Jaya Tiasa is most undervalued - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 13 Apr 2022, 10:24 AM

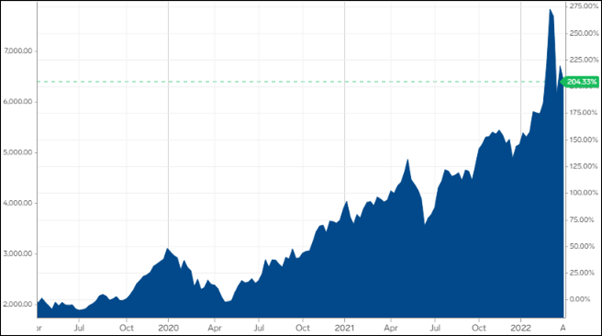

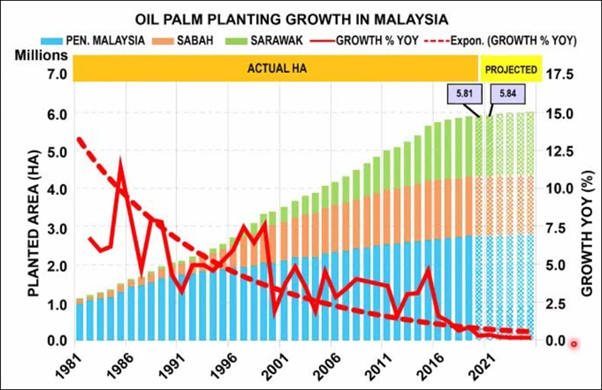

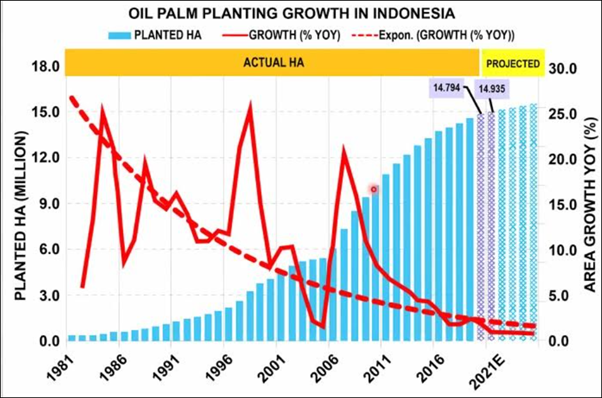

The 2 charts below are showing the slowdown in new planting throughout Indonesia and Malaysia due to land shortage since 2015. With the aging palm tree profile across both countries, the replanting programme will also temporarily limit palm oil supply in the short to medium term. As a result, CPO price started to go up about 2 years ago to hit historical high as shown on the chart below.

CPO price chart

As agricultural land becomes limited, oil palm replanting is key to boosting palm oil yield across Indonesia and Malaysia. It is important replant to sustain supply because Indonesia and Malaysia produce about 85% of the world’s palm oil need.

Due to land shortage, plantation companies with larger planted acreage is a very important consideration for investors. The table below shows Jaya Tiasa is the most undervalued.

|

Name |

Price Rm |

Market cap Million Rm |

Planted hectares |

Market cap ÷Ha |

|

|

JayaTiasa |

1.11 |

1,081 |

70,000 |

15.4 |

|

|

Sarawak Pl |

2.87 |

804 |

35,000 |

23.0 |

|

|

Boustead |

1.10 |

2,464 |

75,000 |

32.8 |

|

|

Cepatwawa |

1.17 |

373 |

10,000 |

37.8 |

|

|

SOP |

6.20 |

3,580 |

88,000 |

40.6 |

|

|

Ta Ann |

5.94 |

2,642 |

50,000 |

52.8 |

|

|

Hap Seng |

3.05 |

2,440 |

35,000 |

69.7 |

|

Jaya Tiasa price chart below:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Should mention that Market cap ÷ Ha = Land Value per Hectare (RM ,000)

A year ago palm oil land was about RM60,000 but i am not sure about the valuation now.

2022-04-13 12:31

In 2009, sold my Oil Palm land, 8 years old, Tenera variety, at Geddes Estate, Bahau , besides Agric Road, for Rm40000/ acre. At that time CPO was at 3k/ ton. Thus price per Ha, x 2.471, equals 100k/ Ha. I believe other factors play a part , like forward sales, borrowings, productivity of mature areas, management quality, segment of profit due to Oil Palm, dividend policy, etc. That is why TaAnn, Inno net profit margin is higher than others as it has no borrowings. Subur Tiasa has borrowings and not 100% Oil Palm. If you notice, as Calvin says - IOI Corp has not moved much due to PNB selling tho it has upstream and downstream investments. Another share is SHChan which at this time of high CPO price, its price fell, probably as Smart Money collecting before it goes higher. In 1993, SHChan touches more than RM20.

2022-04-13 14:30

Why not FGV the most undervalued? KYY old and nyanyuk? Earlier said TDM, TecGuan, Subur and latest become J Tiasa.

2022-04-13 15:02

If like Tiong Hiew King counters(JTiasa, Subur among them) MediaC the cheapest.

2022-04-13 15:07

no one put hectar and divide like that only. amateur.. you need to see the productions.. lately covid many foreign worker cannot come in. not all the hectar running.

2022-04-13 15:36

Few days later KYY May write ‘JT is useless’ or recommend another plantation stocks

2022-04-13 17:43

Jtiasa is ok

At its previous bull run years jtiasa reached Rm3.35 high

See if jtiasa will at least reach Rm3.00 by end 2022

Just buy and hold tight then see

2022-04-13 20:23

Listen! Listen!!

Avoid tdm

Avoid tecguan

Avoid Subur

All in Jaya Tiasa = Giant Treasure

Rm3.00 target price possible

2022-04-14 07:10

Swk Plantation(ranked 2nd in KYY market cap/ha) although not cheap in price but far cheaper than same group Ta Ann paid 20 sen dividend for 2021 at CPO lower price. Current CPO still >RM 6K/tonne 20 sen dividend is likely to maintain if not more given.

2022-04-14 14:55

FGV latest QR EPS 12.75 sen also need to give consideration. Annualised EPS 51 sen PE only 3.9 at RM 2.

2022-04-14 15:02

Timing of this blog is questionable, why not posted it when JTIASA below 0.95?

2022-04-14 15:17

KYY plantation hectarage coverage not extensive. Why leave out stocks like FGV with over >400,000 hectare of CPO land?

2022-04-14 15:18

uncle ... can you please stop posting anything ahhh... u spoil our rice bowl lah!! The moment u post Jtiasa drop !!

2022-04-14 16:42

First TDM then Jayatisa then Subur now this Jayatisa again ?? Please take a hike uncle

2022-04-14 17:42

8888_

FGV is a special case, most of the land owned by Felda, FGV has to pay fixed amount and profit sharing to Felda.

2022-04-15 08:32

Waiting for next Article, SUBUR is the ULTIMATE WINNER of the CPO Rally!! haha

2022-04-17 11:20

Kyy said Jaya Tiasa was undervalue at Rm2.60

now he said Jaya Tiasa at 60 plus sen no good

listen listen listen

when Kyy promoted Jtiasa at Rm2.60 he was selling

now when he no longer say buy you can safely buy Jtiasa

2023-02-13 13:35

speakup

the other day u day Subur. now u say Jtiasa. keliru lah

2022-04-13 10:56