Notion's 2:1 bonus issue just got ex-ed today. With yesterday's closing price of RM1.16, its opening price today should be 77sen. It ended the day at 83.5sen (up 8.4%) even though its day high was 91.5sen.

After falling to 40sen in Mac20, Notion has miraculously crawled back to its pre-Covid price range of around RM1.20.

Recently we could see lots of so-called "Covid-19 related" stocks rocketed into the sky. The party is even joined by a hospital beds provider.

Is Notion one of those stocks?

Not long ago, Notion's chairman mentioned that the company is venturing into face mask production business.

This leaves lots of question marks to investors. What kind of face mask? What is the scale of the production? When will it start? How much sales does it expect?

Yesterday, Notion finally published the detail of its face mask business on its website.

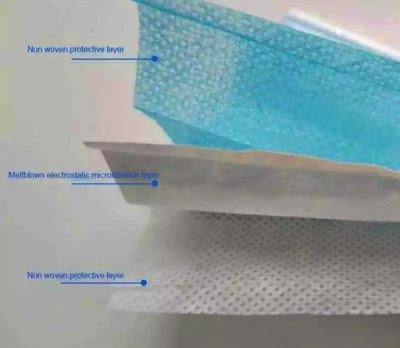

According to the presentation, Notion will produce 3-ply & 4-ply face masks, and also polypropylene melt blown fabric used to produce face mask.

It has invested in 3 lines which can produce a maximum of 8 million of 3-ply face masks per month. This is expected to start operation in June.

It will also add one line to produce 4 million pieces of 4-ply face masks per month in August.

For the polypropylene melt blown fabric (PPMB), it has invested 2 machines which are able to produce 20 tons per month starting from June, and another 2 machines which are able to produce 25 tons per month from August.

So, Notion can produce 45 tons of PPMB from August, but the chairman said that Notion has orders of more than 100 tons per month from ready buyers in China!

As a result, Notion will develop its own PPMB machines in 3 months to produce another 100 tons per month.

The estimated sales of face masks (12mil/mth capacity) and PPMB (45 tons/mth capacity) are expected to be RM11.2mil and RM6.3mil respectively, per month at full capacity.

If this is true, it will potentially contribute RM17.5mil sales per month, or RM210mil per year! This does not even fulfill China's order of more than 100 tons PPMB per month.

Notion's FY19 (ended Sep19) total revenue was RM238mil. So this face mask business will almost double its previous revenue derived from HDD, camera, auto parts etc...

Gross margin is targeted to be 30-50%.

It's not easy to predict Notion's EPS since its recent quarterly financial results are affected by insurance claims and one-off items.

However, Notion's chairman did mention that its operating after tax profit for FY20Q1 was RM5.2mil from a revenue of RM70mil.

It will release its FY20Q2 (Jan-Mac20) result soon in early June. Of course its net profit will be much lower than the preceding quarter of RM14.2mil.

Personally I hope its FY20Q2 net profit can be around RM5mil, which means an EPS of 1sen based on 504mil shares after bonus issue.

This figure is just a guess. If Q2 goes into red, I won't be surprise.

FY20Q3 is widely expected to be loss-making. Besides factory shut down, its existing business might be affected by cancelled or reduced orders from customers.

As the worldwide economy is gloomy in the near term, we are not sure how Notion's second half of calendar year 2020 will look like, but the venture into face masks business might come in time to keep the company busy and moving.

It does not need to rent a place as it just moved to its new and larger plant. It might not even need to hire more workers.

Nevertheless, it might still suffer initial start up loss, who knows?

The demand for face masks is high now, but we don't expect this to last forever.

When the demand wanes, at least it has kept Notion afloat during the crisis, ONLY IF everything the management plans goes well.

George Leong

Thanks for sharing

2020-05-16 11:02