China orders steel mills to cut output - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 14 Oct 2021, 12:18 PM

China has orders steel mills in more cities in northern China to cut production from Nov. 15 to March 15 next year, in order to clear the smog-blanketed sky in the region and to ensure the achievement of the country's steel output reduction target.

Steel mills should keep to their plans to cut production for the remainder of this year to ensure output is no more than last year, according to a statement jointly issued by China's industry ministry and environment ministry on Wednesday. Over the first eight months, China already produced 733.02 million tonnes, up 5.3per cent on year.

From Jan. 1 to March 15 next year, mills are to curtail output by no less than 30per cent of steel production versus 2021.

The order will cover steel mills in its pollution campaign focused on 28 cities in the capital city Beijing and nearby regions, as well as another eight cities in Shandong and Hebei, which altogether churned out more than 40per cent of China's total crude steel output in 2020, National Bureau of Statistics data showed.

China, the world's biggest steel producer, has pledged to limit crude steel output this year at no higher than the 1.065 billion tonnes it made in 2020, as the country vowed to curb expansion of high-polluting and high-energy intensity sectors, including steel, amid its climate targets.

Steel mills in the regions, especially those with blast furnaces, will be ordered to trim production based on their emission levels. While mills using electric arc furnaces can take voluntarily measures to reduce emissions, but will have to make sure their steel output is no higher than the same period a year earlier.

"Local governments are encouraged to fulfil the task by offering economic supports (to the firms)," said the statement, adding local authorities are responsible for ensuring that production equipment is shut and the output cuts are enforced.

China's iron ore imports in September fell 12per cent on year, as steel output controls restrained consumption of the steelmaking raw material.

Meanwhile, the environment ministry also plans to include more cities in its 2021 winter air pollution campaign, in light of the Winter Olympics in Beijing and the nearby city of Zhangjiakou in early February in 2022.

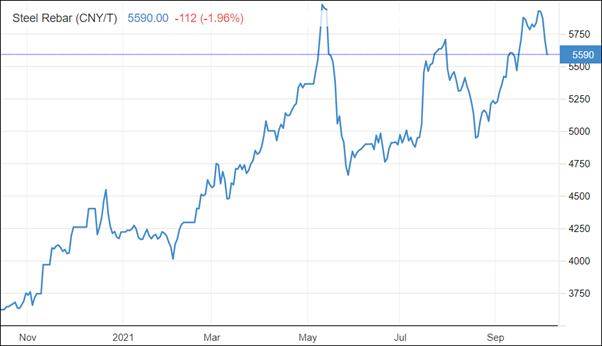

As a result, steel price has been going up higher and higher. The steel price chart below shows that steel price has gone up from 3,500 RMB to 5,590 RMB in the last 12 months. It has gone up about 60% in 12 months.

Hiap Teck should benefit

During the last quarter of 3 months, Hiap Teck’s Kelang factory was shut down for 2 months and its 35% associated Eastern Steel Sdn Bhd was shut down for 1 month. Despite these shutdowns, Hiap Teck could still report record annual net profit of Rm 163 million which is the highest in the last 9 years.

Based on the above facts, Hiap Teck and its 35% associated Eastern Steel Sdn Bhd should make more and more profit.

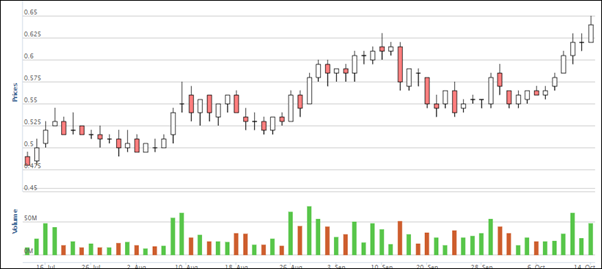

Many investors can foresee that Hiap Teck’s profit for the next quarter ending October, will be another record high. That is why its share price has been going up to form a cup and handle price chart which indicates a very bullish up trend.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

Q2 EPS = 2.21

Q3 EPS = 4.79

Q4 EPS = 4.26

Q1 EPS (Dec 2021) = 6 (news from InXXXXX !!!)

if PE 7, then price = RM1.20!!!

if PE 9, then price = RM1.55!!!

if PE 11, then price = RM1.89!!!

DOUBLE or TRIPLE from NOW !!!!!!!!!!!!

2021-10-16 09:17

China is going through an energy crisis but what's that mean for the world?

China is at the center of major power cuts. Many factories have been forced to shut down, millions of households have lost power, and the demand for Chinese goods has doubled since the pandemic making it hard to keep up. Chinese authorities have begun rationing power as the price of imported coal is on the rise. This is a result of China’s choice to stop purchasing coal from Australia after political tension arose around how Beijing handled the coronavirus pandemic. Meanwhile, China's five-year plan to reduce carbon emissions reduced their use of coal but recent cold weather has created greater demand for the fuel.

The crisis has impacted Chinese citizens, production, and the world economy. With winter approaching, Chinese citizens are reportedly losing power and cannot heat their homes, according to Time Magazine. Factories struggle to meet their global demands for Chinese goods. Foreign businesses are looking elsewhere to fulfill their production needs. The central government is also concerned that the higher energy prices will cause an increase in prices for consumers. While looking for resolutions, the power shortage could harm Chinese President Xi Jinping's plan to make China carbon neutral by 2060.

https://www.youtube.com/watch?v=0q22jjRXrcY

2021-10-16 14:29

Dear kimpau,

Please look at my projection below.

Projected Q1 2022 PAT

I assume Hiaptek steel plant in Klang, PAT = 46.1 Million (same as Q3 2021)

35% Eastern Steel S/B, PAT = 39.5 *1.1 = 43.5 million

I assume 10% growth rate for this blast furnace plant provided the prices of iron ore and steel are at current rate or +- 10% of the present rate.

Total Q1 2022 PAT = 46.1+43.5 = 89.6 million.

Projected FY2022 PAT, EPS and target price

Total PAT = 89.6*4 = 358.4 million

Total number of shares = 1.732 billion

EPS = 358.4/1732 = 0.206

Target price if PER = 5, target price = 1.03

Target price if PER = 8, target price = 1.65

Target price if PER = 10, target price = 2.06

I believe the growth of Eastern Steel in FY2022 is > 10%, I believe the contribution from Eastern Steel may be 50 million per quarter. Hence my projection may be too conservative.

Please review and advise.

Thank you.

From OTB

2021-10-16 18:51

My response:

Dear OTB Bro, you have completed "homework" better than me. Both of us are conservative, hence, the target price could be higher than our estimation!

Thank you.

2021-10-16 18:52

.png)

stockraider

Good for steel co loh!

2021-10-14 14:20