Steel stocks comparison update - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 08 Nov 2022, 03:08 PM

Increase construction activity:

Construction activity in Malaysia rose 6.1 percent year-on-year in the June quarter of 2022, rebounding from a 6.1 percent drop in the prior period and indicating the first increase in a year, as the economy fully emerged from coronavirus curbs. There was an upturn in activity related to residential buildings (7.9 percent vs - 11.9 percent in Q1), while the output of non-residential buildings picked up strongly (18.1 percent vs 4.2 percent), and special trade activities continued their double-digit growth (11.9 percent vs 24.1 percent). In contrast, civil engineering activity fell at a slower rate (-4.4 percent vs -15.5 percent). Source: Department of Statistics, Malaysia.

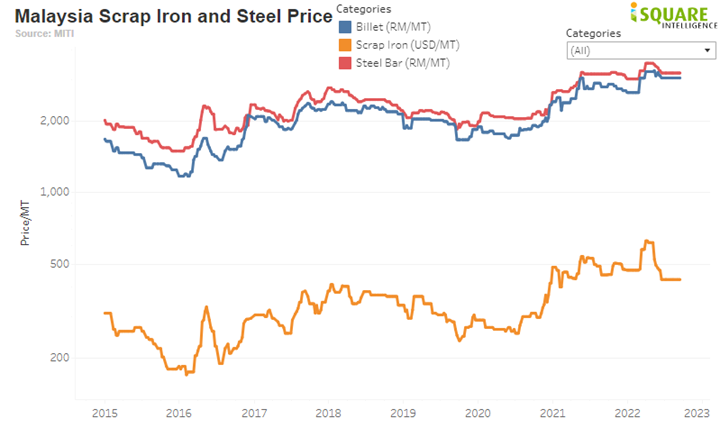

Steel price increase as shown below:

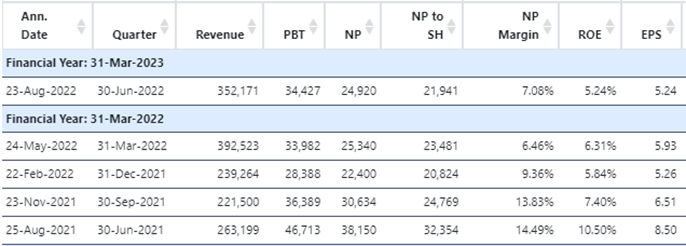

AYS reported EPS in the last 5 quarters as shown below:

Steel stocks comparison update

| Name | Price | Latest EPS | 4 X EPS | PE ratio |

| AYS | 45.5 | 5.24 | 20.96 | 2.03 |

| Leon Fuat | 50 | 4.11 | 16.44 | 3.04 |

| Prestar | 43.5 | 3.27 | 13.08 | 3.33 |

| Hiap Tek | 23 | 1.41 | 5.64 | 4.10 |

| Pantech | 67.5 | 3.78 | 15.12 | 4.46 |

| CSC Steel | Rm 1.17 | 4.62 | 18.48 | 6.30 |

Currently AYS is selling at 45.5 sen. As shown on the above table, it is selling at the lowest PE of 2.03.

It reported latest EPS 5.24 sen and 22.94 sen for the last 4 quarters as shown above. It is selling PE 1.98.

In view of the increase of construction activity and the rising steel price, AYS is best stock to buy.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Created by Koon Yew Yin | Sep 03, 2024

State housing and local government committee chairman Datuk Mohd Jafni Md Shukor said demand for properties in Johor has gone up since last year’s announcement about the SEZ.

Sslee

Steel rebar futures rose past the CNY 3,550 mark, extending the rebound from the 2-1/2-year low of CNY 3,464 hit on October 31st as Chinese production curbs for the winter due to pollution controls are set to lower supply. Still, recession concerns continue to pressure demand for steel and other base metals, limiting the rebound in prices. Fresh trade data showed that the world’s top consumer imported 4.7% less steel-making inputs in October on a monthly basis. On top of that, investment in the country’s giant property sector fell more than 8% year-on-year in the first 9 months of 2022, signaling a lower use of steel. Last month, the World Steel Association revised its forecast of global demand to contract by 2.3% this year, compared to earlier forecasts of a 0.4% rise. Meanwhile, Chinese authorities emphasized that the country would stick to its zero-Covid policy, refuting rumors that believed the economy would reopen.

2022-11-09 08:31