Return on Invested Capital by InvestingMBA

Tan KW

Publish date: Tue, 10 Sep 2013, 11:44 AM

Return on Invested Capital (ROIC):

"Leaving the question of price aside, the best business to own is one that over an

extended period can employ large amounts of incremental capital at very high rates

of return. The worst business to own is one that must, or will, do the opposite - that

is, consistently employ ever-greater amounts of capital at very low rates of return."

-Warren Buffett, 1992 Chairman's Letter

Return on invested capital (ROIC) is the ratio of after tax operating profits

earned divided by the amount of capital invested in core business

operations.

where:

Operating Working Capital equals operating current assets minus

operating current liabilities.

Operating current assets are current assets needed for core business

operations, including inventory, accounts receivable, prepaid expenses

and operating cash. Operating cash is the minimum amount of cash that

should be kept on hand at all times to give the company the flexibility to

meet unplanned cash shortfalls. The proper amount of operating cash

varies by business and industry, however, 4-5% of sales is appropriate

for most businesses.

Non-operating current assets are those assets classified as current, but

are unused in core operating activities. These include excess cash and

holdings of marketable securities. Excess cash is generally a temporary

imbalance and is not expected to earn a return, therefore, it is excluded

from the operating capital base.

When companies hold securities that represent partial or complete

ownership of an affiliate or strategic alliance, more often then not, these

assets should be included in invested capital. These securities tend to be

held on a long-term or permanent basis; the economics of the particular

relationship between the entities determines if such securities represent

capital invested in operations.

Operating subsidiaries are often referred to as "equity investees" or

something similar. Whatever language is used, it is critical to maintain

consistency between numerator and denominator; if an asset is included

in invested capital, the income accruing thereto must be included in

NOPAT.

Operating current liabilities are non-interest bearing current liabilities

necessary for operations. These are usually related to suppliers,

employees and customers; e.g., accounts payable, accrued salaries and

deferred revenue. Theoretically these items are the economic equivalent

of interest free loans made to the company by the related party. If the

company generates ample cash flow and can maintain proper liquidity,

the funding of working capital via non-interest bearing liabilities is

advantageous insofar as the company's own capital contributions will be

lessened.

The book value of property, plant and equipment, net of cumulative

depreciation, is always included in invested capital.

[Goodwill may be included or excluded from invested capital. It is

recommended to calculate ROIC with and without goodwill, giving

appropriate weight to each.] -- (Include or exclude)

ROIC: Better Than Other Return Metrics

ROIC measures the efficiency with which capital is employed and places

a business's ability to create value from operations in perspective. The

metric blends profitability and capital efficiency, expressing operating

profit earned per dollar of invested capital.

For evaluating operating performance, ROIC is superior to more

commonly used return metrics like return on assets (ROA), and return on

equity (ROE). These return metrics are easily skewed by items and/or

financing decisions that do not influence true operating performance.

First, ROA includes the income from, and capital invested in, items

unrelated to core business activities. While it is true that non-operating

items may impact a company's value, sometimes dramatically, significant

non-operating considerations should be temporary and are generally

easier to value separately from core results.

Second, ROE is influenced by the company's capital structure. Even if

operating results for a period are poor, ROE can be artificially enhanced

with the use of excessive debt. In this way ROE can be very misleading

when it is studied only at face value. Trusting a high ROE as a sign of

good performance, without considering how heavily the equity capital is

leveraged, is always dangerous. A highly leveraged company may face

insolvency from only a small and temporary reduction in revenues.

(Essentially good ROIC is equivalent to good ROE that is not excessively

leveraged).

ROIC remedies these shortcomings by measuring returns against a

blanket measure of funds provided. Invested capital encompasses the

capital contributions of all investors unsegregated between debt and

equity; NOPAT is the effective return the company earned for all

investors. When calculated correctly, ROIC yields an unbiased measure

of performance and a fairly objective medium for comparing operating

results among companies of different size and/or capital structure.

Essentially, ROIC evaluates performance by measuring returns on a

hypothetical all-equity, or unlevered, capital structure.

Interest expense is really the return earned by creditors; this return must

be accounted for in NOPAT. Since interest payments are a tax deductible

"expense" the associated tax shelter must be added back in the

calculation of operating taxes. Taxation arising from non-operating

income are excluded from operating taxes.

Economic value is created for investors so long as ROIC exceeds the

market determined opportunity cost of capital. If the company's securities

are priced efficiently they will sell at a premium (or discount) of invested

capital commensurate with the ROIC-opportunity cost spread to be

achieved in the future.

Analyzing ROIC

ROIC analysis can provide quantitative evidence of factors otherwise

difficult to measure. Very high and sustained operating earnings relative

to capital employed is prima facie evidence of a strong franchise with a

competitive advantage.

Buffett has alluded to the importance of this metric a number of times. In

his 1977 chairman's letter, he states that businesses typically add to their

equity (capital) base on a consistent basis; he is therefore unimpressed

by a firm that increases its capital base 10% and its EPS by 5% then

claims "record profits". "After all, even a totally dormant savings account

will produce steadily rising interest earnings each year because of

compounding."

In his 1987 chairman's letter, clear logic is provided for the importance of

ROIC in determining business value. He asserts that viewed by itself,

operating earnings describe little in terms of economic performance. "To

evaluate that, we must know how much total capital - debt and equity -

was needed to produce these earnings."

The ROIC a business achieves over time is influenced simultaneously

through its own competencies and the competitive landscape in which it

operates. A mediocre business can generate high ROIC for a short

period; however, newfound success tends to breed newfound

competition. Only the truly outstanding business, backed by an

identifiable competitive advantage - or economic moat - can sustain

excellent ROIC in the presence of strong competitive forces.

Qualitative Aspects of ROIC and Competitive Advantage

As mentioned above, if a company is to sustain above average ROIC for

any significant length of time, it must have certain favorable qualities or

competencies that give it an advantage over competition unless overall

industry competitiveness is weak. It is essential to have a grasp on the

qualitative aspects of the business - it's competitive position and overall

strategy - because these conditions are usually epitomized by the future

ROIC.

Economic theory suggests that any business currently enjoying

abnormally high returns can expect competitors to enter the industry and

attempt to capture "excess returns". Once enough players are in the

game, no one in the industry earns return greater than the opportunity

cost of capital.

The exception is when a firm has successfully separated itself from

competition with an ‘economic moat’, designed to protect its business

from invaders. To justify a high and sustained ROIC, especially when

forecasting future performance, you must identify at least one

competitive advantage.

Broadly speaking, a competitive advantage will fall into three main

categories:

1) Price Premium

Companies that compete in commodity type markets are known as "Price-

takers". Their customers base buying decisions almost exclusively on

price. By definition, price-takers have little or no input in the price they

charge. In contrast, "Price-setters" are companies that offer differentiated

products, or products of superior quality, whose customers willingly

accept the higher price tag relative to substitutes.

Price-setting companies tend to have rock solid brand names that

consumers instantly identify with quality. The "share of mind" these

companies enjoy give them pricing power - the ability them to charge a

higher markup over production cost without significantly diminishing

demand.

Product quality and differentiation can come via proprietary technology,

patents or added features and reliability that competitors simply can’t

match. Also, products symbolic of status tend to garner premium prices

(e.g., Rolex, Mercedes-Benz etc.)

Just because a firm is able to command premium pricing today, does not

ensure it will enjoy this luxury next year, or even next month. To be

confident of sustained premium pricing the firm must constantly work to

"widen its moat". Perhaps more importantly, there must be a degree of

stability in the industry. For example, consider two companies with

significant pricing power: Coca-Cola and Microsoft.

It is pretty safe to assume the soft-drink industry will look quite similar 50

years from now as it does today. The industry will be larger, population

growth and globalization will take care of that; but you can bet there will

be no major groundbreaking advances in the product itself. The same

can not be said about the software industry. Coke’s ability to keep its

position as industry leader and retain pricing power over the long-term

looks much better than Microsoft’s.

This is what Buffett means when he says he needs to understand the

business before he can commit capital. There is no question about

Microsoft's current dominance in their industry; the question is what is the

length of their competitive advantage period? Not an easy one to answer.

2) Cost Competitiveness

The ability to maintain total unit costs below those of competitors is a

second determinant of competitive advantage and high ROIC. Wal-Mart

has achieved excellent returns on capital (in spite their massive capital

base) for many years due largely to its highly advanced system of

monitoring and controlling costs. As the largest retailer in the world, Wal-

Mart has favorable relations with suppliers and enjoys significant

economies of scale by virtue of massive purchasing volume. Also, the

company's sophisticated distribution system creates further cost savings.

3) Capital Efficiency

The third source of competitive advantage is the ability to earn higher

returns per dollar of invested capital than competitors; stated in terms of

the ROIC ratio, capital efficiency is improved by lowering the denominator

without lowering the numerator commensurately.

Dell, for instance, has championed of the capital efficiency advantage.

The company’s business is built around direct selling through its online

ordering system. The company operates a minimal property account and

much of its working capital is financed by suppliers and customers,

meaning it receives payment from customers before it pays vendors for

supplies.

These factors - world-class inventory management and lack of brick-and-

mortar locations - allows Dell to earn significant profits while operating

with relatively tiny amounts of invested capital.

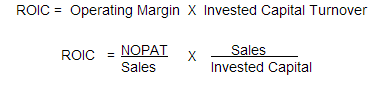

Disaggregating ROIC

The ROIC equation can be broken down to allow for study of the source

of a company's competitive advantage:

In general, businesses with a competitive advantage and related high

ROIC, will achieve a better than average showing in either its operating

margin or invested capital turnover, or both. The source of a strong

ROIC, in either operating margin or capital turns, will be determined by

the nature of the business. Obviously, a company with low operating

margins is not necessarily doomed to low ROIC, if the low margin is

compensated for with excellent turnover.

Price-setters, sellers of differentiated or high quality products, tend to

benefit from a high margin while price-takers that rely on high sales

volume, should show better capital turnover.

It is useful to compare these items relative to the company's peers and

monitor them over time. A gradual trend of improvement or decline in the

advantage source (operating margin/capital turnover) can be taken as

early signs of a competitive advantage growing stronger or weaker as

well as changes in the degree of competitiveness in the industry.

Summary

ROIC analysis is critical for assessing a business's ability to create value

for investors from its operating activities. When the capital invested in a

business is capable of continually generating returns greater than its

opportunity cost economic value is created.

ROIC is a better benchmark of performance than other more commonly

used metrics (e.g., ROA, ROE). The reason is that ROIC is objective in

that it is considers only capital invested in, and income earned from the

core business; secondly, it is not skewed by how the company is financed

while ROE is necessarily affected by capital structure.

Leaving price aside, when considering acquiring partial ownership of a

business, the candidate is the one that can employ the most additional

capital at the highest rate of return.

Very high and sustained operating earnings relative to capital employed

is a tell-tale sign of a strong franchise. ROIC analysis helps answer the

critical question- Is this a good business with a durable competitive

advantage?

A competitive advantage can be manifested in excellent ROIC in a

number of ways depending on the nature of the business and the "width

of its moat." Companies that command pricing power should show above

average operating margins and may also benefit from a capital efficiency

advantage. A price-taker may build a competitive advantage insofar as it

achieves cost competitiveness and capital efficiency.

As important as the level of ROIC is the ability to sustain the ROIC over

time. This is not an easy task for most businesses. Factors determining

the competitive advantage period are the firm's own competencies and

the degree of industry stability and predictability.

More articles on Good Articles to Share

Created by Tan KW | Dec 23, 2024

Created by Tan KW | Dec 23, 2024