Supermax price drop is so illogical - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 30 Dec 2020, 09:44 AM

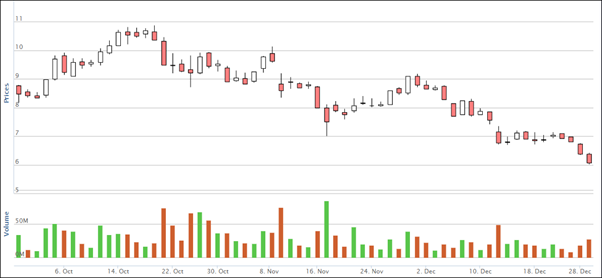

The price chart shows that its price was Rm 10.36 on 20th October and it closed at Rm 6.06 yesterday. It dropped 42% in the last 2 months.

It is so illogical to see the price continues to drop when the company continues to report more and more profit every quarter.

The reason for the price to drop is profit taking by EPF, Investment Banks and stupid investors who are following like sheep to sell.

Currently there are 81.7 million Covid 19 cases and 1.78 million deaths. USA has 19.8 million cases and 343,182 deaths. All these figures are still increasing more and more.

Due to Covid 19 pandemic, the demand for gloves far exceeds supply. All the glove makers can easily increase their selling prices to make more and more profit which should reflected on their share prices.

Many scientists predicted that the pandemic will not be under control for at least another 2 or more years despite the vaccinations because 80% of the world population needed to be vaccinated.

In fact, additional gloves will be required for medical staff to wear during vaccination as shown on the photo below.

Supermax reported EPS 30.58 sen for 1st quarter ending September. It made 100% more than its previous quarter. Supermax profit for its 2nd quarter ending December should be another new record high. The company will report its 2nd quarter result in Mid-January.

What investors should know?

The most powerful catalyst to push up share price is profit growth rate. Supermax has the best profit growth rate among all the glove stocks. Currently, glove sector offers better profit growth rate than any other sector.

Based on the above facts, Supermax will continue to make more and more profit in the next 2 years. Its share price should continue to go up higher and higher.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Guys, SUPERMX is now HENGYUAN 2.0, DAYANG 2.0, and is even JTISA 2.0 if you have been in market for long enough (since 2012) .... Don't cry for me Mr. Golden Rules, but for yourself!!!

2020-12-30 20:03

@onionchong uncle is sweating bullets. what to do? write more articles? maybe a few billion words will prop it up?

2020-12-30 20:21

Supermax is considered the leading indicator of Glove ASP's and Orders as they have the largest proportion of spot / adhoc orders

If share price has made a big move downwards way in advance with no change in publicly available information (just like start of the year 2020 when share price shot up), it means ASP's and glove demand is already dropping as we speak

All sophisticated glove investors should consider diversifying their portfolio to true recovery stocks to protect their profits and grow them further

Top pick is Genting Berhad (3182) powered by the super cycle growth catalysts: -

Skyworld Outdoor Theme Park

Resorts World Las Vegas

Japan Integrated Resort Bid

Genting Plantation (CPO record high)

Genting Power, Property, Oil & Gas (cyclical sectors in a massive upcycle)

Sincerely,

EMSVSI

2020-12-30 20:56

This kyy old man only look at the fundamental of. supermx but he neglect or may be no investing knowledge like doesn't know how to use and read chart analysis for his investment, thus he not realize all glove stocks including supermx in down trend , the change of market theme play to recovery counters. Anyone invests against the market trend like kyy this old man would definitely make loss.

2020-12-30 22:32

Good for uncle to buy more. Why complain. Karma has a way to bite you back.

2020-12-30 22:59

Koon ah koon, who says glove makers can easily increase their selling price & make more profits? Look at the future, key indicator is growth. Is there? Demand will increase tremendously, so do SUPPLY comes 2021 onwards. Over supply and full of competition!!!

2020-12-30 23:21

The up trend of glove stocks including supermx at beginning of this year is due to the pandemic. Thus, it's logical for their price drop now in down trend when vaccines come out to control or end the pandemic. Why u think illogical, kyy old man.

2020-12-30 23:29

Kyy, remember the rules of investment that buy on foreseen or looking forward and sell on reality. Stock market always look forward future and not look at current or past.

Just like at the beginning of this year stock market look forward or foreseen glove companies will have super profit led by high demand for glove due to pandemic, all glove counters up trend with super bull. Now stock market look forward vaccines come out to cure the pandemic lead to decline in glove demand and profit of glove companies that all glove counters price drop in down trend.

Thus, should buy glove stocks at beginning of this year with forward looking its super profit will happen and now should sell it on reality of its super profit already happened.

2020-12-30 23:48

The stock market characteristics is to reflect the forward looking future events and not the current events happening or the past.

2020-12-30 23:54

@emsvsi

Assumption that all vaccines will work. The Australian vaccine has failed. GSK and Sanofi vaccine have encountered problems and will be delayed till later in 2021.

Also AstraZenneca production capacity is 2000bn aiming for 3000bn in 2021.

Gamaleya vaccine SpunikV is a black box. Nobody has any data on this vaccine.

There are 7.8bn people on the planet. All these vaccine are 2 doses. So 15.6bn doses are needed.

2020-12-31 01:59

when the price grow 1200% from 1.00 to almost 12.00, and market cap grow from 2 billion to almost 30 billion, you didn't call people sheep??

You late to the party and feel angry now??

2020-12-31 06:28

Looks like uncle is mixing up a trade with an investment.

Gloves will be intraday at its best. There I said it.

Unless TG somehow miraculously gets its US ban lifted, the other gloves will suffer too.

One kena labour/accomodation issue, the rest will be receiving it.

2020-12-31 06:31

Glove makers cannot simply increase price to make more profit just because there is a demand for it... In the beginning they might make some money, but eventually when many more glove companies come into the picture, the price will stabilise and hiked up glove sector will.stabilose.

If one "invest" thinking only about the demand, then the chances of investment gone wrong is high..

2020-12-31 07:37

now i know how to be an extraordinary investor...

when market goes against ur wish, blame the market...

when IBs give low TP, ask SC to investigate them...

when other investor do profit taking, say they are 5tupid..

most importantly, always think ur r right, it is always everyone else's fault....

2020-12-31 08:27

My prediction for 2021 would be a year of big gains on the recovery themed stocks. Glove stocks will be the biggest losers. They were the biggest winners in 2020. All the best to all traders and investors. Do invest wisely and learn from past experiences, cheers.

2020-12-31 10:37

SINGAPORE DOCTOR ALSO NO USE GLOVES WHEN GIVE INJECTION TO NURSE, WHY THEY DONT WANT TO USE GLOVES ALREADY ?? https://www.channelnewsasia.com/news/singapore/covid-19-first-vaccinations-ncid-healthcare-workers-pfizer-13864346

2020-12-31 10:57

Very fair & intelligent opinion loh...!!

Posted by drkelvin20 > Dec 31, 2020 11:28 AM | Report Abuse

just some neutral opinion, my own opinion, you can ignore if you do not agree:

The glove counters currently are still way too pricey compared to PreCovid level, it is a crystal clear and rock solid that the glove counters do not have that kind of sustainable profit/revenue to support even the current depreciating share price...The gloves selling prices are still high at the moment, if you know how the industry business and marketing operate, or just talk to someone in this industry you will know the glove selling price will be back to normal, or some higher than PreCovid level. But definately selling price cannot remain at this level.

In my opinion, there is a lot of downside for supermx and top glove, and other glove counter. considering 1:1 bonus share issue and 1:2 bonus share issue, and even consider a slighty higher glove selling price than PreCovid level, I would consider a good buy for supermx at ~rm 2, and top glove around ~rm3.

Mayb some of you may laugh off this low target price and think it is too far off from current share price. BUt if you recall supermx was rm 9++, top glove was rm 9++ after bonus share issuance, now dropped to rm 6+ respectively, then further drop can happen slowly.

The fact that 2020 Financial year super bull profits for glove counters, it will present a high pressure to the glove companies to sustain the super bull profit after the pandemic is getting over. Say, the financial quarter at the end of 2021, or beginning of 2022. These year end 2021 and early 2022 on wards, financial report, when compared to 2020 whole year revenue and profit. It will be inevitable that the performance will show a huge drop. and by then, in my opinion, the glove counters will drop to thier sustainable. And only then, for me, it is a very good buy, especially top glove with high CAGR all these years.

2020-12-31 11:33

Take Insas and Kenanga as example. Based on their latest Sept 20 quarterly EPS of 9.85 sen & 7.03 sen, both should record single digit PE of less 5 times if their earnings sustain over 4 quarters. But why is their shares selling for pennies? The answer lies in their business. It is perceived that the earnings are not sustainable and is volatile in line with the trading sentiment in Bursa. Currently, it's red hot in Bursa with daily record volumes but why do investors not buy these shares like no tomorrow? Because of the perception that their earnings are not sustainable. So, this old geezer has much to learn in the stock market. It will be difficult for this old geezer to earn back his credibility due to the many stories of deceit posted in i3, cheers.

2020-12-31 14:09

This old geezer should look at so many companies selling at single digit PE in Bursa apart from glove stocks. Anyone pushing them up? NO. The reason is simple. They do not perceive these companies to have sustainable earnings at current prices. So, old geezer has a lot to learn although he boast of his broken track record even though he has a trail of losers such as Xingquan, JTIASA, Jaks, Dayang, among others. His golden rule and business sense is nothing but bullshit.

2020-12-31 14:15

On the first sign of the gloves ASPs retreating in 2021, all glove counters will see a big sell-off.

2020-12-31 14:52

Even some Anal-lists have some cow sense to avoid glove stocks before the Avalanche arrives.

2020-12-31 14:53

RM10 mil fine awaits half-baked stock market gurus, warns SC

Author: savemalaysia | Publish date: Thu, 31 Dec 2020, 9:17 AM

USING a disclaimer to camouflage the rendering of investment advice does not safeguard an individual from the long arm of the law.

In its latest Guidance Note on Provision of Investment Advice, the Securities Commission (SC) said it is more likely to consider discussions on specific stocks on blogs, forums or other social media as an investment advice if they involve the provision of recommendation or opinion which may induce readers to take an action regarding the specific stock.

“Your activity of giving investment advice is likely to require a license under the Capital Markets and Services Act (CMSA) 2007 if that activity is considered as carrying on a business,” the market regulator cautioned.

As such, the SC pointed out that it will take into account the overall circumstances of a person undertaking the activity in making a final assessment.

“As such, the use of a disclaimer if any, does not, by itself, determine whether an activity amounts to carrying out a regulated activity of investment advice,” it noted.

Any person carrying on a business of giving investment advice without a license commits an offence under the CMSA which is punishable with a fine not exceeding RM10 mil or imprisonment not exceeding 10 years or both, if found guilty.

This guidance note which can be downloaded at www.sc.com.my/regulation/guiding-principles is issued in response to the increasing number of queries and complaints regarding various social media, chat rooms and messaging applications that appear to be providing specific stock recommendations to the public for a fee.

Information on persons licensed or registered by the SC can be found at the Public Register of License Holders www.sc.com.my/licensed-registered-persons and List of Registered Recognised Market Operators www.sc.com.my/rmo.

Members of the public who have any information on any person providing investment advice without a licence may contact the SC’s Consumers and Investors Department at +603 6204 8999 or email aduan@seccom.com.my. – Dec 30, 2020

2020-12-31 14:54

@ surewin1woh. Thanks for the info. Hopefully, this will send a clear message to all and sundry of the risk they faced when trying to promote their shares in i3. These unscrupulous share manipulators should have been hauled up by the authorities a long time ago. They're nothing but rogue traders.

2020-12-31 16:25

kelvin61..agree..being one of the victim i feel how pain it is when someone talk bad about stock that i hold by this so called manipulator

2020-12-31 19:46

of course it is logical. Just like face masks prices can not go up anymore. how can share prices go up when the prices of the products the company manufactured can not go up any more. productivity or income can only increase if prices of gloves can go up over time. no... this is a dead product as far as its selling price is concerned.

2020-12-31 23:42

selling prices go up and go up with respect to time...or else income will fall because money lose purchasing power over time. 1000 now and 1000 later on is not the same. this is called low productivity or profitablity.

2020-12-31 23:44

Stock: [TOPGLOV]: TOP GLOVE CORP BHD

Dec 18, 2020 10:50 AM | Report Abuse

Stocks on KLSE r all P n D except a few tech stocks that fly non.stop.

Being P n D, pump n dump, these stocks can have 1 n only 1 wave 1, just implausible to go higher to wave PRIMARY 3!

GLOVE is considered special. Glove had A > B > C of wave 1, the best thus far for all fa stocks.

Why is it like this? bcos the fun pple in money power always love to SELL.ON.NEWS, more so in v special news. In so doing, they kill off the financial fire.

The only way to do well: count the MAJOR waves early n act on it correctly at right.timing.

NB:

Position well n early into the best growth stocks in OSAT n EMS biz THEME.PLAY for 1st half 2021...

2021-01-01 06:11

The big sell-off has started on the very 1st trading day of 2021 for the glove big boys. Margin players will be running helter-skelter now. Let's see if they're still saying is illogical to sell.

2021-01-04 09:42

CCCL

Closing at 5.98 Cantonese meaning Ng Kao Fatt, not enough gains ! This number is the most expensive car number plate in Hong Kong. Hopefully 2021 All fatt fatt!

2020-12-30 19:51