Of course, the US government felt that the way to control the growth of China is through imposition of tariffs of up to 25% on $200 billion worth of goods from China. Since the late 20th Century, China has been steadily growing as the world's manufacturer, and this trade war is set with the intention to reduce that dependencies on China. Funnily, China which is now the second largest economy globally is already planning for this since the beginning of this 2010 decade. Since Xi Jinping has taken the helm in 2012, he has largely been trying to drive China to be a consumer and technological power.

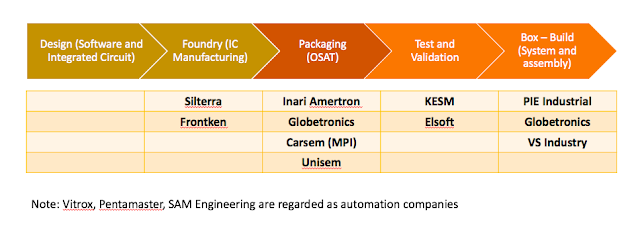

In any case, Malaysia having been one of the larger semiconductor based products manufacturer would have been affected by this "trade war" disruption as many companies especially whom are dependent on China as a supply based are now reevaluating themselves. To this end, I can say all the semiconductor companies would be affected one way or another. To see this clearly, we have to understand in which value chain would many of these E&E companies would play. The diagram below, would provide a good indicator although there are other ways to slice that presentation.

Many of the products that are exported to US would be at the end of the value chain, i.e. box build and this is where the 25% tariffs is being imposed on. Box build basically means the phones, routers, switches, accessories etc that are assembled and exported. Malaysia is not a big exporter of final value chain products but rather the component exporters - pretty much at the Intel, Broadcom, Osram and Inari level.

At the moment, due to the disruption caused by the tariff, the component sellers are affected as most definitely many buyers are reducing their purchases due to the wait-and-see attitude from the negotiations between the Trump and Xi's trade team.

In any case, I see that the trade war is something which is not only due to Trump but is coming nevertheless. US as a country would not allow China to surpass them as it has been dominant since World War 2 - i.e the world's superpower without much competition for 75 years.

This phenomenon will see changes in terms of supply chain. I do see some Malaysian companies getting larger orders as they have been building themselves as the system builders (box-build).

One of them is PIE Industrial - a final system exporter. Ironically, the company has not been doing that well for the last few years due to several reasons - such as shortages of supply and lost of customers. This trade war will see difference as in the management discussion (2018 Annual Report) provided below.

I have decided to buy 4500 units of PIE.

No right Nor wrong Only to Win

Like 1st,

rarely filicity share her research for a small cap ...

2019-07-29 18:11