Dayang: Puzzle is Clearer - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 18 May 2019, 01:03 PM

Ever since Dayang hinted that it would require to carry out a fund-raising exercise, all investors were wondering what could it be. In most cases, many shareholders in anticipation of the fund-raising exercise would sell their holdings because they think the company is financially not sound and the share price will drop.

From my long experience, raising money from shareholders or from financial institutions to do more business is a good strategy. In fact, in the 1st year of any MBA course, students are told that if they do business with only their own capital, they are considered inefficient. They must not be afraid to borrow money to do more business, provided they know how to do business. Unfortunately, statistics show that 90% of beginners failed in their first attempt to do business.

Dayang’s announcement of raising fund to do more business is a good strategy.

Investors normally do not like uncertainty. For example, our famous Ooi Teik Bee sent out his advice to his 1,000 subscribers to sell and cut loss. Those who sold at higher prices should be happy to buy back at cheaper prices.

No one can win from any kind of war. The uncertainty of the US-China trade war and the announcement of the foreign fund, called Numeric Investor LLD sold a few millions shares and ceased to be a substantial shareholder also depressed the price.

Moreover, our national economy is in a bad shape due to the billions of Ringgit stolen by Najib, his cronies and the corrupted officials.

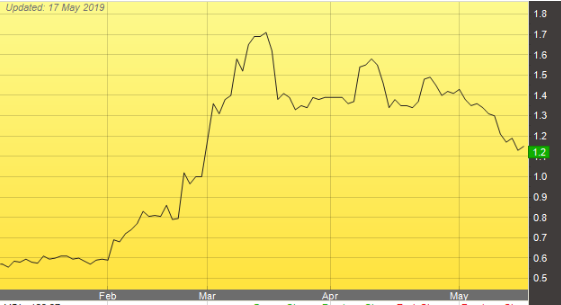

As a result, the price has been dropping in the last 2 months from its peak of Rm 1.71 to close at Rm 1.15 yesterday.

Finally, Dayang made an announcement of its financial restructuring exercise yesterday which makes the puzzle clearer. I believe the price has reached its bottom and the worst is over. Immediately after seeing the announcement, my wife and I celebrated diner and drank the recently voted best whisky in the world, 8 years old Queen Margot as photo below.

The 1st quarter result should be announced before the end of May and the 2nd quarter result should be announced before the end of August which is about 4 months away.

Based on the profit growth of the last few quarters and the recently secured additional new contracts, the company should continue to report increasing profit for the next 2 consecutive quarters-thus complying to my golden rule for share selection. I believe the price will easily double after the announcements of the 2 quarter results. This may sound impossible.

If you look at the price chart you can that it had shot up from 60 sen to Rm 1.71 about 300% within 1 and a half months before.

The best time to buy is at the pivoting point when it starts to move uptrend. I will sell my all my other holdings to keep buying Dayang.

I have posted a few buy recommendations before when the price started to rise and I have only Dayang shares. I am not asking readers to buy to support the share price to help me because the daily volume is tens of million shares and whether you buy or sell will not affect the share price.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-22

DAYANG2024-11-21

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-18

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANG2024-11-14

DAYANGMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.