AYS has the best profit growth prospect among all the steel companies - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 29 Oct 2021, 11:46 AM

Record shows Malaysia entered a nationwide lockdown from June 1 to halt rising COVID-19 infections in the country, Prime Minister Muhyiddin Yassin said.

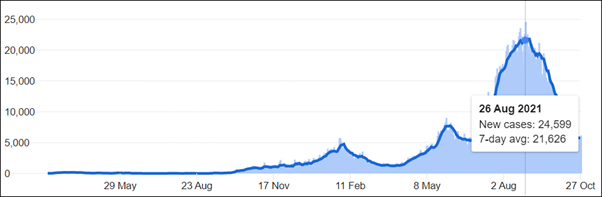

The chart below shows that Covid 19 cases has been surging to peak on 26 Aug with 24,599 cases. Since then, the number of daily new cases has been dropping to about 6,000.

Despite the nationwide lockdown, AYS still reported increasing profit in the last 4 quarters.

Its EPS 8.5 sen for quarter ending June, EPS 4.45 sen for quarter ending March, EPS 2.27 sen for quarter ending December 2020 and EPS 0.05 sen for quarter ending Sept 2020.

Based on its rate of increasing profit as reported, AYS should continue to report better profit in the next few quarters in view of the fact that there is no more MCO lockdown.

Since there is no more lockdown, there will be more infrastructure and property construction. As a result, the demand for steel will increase and all steel companies especially AYS should report better profit in the next few quarters.

Even if the profit for AYS remains unchanged, its annual profit will be 4 X 8.5 sen = 34 sen. Based on PE 5, AYS share should sell at Rm 1.70 per share.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

Every stock you recommended, very soon fall from cliff. Uncle, You want people to fall from high cliff?

2021-10-29 23:21

Dear Mr Koon Yew Yin,

I've stated it before, but it seems your stubbornness due to possibly your age has meant that you never listen. You must understand that only one of us can be right. Lets hope that the steel stocks have not left you with irreparable damage

" Blog: Why foreign funds return? Koon Yew Yin

Posted by emsvsi > Oct 11, 2021 9:13 AM | Report Abuse

Dear Mr Koon Yew Yin,

You must understand, steel stocks may or may not rise, however what is proven is that the sector is highly cyclical and subject to one-offs. Foreign investors know this

What is not one-off is Gaming. After all, gambling is human nature and is as old as Man himself.

In fact, with all the other travel and tourism stocks closing due to the pandemic, Genting's attractions in Genting Highlands, US & Bahamas, UK & Egypt will be that much more attractive - as the aphorism goes, 'what doesn't kill you, makes you stronger'.

As such, we hope that you are able to take a position in Genting before you miss the boat on the greatest run in Genting's history

1971 Genting Highlands Opens

2021 50 Years of History and Growth

2009 Global Financial Crisis

2020 Covid-19 Pandemic

2009 Year of the Ox

2021 Year of the Ox

2010 Resorts World Sentosa (SG) opens

2021 Resorts World Las Vegas (US) opens

2009 Mar RM3.08 (low) to 2011 Nov RM 11.98 (all time high)

2020 Nov RM2.95 (low) to 2022 Xxx RM ????

History always repeats itself

Sincerely,

emsvsi "

2021-10-30 22:38

Just ignore the Geezer. He just want people to know he has bought the share and hope traders will jump in. If no one knows what he buys, then he will be just another mediocre in the market place and he thought he was a Super Investor.

2021-10-31 11:06

Uncle shd recommends newbies to buy Supermx as it dropped more than 80 % as end last yr he is the great promoter

2021-10-31 14:20

If you have bought the share, no need to write any articles informing the world what you have bought. Unless you have an hidden agenda..

2021-10-31 14:25

He promote what die what.. really light bulk in the dark... He show which way, Running. That's all

2021-11-01 13:32

He save me many times. He promote what I terms sell and run away. Wahahhaha . Find bulk in the toilet

2021-11-10 16:14

.png)

Yu_and_Mee

rubbish. Steel good but stock price may not up.

He keep doing this to trap newbies. I wish he could awake and keep quiet for what he bought. But old man is hard to be changed. sigh.

non-ethical person.

2021-10-29 18:33