Why Hengyuan is Falling So Rapidly? Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 04 Apr 2018, 03:49 PM

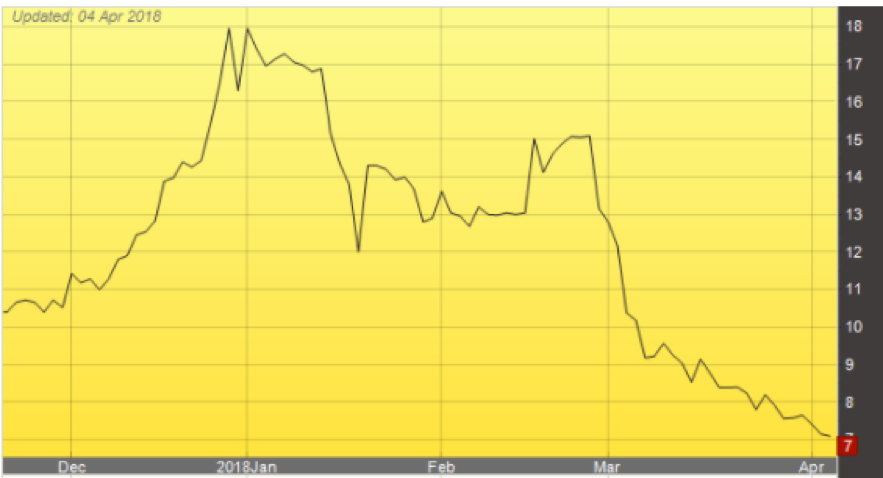

The price chart shows that Hengyuan has been dropping from Rm 18 to around Rm 7.20 per share in the last 3 months. Many people ask me for my opinion. Some wanted to know if they should bottom fish and hope for the down trend reversal to make money. Some said that they wanted to buy because its EPS for last year which was Rm 3.03 per share and it is selling at P/E less than 3 and they could not find any other good respectable company share sell[ng at such ridiculously low P/E.

All I can say is that it does not comply with my share selection golden rule as follow:

The company must have reported increasing profit in the last 2 consecutive quarters and it must have good profit growth prospect which is the most powerful catalyst to push up share price.

Although Hengyuan has reported increasing profit in the last few quarters, it does not have good profit growth prospect. All the smart shareholders know that the company has to stop operation for 2 months to upgrade its refinery and it also has to pay the income tax for the profit it made last year. It has no profit growth prospect for the whole of this current year. That is why they are selling so aggressively. As a result, the price is falling so rapidly

Many experts based on financial report would recommend you to buy because the reported accounts for last year is so beautiful.

Remember accounts is only showing historical facts but it does not tell you anything about the future profit growth prospect of the company. Also, P/E ratio 3 is based on last year’s earnings.

After my publication of this article, I expect many will ask me if they should sell to cut loss and utilise the sale proceeds more effectively to buy stocks with better profit growth prospect.

My answer is that Hengyuan will surely report less profit for this current year and until it can report increased profit the share price will remained depressed.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.