Leon Fuat is on fire sale - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 24 Jun 2021, 11:08 PM

China is the biggest steel producer

China is the biggest steel producer in the world. Since China wants to reduce the use of coal to reduce air pollution, it has reduced steel production and stopped steel export. China requires all the steel for its own property and infrastructure development.

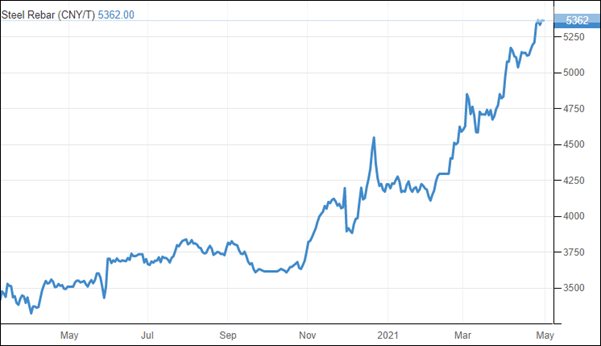

As a result, the price of steel has been going up as shown on the price chart above. It has gone up about 50% in the last 12 months.

All the steel products makers will benefit because their steel stocks and manufactured goods have also gone up in price. That is why all the steel companies have been reporting increased quarterly profit. Leon Fuat reported the best quarterly profit increase among all the metal stocks. As steel price continues to rise, Leon Fuat will continue to make more and more profit which should be reflected on the share price soon.

Today the closing price is 98.5 sen. Its latest quarter EPS was 11.65 sen. Even if I assumed its next 3 quarter is the same, its annual EPS will be 4 X 11.65 equal 46.6 sen. It is selling at PE 2. That is why I put the title of this article “Leon Fuat is on fire sale”.

Today RHB bought 745,000 Leon Fuat for me. You can call 05-2493279 to confirm my purchase. Today HLIB bought for me 565,000 Leon Fuat for me. You can call 05-2559110 to confirm my purchase.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Now he only can buy in the 100ks as he has lost 90% of his fortune on dayang....

2021-06-25 11:45

Geezer is again giving false information of the increase in steel prices. Take note that he did not show you the latest month of June 21 where prices have retraced. He will continuously received bad KARMA for lying.

2021-06-25 14:34

kyy is trying to mislead newbies again by showing an outdated steel price chart. He either has no idea what happened in recent months or he is doing it purposely.

This oldman simply doesnt have credibility and integrity. Pui!

2021-06-25 20:22

No harm listening to the almost-senile KYY, if you have the spare cash!!!

2021-06-26 08:32

Besides Leon Fuat, Astino released great QR too, if uncle KYY's prediction is right, then we are on our way to the moon! If it is wrong, rugi a bit je, since recovery theme is in place and construction post-covid should be greater than during covid. Worth the risk, but bet accordingly to your appetite, as long as it doesn't exceed 20% of your total portfolio in one counter, should be decent.

2021-06-26 09:32

It’s clear who’s under fire. Just collect more if you love this high-net-debt company.

2021-06-26 09:34

The intention of his posting is very obvious ; for people to push up the price

2021-06-26 16:37

Dun worry, there will be a more fierce fire sale soon. The sale has barely begun!

2021-06-28 14:05

stockwin

Hahaha.....If you call the above number, obviously RHB would not confirm any details due to banking secrecy !!! good one KYY. But I believe you bought the share. Good luck to you.

2021-06-25 11:04