Supermax: Update my target price - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 13 Jul 2020, 09:15 AM

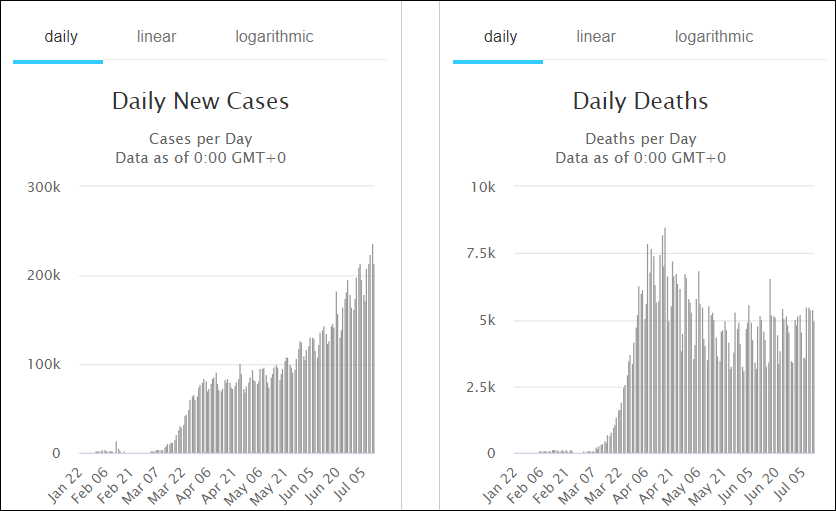

Currently there are 12,400,000 confirmed Covid 19 cases and 559,000 deaths in the world. The chart below shows there are more than 200,000 new cases daily.

The Chart below shows that there are 3,097,300 confirmed Covid 19 cases and 132,683 deaths in the USA. The chart below shows that in the US the daily cases started in March and currently there are about 60,000 new cases daily. The US has the largest number of Covid 19 cases in the world.

China and many other countries are testing vaccine on humans. It will take a long time for FDA to approve the use of the vaccine and to vaccinate millions of people.

Due to Covid 19 pandemic, the demand for medical gloves far exceeds supply. As a result, glove price continues to increase higher and higher. All glove manufacturers are taking advantage of the situation to increase their selling price.

After I read the analyst briefing from Supermax on 5 July I need to update my target price based on page 13 as shown below.

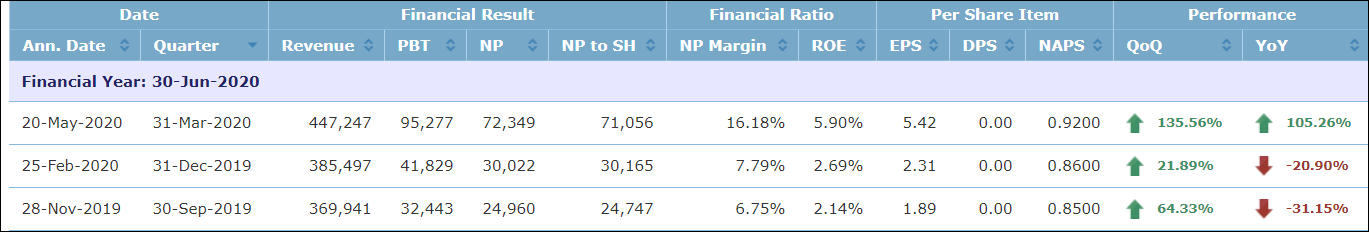

I refer to the above report, total issued number of shares is 1,360 million.

The 3rd quarter ending 31 March 2020, revenue/sale Rm 447 million, PBT Rm 95 million and PAT Rm 71 million. The production cost is revenue Rm 447 million minus PBT Rm 95 million = Rm 352 million and average selling price (ASP) is US$ 60.

As shown on Supermax’ briefing page 13 above, ASP for the 4th quarter ending June 2020, the selling price was increased from US$60 to US$ 160, an increase of US$100 which is pure profit because the additional selling price does not involve production cost.

The 4th quarter ending June 2020, the production cost Rm 352 million divided by 60 X 160 = Rm 939 million which is the revenue/sale minus Rm 352 production cost = Rm 587 million which is pure PBT or PAT Rm 410 million.

I refer to the table above. The total PAT for 1st quarter Rm 24,747 million, 2nd quarter Rm 30,165 million and 3th quarter Rm 71,065 million. As I calculated, the 4th quarter PAT is Rm 410 million.

The total profit before tax (PAT) for the year ending June 2020 is Rm 536 million.

EPS Rm 536 million divided by total issued share 1,360 million = 40 sen.

Based on P/E 25 my current target price is Rm 15.00.

I want to be very safe and conservative in calculating my Target price. I assume the company does not have additional production and it does not increase its selling price for the next financial year ending June 2021, its annual profit will be 4 X 4th quarter PAT Rm 410 million = Rm 1,640 million.

EPS Rm 1,640 million divided by 1,360 total issued shares =Rm 1.21.

Based on P/E 25 my target price will be Rm 30.25.

Based on P/E 20 my target price will be Rm 24.20 which is easily achievable.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...