The Trouble With AirAsia's Charismatic Founder - David Fickling

Tan KW

Publish date: Wed, 05 Feb 2020, 04:23 PM

It’s hard to know where Tony Fernandes ends and the company begins. An anti-corruption investigation isn’t the airline’s only challenge.

Asia’s largest budget carrier is in trouble, caught up in an anti-corruption investigation of Europe’s aerospace industry. Things could get worse.

AirAsia Bhd. Chief Executive Officer Tony Fernandes stepped down for two months earlier this week along with Chairman Kamarudin Meranun, after the airline was named in a 3.6 billion euro ($4 billion) settlement of bribery allegations against Airbus SE. Shares have fallen about 16% since the agreement was announced. The carrier denies any wrongdoing.

Like his mentor Richard Branson, Fernandes has made his identity synonymous with that of his company. The former music executive appeared at events in a branded baseball cap and vigorously defended the sprawling group on social media before he quit both Facebook and Twitter over the past year. It’s often been hard to tell where Fernandes ends and AirAsia begins.

That issue is at the heart of the current allegations. European prosecutors and Airbus say the aircraft manufacturer agreed to pay $50 million to sponsor a sports team — the Caterham Formula One team, at the time owned jointly by Fernandes and Meranun — in return for AirAsia purchasing 180 aircraft. AirAsia, for its part, says that Airbus had its own branding reasons for sponsoring Caterham, while there was a sound commercial logic in purchasing A330s from Airbus.

It’s not the first time AirAsia has been named in connection with such activities. In a 2017 case brought by the U.K.’s Serious Fraud Office, Rolls-Royce Holdings Plc admitted to providing $3.2 million worth of credits to an AirAsia executive in connection with an engine contract, with the expectation they would be used to pay for maintenance of a private jet owned with other executives. AirAsia has previously said there was nothing improper in the arrangement and that relevant information was disclosed in investor materials.

As Branson and Fernandes himself have demonstrated, consumer businesses led by flamboyant executives with interests beyond spreadsheets and boardrooms can often receive valuable free publicity. The problem comes in knowing where to draw the line between personal interests and those of the company.

There’s certainly been no shortage of related-party transactions between AirAsia and companies associated with Fernandes and Meranun. AirAsia’s annual reports disclose multiple examples: 20 million ringgit ($4.9 million) paid to Caterhamjet Global for the lease of a Bombardier Inc. private jet like the one mentioned in the Rolls-Royce case, and another 3 million ringgit to Tune Group to crew the plane in 2016. In multiple years, Tune Insurance Malaysia Bhd. has provided insurance for AirAsia passengers outbound from Malaysia, with commission fees returning to AirAsia itself.

The question is whether this activity is improper or not. In its statements on the Airbus and Rolls-Royce cases, AirAsia makes the point that all such deals were agreed by the board and disclosed in financial statements. In that sense, it’s up to directors and shareholders to decide if anything was amiss, and to censure management if they don’t like it.

Charismatic chief executives are famously hard to rein in. When they’re also major shareholders in the company — Fernandes and Meranun jointly control about a third of AirAsia shares via affiliated companies — it’s even harder.

Of the four independent directors on AirAsia’s seven-person board, one of them, Stuart Dean, is a retired long-time executive for General Electric Co., a major provider of aircraft engines to the company through its joint venture with Safran SA. Given the issues that the Airbus and Rolls-Royce cases have raised around AirAsia’s relationships with its other suppliers, adding another independent director with less of an aerospace background might provide more reassurance to smaller shareholders.

Another board member, Noor Neelofa binti Mohd Noor, popularly known as Lofa, is a model, fashion entrepreneur and Instagram influencer. Her presence brings some welcome gender balance to the otherwise all-male board, but the 30-year-old has a short resume for someone expected to bring the managers of this multi-country business empire into line.

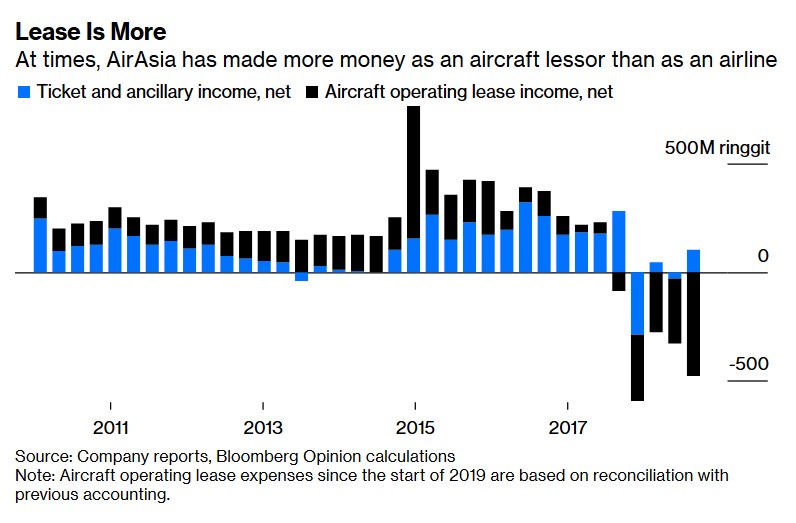

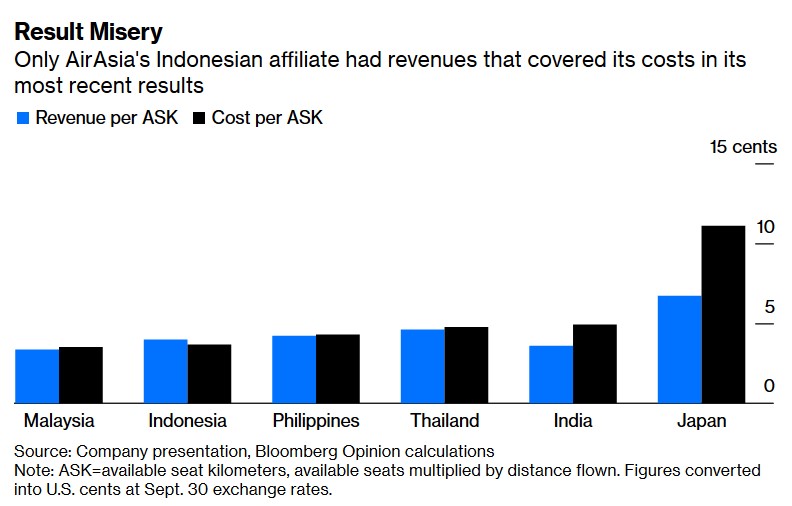

Even before the Airbus settlement, this wasn’t likely to be an easy year for AirAsia. Quite apart from the impact of coronavirus on airlines in Asia, it’s dealing with a switch in accounting rules that’s turning its long-standing practice of making money leasing aircraft to group affiliates from a profit center to a money loser. Of its six regional carriers, only the Indonesian one currently has ordinary revenues sufficient to cover its costs.

For nearly two decades now, Fernandes and Meranun have been central to making sure that every instrument in this sprawling orchestra plays in tune. Shareholders may be about to find out how the music sounds when they’re no longer holding the baton.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Dec 21, 2024

Created by Tan KW | Dec 21, 2024

Created by Tan KW | Dec 21, 2024

Discussions

Time to whack AirAsia......

Dr.M can turn potential PM to convict and back again to a PM

..................

His words are final:

PM on AirAsia-Airbus scandal: It’s normal to have ‘offsets’ in business

2020-02-06 16:09

warchest

He is acting against the fiduciary duty as the director of the Company. Your role here is to enhance the value of the shareholders not causing a damage to it. As for Airbus SE case, it is already a verdict and no longer allegations. AAX already lost so much from RM1.25 to RM0.12, 90% shrink in shareholders’ value. On corporate governance matter, he and his partner should not only resign as management team but in the Board of Directors as well to avoid the interference in the on-going investigations on this. Air Asia Group should revisit and enhance their internal procedures on gifts and gratuities. SC, MAVCOM, MACC and even ministry on transportation should form a steering committee to discuss on this matter. Bear in mind, this will affect our ranking of Corruption Perception Index going forward if this is not handle in tactical manners

2020-02-06 11:00