

Savwee: Great writing. Don't feel sorry for entering at 1.89, you have many friends entering at that price range. I am one of them, with a big sum too. Luckily I was able averaging down when it dropped to 1.7x, 1.5x, 1.4x and 1.3x. If it drops to 1.3x again, I will buy more to pull the average down further. Good luck, cheers for the high div yield.

2015-01-25 00:13

I would not say it is a "No competitive biz" but it you say it is "not sexy", I have to agree. A "no competitive biz" would not survive in the intense competitive market for so many years, not only making money each year but making more each year.

2015-01-25 08:44

there have competitors. H&M and uniqlo are their competitors. both of them probably would have products sell 20-30% higher than padini and brands... not to mention mango and cotton on too

2015-01-25 21:08

hey, i also made the "same mistake" as you! same entree point as well. I'm hoping for it to recover though. at the moment, just treat it as an FD :)

2015-01-26 13:38

I also buy at RM1.80. When the price come down, I buy more to average down as I have confident in this company.

2015-01-26 14:16

Flintstones

Saywee strikes again. Wonder how many people went to Holland following their recommendation

2015-01-24 21:13