Why is US in a mess? Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 10 Oct 2021, 06:16 PM

US is in a situation that is confused and full of problems. In the last few days, the US Senate has been discussing how to raise the national debt ceiling.

The U.S. debt ceiling officially became operative again after a two-year suspension, with lawmakers in Washington yet to outline how they’ll avoid a potential default later this year.

The debt limit -- the total amount that the federal government is authorized to borrow -- was set at $22 trillion in 2019. It will adjust to the current level of debt -- which had risen to $28.5 trillion as of the end of June -- when the suspension ends, putting pressure on Congress to find a solution that will allow the government to keep borrowing.

Trade deficit: Washington Post reported: The U.S. trade deficit jumped to $68.1 billion, the highest monthly deficit in 14 years, as a surge in imports overwhelmed a smaller increase in exports.

The gap between what America buys from abroad compared to what it sells abroad rose by 8% from the October deficit of $63.1 billion, the Commerce Department said Thursday.

US is a wicked bully

US military spending: In May 2021, the President's defence budget request for fiscal year 2022 (FY2022) is $715 billion, up $10 billion, from FY2021's $705 billion.

The US controls about 750 bases in at least 80 countries worldwide and spends more on its military than the next 10 countries combined. All the money is wasted because no one will attack US!!!

20 years’ Afghanistan war: US spent US$2.3 trillion over 20 years fighting the Taliban in Afghanistan and in the end, US got defeated.

US cannot stop printing more money

What is M1 M2 and M3 money supply?

M1, M2 and M3 are measurements of the United States money supply, known as the money aggregates. M1 includes money in circulation plus checkable deposits in banks. M2 includes M1 plus savings deposits (less than $100,000) and money market mutual funds. M3 includes M2 plus large time deposits in banks.

Who controls the money supply and how?

To ensure a nation's economy remains healthy, its central bank regulates the amount of money in circulation. Influencing interest rates, printing money, and setting bank reserve requirements are all tools central banks use to control the money supply.

Fast-forward to February 2020. Since then, the quantity of money in the U.S. economy, measured by M2, has increased by an astonishing $4 trillion. That's a one-year increase of 26%—the largest annual percentage increase since 1943.

What happens when the US prints more money?

If the government prints too much money, people who sell things for money raise the prices for their goods, services and labour. This lowers the purchasing power and value of the money being printed. In fact, if the government prints too much money, the money becomes worthless.

Covid 19 is the game changer:

US has the most Covid 19 cases in the world.

Currently US has 45,135,620 Covid 19 cases, 732,477 deaths and 34,577,516 recovered patients. Many of the Covid 19 cases will soon die and some will recover. From medical studies, the recovered patients will continue to have ill health. Moreover, their lives will be shortened. All these are draining the US economy.

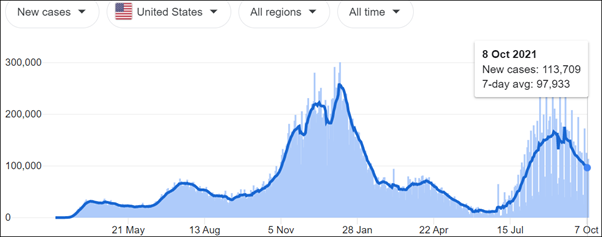

When Donald Trump was the President, he kept bashing China to win more votes because most Americans liked it. He claimed that Covid 19 was made in China and he called it “kongflu”. Moreover, he did not even believe in wearing a face mask. Unfortunately, he has about 34 million followers who believed him. US has a daily average of about 100,000 new Covid 19 cases as shown on the chart below.

Another reason why the US has the most Covid 19 cases is that they believe in freedom and democracy. They want to free from wearing face masks. They can even demonstrate against popular believes.

After Trump lost in the general election, his supporters stomped Capital as shown the photos below.

US jobless claim is increasing

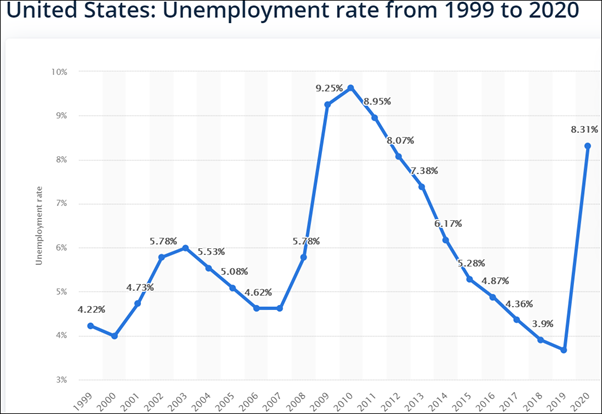

Due to Covid19 pandemic and many other reasons, the number of unemployment is rising as shown on the chart above. The jobless claim is increasing which will continue to drain the US economy.

Gun violence in US is increasing

The Small Arms Survey stated that U.S. civilians alone account for 393 million (about 46 percent) of the worldwide totals of civilian held firearms. This amounts to "120.5 firearms for every 100 residents." There are more firearms than people in US.

In 2020, gun violence killed nearly 20,000 Americans, more than any other year in at least two decades. An

additional 24,000 people died by suicide with a gun.

As a result of increasing Covid 19 cases, increasing jobless claims, increasing gun violence and many other problems, in 2020 US suffered a negative GDP growth rate as shown below.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Discussions

An american strategist once said that the US should get a cut for whatever transaction is made in any part of the world. If you really look into your life today, you will realise it is true ...from everyday products, fast foods,soft drinks, medicine , clothes, entertainment, financial transactions and social media ...everything is from the USA..why? some time a ago an adversarial country produced a 10 minute propaganda video on how it will attack a US military base..and you know what ? ..in that short 10 minute videa, it used video clips from 3 different US movies...The point I am saying is the US is much, much stronger than many people think..It created the civilization we live in ...By the way, the US unemployement rate in August 2021 is only 5.2% ..as a after thought, the colgate that we use every morning is a US brand, check out on the rest of the products we use and enjoy ...and you would be in for a shock

2021-10-10 21:21

VolatileIsMyGold coca cola, pepsi cola, mcdonalds, kfc, subway, rambo, rocky

========

the number 1 and 2 show in Netflix is a Korean thing, Squid Games and a Spanish thing, Money heist. takes time but sure changing.

2021-10-10 21:48

the mess is not one cause or one result....

the mess eats every thing from within.

2021-10-10 22:21

KYY - he just slaughter the small retail trader ..maybe he is in a mess with hiapteck

2021-10-10 22:51

Hahaha

who said he sailang half his capital in Sendai at Rm1.50?

Still keeping Sendai below 30 sen or runaway already ??

2021-10-10 23:06

Below qqq3333 is your previous ID qqq3 now R.I.P

Posted by qqq3 > Mar 21, 2018 10:20 AM | Report Abuse

Sendai.....revenue for 2017 $ 1.8 billion. eps 2017 11 sen.

Balance Sheet shows Amount due from customers under contract $1 billion ( 2016 $ 1 billion)

Trade receivables $ 600,000 ( 2016 $ 600,000)

No change , and no increase.

If KC/ Calvin wants to do a micro analysis and find reasons to worry....go ahead, no body stops you.....there are after all, another 1,000 companies out there.

ps.....By the time the balance Sheet has been cleaned up, I would be enjoying my rewards already.

ps...if you find companies where there are no more Amounts due from customers, its probably because no more customers.

ps...a significant portion of the Amount Due from customer is work done on 2 oil rigs to be delivered to customers ( related party) in 2018.......

rather than why not Sendai....there is the other side of the coin which is Why Sendai?

This is a genuine home grown multi national steel fabricator and contractor involved in many of the most iconic structures across Asia.

A rags to riches story, a successful story that serves as great example to all Malaysians.

THIS QQQ3 AKA QUACK 3 Duck has sailang 50% of his life saving into Sendai & now lost till R.I.P https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2021-09-12-story-h1571500044-8TH_ANNIVERSARY_SINCE_SEPTEMBER_2013_CALVIN_TAN_HAS_BEEN_IN_i3_FORUM_AN.jsp

See

See never listen to Kind hearted warning (qqq3 sendai crashed from Rm1.60 to only 20.5 sen now)

See https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2017-09-14-story-h1451467356-There_is_a_50_50_chance_that_Sendai_might_go_bankrupt_like_LCL_in_Middl.jsp

2021-10-10 23:40

calvin, things change, stuffs change.

there is also diversification and risks.

only founders sailang every thing on one share. ..or if u are incorrigible nut head.

2021-10-11 00:23

Why is US in a mess? u must be joking,US with strong economy ,full employment , stock market reached all time record high, this kind of mess , every american love it.don't get jealous about it.

2021-10-11 08:29

ed by khyeap > Oct 11, 2021 11:12 AM | Report Abuse

China is surely learning from US's mistakes... humbl n QUIETLY..

========

now common prosperity not just stock market.

2021-10-11 11:55

Why the preoccupation with the US? When all your intellectual property get stolen, people copy everything you do and dump their cheap stuff back to you sure there will be mess.

2021-10-11 13:23

Unloading Australian coal, bigger power bills...Can China solve the power shortage problem?

Examine what measures the Chinese government is currently taking to deal with the sudden and massive power shortages and whether these measures can alleviate the problem.

https://www.youtube.com/watch?v=x73T81t92Y4&t=481s

2021-10-11 20:27

‘Unprecedented’ China Power Outages: Close Factories and Threaten GDP Growth/What are the Causes?

The recent "power cuts" in China are disastrous, affecting at least 20 out of 34 provinces and jurisdictions and growing in scope.

https://www.youtube.com/watch?v=eONGlAKxJzs

2021-10-11 20:29

What is happening in the world's largest country (by population) is a perfect storm, to say it is a mess is an understatement. From disrupive weather, blackouts, business closures, bankrupcies, social enginneering (affecting business practices, IT, education, entertainment, gambling, social media etc etc), problematic foreign relations, covid to does not seem go away, foreign businesse exiting the country etc etc ...there is a lot to talk about ......I am looking forward to KYY giving his views on some of these issues

2021-10-11 21:30

by Starship2 > Oct 11, 2021 9:30 PM | Report Abuse

What is happening in the world's largest country (by population) is a perfect storm, to say it is a mess is an understatement. From disrupive weather, blackouts, business closures, bankrupcies, social enginneering (affecting business practices, IT, education, entertainment, gambling, social media etc etc), problematic foreign relations, covid to does not seem go away, foreign businesse exiting the country etc etc ...there is a lot to talk about ......I am looking forward to KYY giving his views on some of these issues

=======

in a few months , no one will remember any of these.

2021-10-11 21:32

osted by uncensored > Oct 11, 2021 8:29 PM | Report Abuse

‘Unprecedented’ China Power Outages

=========

whole world short of energy, why only china case become unprecedented?

2021-10-11 21:33

whole world short of energy? don't be silly , no such thing ,other then red china.

2021-10-11 21:54

how silly ,there is no shortage , just good demand , and supply slow ,oil producing countries want to push for higher price ,before they open the oil tap.

2021-10-12 09:13

The U.S. nuclear energy regulator has decided to suspend licensing for shipments of radioactive materials and deuterium to China General Nuclear or CGN, China's largest nuclear power company.

In recent years, the CCP's expansion of nuclear weapons has become less covert, a move that runs counter to a decades-old nuclear strategy based on minimal deterrence. So why is the CCP doing this?

https://www.youtube.com/watch?v=lzeuDZ6qnZA

2021-10-12 13:02

Beijing Has No Choice but to Buy Australia’s Iron Ore | Australia China Trade War

Despite politically motivated trade sanctions on Australian goods, Beijing has been left buying Australia’s expensive iron ore by the boatload.

Professor of Economics at the University of New South Wales (UNSW), Richard Holden, said that Canberra holds a great deal of influence over Beijing, who has nowhere else to turn to meet its ravenous iron ore demand, even if it wanted to.

“We’ve actually got quite a lot of leverage with China in this instance, which is that they need a lot of iron ore,” Holden told The Epoch Times. “And they don’t buy iron ore from us because they want to be particularly nice to Australia.”

“They buy it because we produce a lot of it, we produce it very efficiently and effectively, and we don’t have some of the situations that have led to the iron ore price going up so much, like when Brazil had so many issues with supply.”

https://www.youtube.com/watch?v=JdAafOCGKo8

2021-10-12 13:06

@qqq3333 ,u no historical knowledge, ask the same question ,why USSR sure die.

2021-10-12 14:31

Common prosperity with sustainable growth. China / Xi has the confidence to aim for both

2021-10-13 11:30

1990 to 2020 learning from USSR mistakes....2020 onwards also learning from American mistakes.

2021-10-13 11:38

In America, every thing is in a mess, except stock market and financial assets.

Supply chain disruptions, shortages, every thing from energy , food, bicycles, spares, chips, commodities prices are at or near record highs. Small businesses suffers, major DJ companies, oligarchies and monopolies record profits. People suffers but big corporations , billionaires never have it so good.

Stocks, shares, useless bitcoins, art works, second hand Rolexes all in high demand while record number of hungry and homeless people in the street. Remind you of Shanghai 1920?

In previous eras, this scares stocks to bear market, not this era. This era, the experts smarter, they think they can keep the whole thing in control with endless printing of money.

2021-10-14 11:00

Tobby

Pointless to talk about US! It's failing nation! Still pretending to be No.1 but we all know that days already history!

However, having said that, China will follow Japan! Japan was booming in the 90s! Today, Japan doesn't even bother to compete at all! Reason, quality of life is super high in Japan that they no longer bother much to develop further! I mean, isn't that why one should progress in the first place!

I don't blame Japan at all! They have achieve the very best in quality of life! They are No.1 in this area so we should learn from Japan! Singapore is replicating Japan, Malaysia should too!

2021-10-10 18:24