MQ Research: Tenaga’s 1Q20 Inline; Covid – Not as Bad as Expected?

kltrader

Publish date: Thu, 11 Jun 2020, 09:36 AM

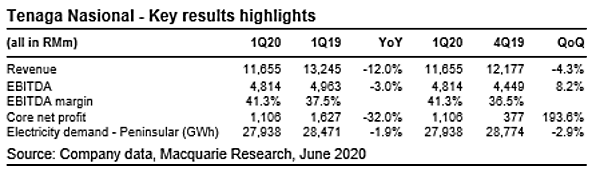

Tenaga Nasional (Tenaga) posted its 1Q20 results yesterday with its core profits at RM1,106mil (-32% year-on-year (YoY)) that was largely in line with Macquarie Equities Research’s (MQ Research) expectations. MQ Research highlighted that electricity demand and collections in 1Q20 declined affected by the movement control order (MCO) but they have gradually improved as the MCO was steadily lifted. MQ Research maintains Tenaga’s target price at RM15.20.

Event

- MQ Research maintains its Outperform recommendation on Tenaga following the release of 1Q20 results. Core profits (ex-forex and exceptionals) of RM1,106mil (-32% YoY) came in at 21% of MQ Research’s and consensus estimates - largely in line. Interestingly management pointed to both collections and demand coming ahead of expectations as the movement control order was gradually lifted. MQ Research retains its view that Tenaga’s shares remain attractively valued at 13.4x core 20E price-to-earnings ratio (PER) with special dividends likely to keep yields at 6% in FY20 and FY21.

Impact

- Janamanjung and provisions drag 1Q20. With Janamanjung 2 only coming onstream in mid-February, capacity payments were impacted by approximately RM100mil. Bad debt provisioning was lifted to RM99m as a prudent move towards Covid-19. Electricity demand in 1Q declined 1.9% YoY, with a 10% YoY decline in March. Core profit fell 32% YoY, although MQ Research notes that reversal of Long-Term Incentive Plan provisions in 1Q19 (+RM220mil) exacerbated the decline.

- Not as bad as expected. Management admitted that they were surprised with the rebound in demand and collections as the MCO was relaxed. Demand troughed in April (-22% YoY) and had begun to improve in May (-11% YoY). Collections improved having fallen 36% YoY in April, 30% in May and up 95% YoY in the 1st week of June. There is an increased focus on collections and dealing with customers whose bills rose as they stayed at home.

- Restructuring delayed. While the generation business will begin separate management structures from 1 July as planned, the legal split has been delayed to 1 October owing to the MCO. The completion of the RetailCo element has been delayed to October as the teams focus on collections. This should have little bearing on financials, in MQ Research’s view, although management noted that it has already started to see cost reductions filter through.

- Capital management and expanding renewables reach. While Tenaga remains committed to rewarding shareholders and improving capital efficiencies, no commitment on special dividends were made. It is also looking to make opportunistic acquisitions for its renewables portfolio.

- Regulatory Period 3 (RP3) delay? Discussions are ongoing with the regulator to delay the implementation of RP3 to 2022. Management felt that both demand and fuel cost shifts due to Covid require an extension of time for better planning estimates. MQ Research assumes a reduction in the regulated return by 0.2ppt to 7.1% from 2021.

Action and Recommendation

- Outperform reiterated.

12-month Target Price Methodology

- TNB MK: RM15.20 based on a PER methodology

Source: Macquarie Research - 11 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-16

TENAGA2024-08-16

TENAGA2024-08-16

TENAGA2024-08-16

TENAGA2024-08-16

TENAGA2024-08-15

TENAGA2024-08-15

TENAGA2024-08-15

TENAGA2024-08-15

TENAGA2024-08-15

TENAGA2024-08-15

TENAGA2024-08-14

TENAGA2024-08-14

TENAGA2024-08-14

TENAGA2024-08-14

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-13

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-12

TENAGA2024-08-09

TENAGA2024-08-09

TENAGA2024-08-09

TENAGA2024-08-09

TENAGA2024-08-09

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-08

TENAGA2024-08-07

TENAGA2024-08-07

TENAGA2024-08-07

TENAGA2024-08-07

TENAGA2024-08-07

TENAGA2024-08-06

TENAGA2024-08-06

TENAGA2024-08-06

TENAGA2024-08-06

TENAGA2024-08-06

TENAGA

.png)

.png)

RainT

READ

2020-06-13 14:26