What is causing the steel price to increase so rapidly in USA? Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 27 Oct 2021, 09:43 PM

Yesterday all the steel stocks shot through the roof. Today all the steel stocks plunged. Yesterday I WhatsApp “All the steel stocks shot through the roof and I am laughing to the bank” because steel price in Malaysia is much cheaper than in China and in USA.

Today I am so puzzled and I found this useful information about the steel price increases so rapidly in USA for all interested investors.

In just over 12 months, iron ore prices have increased by over 260% from $83.50 USD/tonne in May 2020 to $219 USD/tonne in June 2021. The price increases are a result of several factors, primarily instigated by the flow-on effects of COVID-19, creating a perfect storm of high demand and low supply.

But before COVID-19 was even a term in our vocabulary, China’s major steel producers such as China Baowu Steel Group cut over 10% of its steel production capacity between 2016 to 2018 from its 2015 levels, according to the government.

As COVID-19 cases rose across China in January 2020, most Chinese factories were forced to shut and production almost came to a complete halt. Meanwhile, construction sites across the globe faced some initial or intermittent shutdowns. But many governments saw construction as the key to keeping the economy operating and kept sites open. This meant demand for basic building materials remained whilst supply was substantially impacted.

This shortfall of key materials put upwards pressure on iron ore prices and by June 2020 iron ore had risen to $101.50/tonne. But the shortfall of finished materials, including finished steel, exported out of China was just the beginning of an onslaught of factors contributing to ongoing price rises.

By July 2020, stimulus packages were being rolled out by countries across the globe. Much of this was directed towards construction which is seen as one the most effective means of fiscal stimulus. This caused a massive global surge in demand for finished steel products and added pressure onto steel producers who were already struggling to fulfil the backlog from factory shutdowns. Consequently, the iron ore price surged from $118/tonne to $158.50/tonne between 30 October and 31 December 2020.

The backlog of global exports in turn placed pressure on shipping, leading to a double whammy of rising shipping costs and a further reduction in supply of imported finished steel. This created a surge in demand for finished steel products from local Australian steel producers, such as BlueScope who are benefiting from record earnings.

In addition to the demand for iron ore, another key resource for steel production, coal, has seen its price soar. Since China placed an unofficial ban on coal imports from Australia in October 2020, coal prices more than doubled to June 2021.

As trade tensions rose between China and Australia through the first half of 2021, many Chinese importers were found to be stockpiling iron ore in anticipation of a worsening trade relationship. This further restricted supply and consequently pushed prices upwards.

More recent rises in June and July 2021, have been induced by a shortfall in Brazilian iron ore exports plus an announcement that China had suspended the agreed activities under the China-Australian Strategic Economic Dialogue framework.

The chart below shows in USA iron ore price has been going up in the last 12 months. The current price is US$ 222 per metric ton.

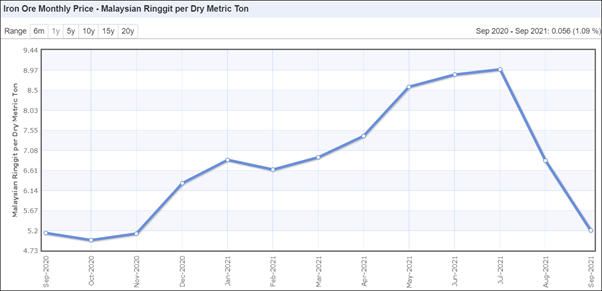

The chart below shows the price of iron ore in Malaysia is Rm 5,200 or US$ 124 per metric ton which is much cheaper than in USA.

Yesterday all the steel stocks shot through the roof and today all the steel stocks plunged. I cannot find any reason for this erratic stock price fluctuation.

All investors should know that the Covid 19 MCO shut down has affected all Malaysian Steel companies in the last quarter. Currently there is no more MCO and workers are free to go to work. All the steel companies should report better profit in the next quarter.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

Lol, now I understand why people call him conman. One chart is July where price was on uptrend compared against another chart that is on the downtrend

2021-10-28 18:46

The downtrend chart is September . If didn't see clearly , one would think it is comparing apple to apple.

2021-10-28 18:48

I used to think he is a great investor writing article to educate others. Now, I think otherwise, this article is very deceiving , it painting a picture that the Iron ore price in Malaysia is much cheaper now than US when it is not

2021-10-28 18:53

welcome to KYY world

------

gladiator Why kyy always post outdated chart?

28/10/2021 3:28 PM

2021-10-28 20:15

.png)

novice2020

Your chart did not show the current iro ore price of US$117.

2021-10-28 10:13