Investors in dilemma - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 01 Jul 2021, 10:57 AM

Covid 19 pandemic and political uncertainty are depressing the stock market. Agong proposed Parliament to reconvene as soon as possible. Currently Muhyiddin has diarrhoea and is in hospital. The Chinese word for diarrhoea is “lou sai or lai see”. He is afraid to lose his PM position. I believe the stock market will rebound when the new PM is elected.

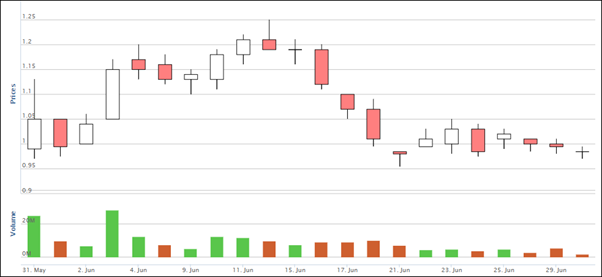

China has been the biggest producer and exporter of steel in the world. Currently China has reduced steel production and stopped export to improve its air quality and environment. As a result, steel price has gone up about 50% in the last 12 months and all the steel companies have reported increased profit. Unfortunately, even the most profitable steel companies Leon Faut has been dropping in the last few weeks as shown on its price chart below.

The last traded price was 98.5 sen per share. Its EPS was 11.65 sen for quarter ending March 2021. Even if I assume its EPS for the next 3 quarter is the same, its annual EPS will be 4 X 11.65 = 46.6 sen. Share price 98.5 sen divided by 46.6 sen = PE 2.

Mr Ooi Teik Bee has circulated his weekly stock newsletters “Steel Stocks on cheap sale”.

Investors cannot be so foolish to sell Leon Faut now.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

KUALA LUMPUR (July 1): The IHS Markit Malaysia Manufacturing Purchasing Managers’ Index (PMI), a composite single-figure indicator of manufacturing performance, fell to 39.9 in June 2021 from 51.3 a month earlier as Malaysia’s Covid-19-driven movement restriction policies resulted in output and incoming orders moderating to the greatest extent since the worst of the initial outbreak of the pandemic in April 2020.

In a statement today, IHS Markit said the country's manufacturing sector lost considerable momentum at the end of the second quarter of 2021 (2Q21) as Covid-19 infections led to the reintroduction of stricter containment measures to curb the spread of the pandemic.

"Business confidence hit the lowest reading on record,” IHS Markit said.

2021-07-01 12:48

My opinion on Leon Faut

Private placement of Leon Faut 31m at 85 sen was completed on 07 May 2021

At current price of 99.5 sen, Private placement investors still can make a profit of 14.5 sen (17% profit)

Chart wise, the private placement investors could be in the process of unloading their stock before it move down to break even price of 85 sen

In my opinion, the upside potential is limited. Buying is easy, but getting out of your buying position with a good profit could be tough under present conditions

2021-07-01 22:52

Uncle said buy... you need to follow his instructions kah?

Don’t listen to anyone in Bursa. Every one has his own motives in promoting stocks.

2021-07-02 06:22

Leon Fuat or Leon Faut? Leon Faut tak wujud ni.

Anyhow, not interested in cyclical steels. Out of my circle of competence.

2021-07-03 09:49

I oredi raised my red flag bcos my portfolio is in the red !

Any financial assistance ?

2021-07-03 13:50

malaysia in MCO, construction is not allowed to operating. Who want to buy steel ? aduih...think logic la. everyone now rushing to buy technology and software company like D&O, Revenue, Genetec, Kobay, Hightec and so on. Investors are looking at value investing or future technology or long term play technology. Steel is just steel and play when commodities price up and down. but only happen when country with no MCO then can play la. now totally can't. is over for steel.

2021-07-03 14:42

During MCO:

Meanwhile, the five sectors allowed to operate with 10% workforce are automotive (vehicles and components); *** IRON and STEEL ***; cement; glass; and ceramics.

He failed to metioned that LeonFB and STEEL Co's is only operating at 10% CAPACITY!!

2021-07-04 22:41

emsvsi

Dear Mr Koon Yew Yin,

Investors may or may not be in a dilemma and steel price rise may or may not be a short term affair, but what is for certain is in 6 months time Genting's business performance will be much better

The world moves in cycles - the seasons, economic cycle and recession (10 years), stock market cycle, property cycle, commodities cycle...

1971 Genting Highlands Opens

2021 50 Years of History and Growth

2009 Global Financial Crisis

2020 Covid-19 Pandemic

2009 Year of the Ox (KLCI + 44%)

2021 Year of the Ox

2010 Resorts World Sentosa (SG) opens

2021 Resorts World Las Vegas (US) opens

2009 Mar RM3.08 (low) to 2011 Nov RM11.98 (all time high)

2020 Nov RM2.95 (low) to 2022 RM ????

History always repeats itself

Years of downtrend will be replaced with years of uptrend

All are welcome to GENTING (3182) the numbawan top pick sure win Recovery + Value + Growth stock in the Year of the Golden Ox

Sincerely,

EMSVSI

2021-07-01 12:32