The Secret to be a Millionaire or Billionaire - Compound Interest

Tan KW

Publish date: Sat, 31 Jan 2015, 06:32 PM

Compound Interest is The Eighth Wonder of the World....

It can help you to earn a million or billion..

How?

Refer to Int. Investor blog (http://klse.i3investor.com/blogs/intelligent_investor_notes/53832.jsp), he aim to earn 3 million with a 150k capital, 6k saving per year and compound his investment with 15%. Attached is the screen capture from the CAGR Calculator.

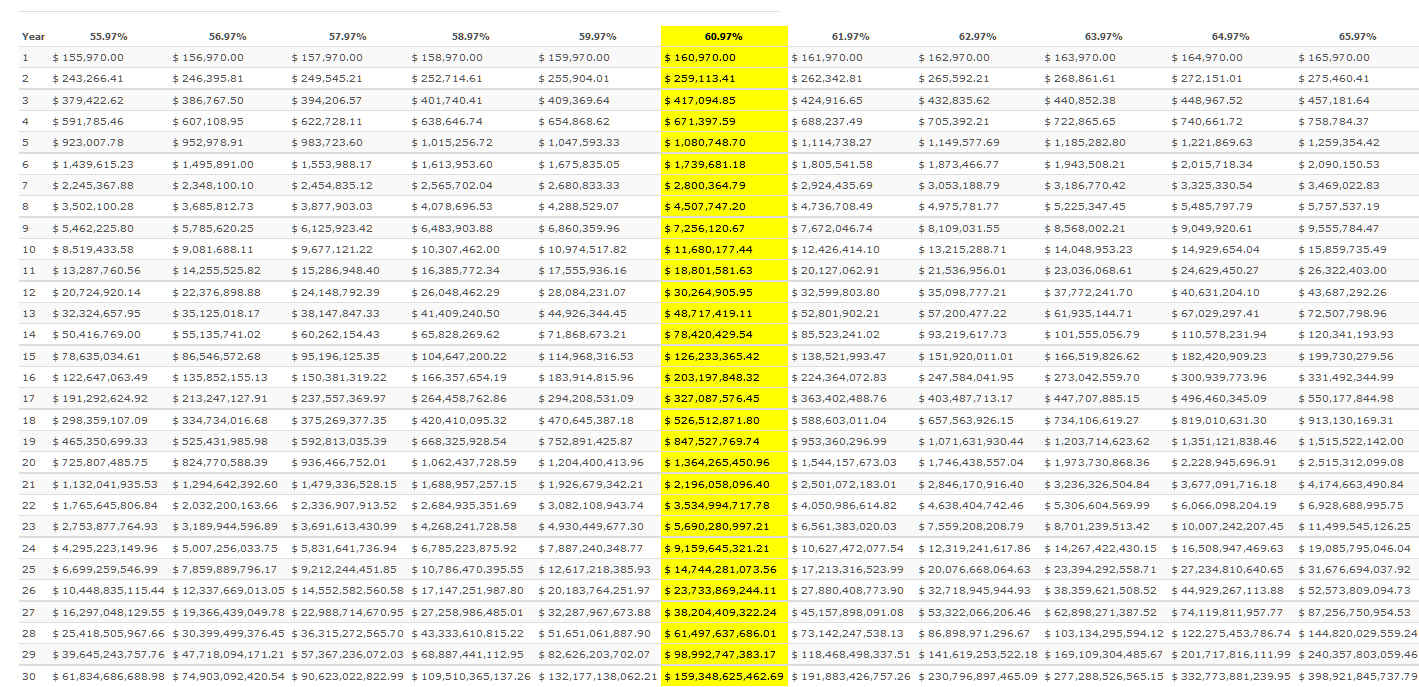

From the Stock Pick Contest 2014 (http://klse.i3investor.com/blogs/stock_pick_2014/67447.jsp), the top 5 able to get 60.97%, 51.22%, 32.04%, 28.12% and 14.05% respectively.....

If I someone using the 100k capital and achive the average result of the top 5 - sum(60.97%, 51.22%, 32.04%, 28.12% , 14.05%)/5 = 37.28% for the next 30 years....... What's will be the amount??

I am finding the answer with the same CAGR Calculator, and the answer is $ 1,343,439,505.57 [1.3B]

What if the investment return on 37.28% reduce 50% to 18.64% only? The CAGR Calculator show me $ 16,862,972.84 [16M]

More articles on Good Articles to Share

Created by Tan KW | Jul 25, 2024

Created by Tan KW | Jul 25, 2024

Created by Tan KW | Jul 25, 2024

Created by Tan KW | Jul 25, 2024

Discussions

the 3rd scenario is a bit unrealistic, with RM 100 bil , you wont be able to continue making 60% p.a. as the capital has grown too big... In fact I think 15% is already a very difficult task if we re talking about a 30 year time frame...

2015-01-23 15:14

I agree with NOBY. I am very happy if I am able to get 15% for 30 years. My task is relatively easier in view of my small capital.

2015-01-23 15:34

Of course,i agree with this. But,need to buy which high dividend counters?

2015-01-23 21:23

If some one can compound based on scenario 2 or 4....he or she must be 世界未来首富

2015-01-23 22:03

The computational in theory are correct. However, when taking into account of realism, you may not be making consistent returns for the next 30 years. Some years you may make loss or some years you may make significant returns. Besides, the computation shows that the investor did not take a single cent out of the fund which i think would be impossible when you have few millions in your fund.

2015-01-25 18:59

those put compound interest to practice is one of the rarest investors.legendary investor warren buffett is obsessed with the idea of compounding and his two most profitable portfolio are result of this obsession.

2015-01-27 22:37

Well said!

It is a norm that 80% volume come from penny stock trading. The promise of big gains is why investors dabble in penny stock in the first place, leaving only a handful long terms investors. Even for the most committed long term investors, compounding is a monumental task to achieve. Compound investor is a rare breed indeed.

2015-01-31 19:31

Haha!

3i is here!

How did you arrived at the price of PM Corp at 14.4 cents?

And see no value in Mui Bhd?

Did you study Walter Schloss?

Or Ben Graham properly?

2015-01-31 20:13

Intelligent Investor

Invested Capital, Time and the Rate of Return play important role in wealth compounding.

We should work & save for the capital, identify good companies, buy them cheap, and be patient.

The Stock Market is designed to transfer money from the Active to the Patient. - Warren Buffett

Investing should be more like watching paint dry or watching grass grow. - Paul Samuelson

No matter how great the talent or efforts, some things just take time. You can't produce a baby in one month by getting nine women pregnant. - Warren Buffett

Time is the friend of the wonderful company, the enemy of the mediocre. - Warren Buffett

2015-01-23 14:43