laulau's research

THE BULL MARKET IS STILL ALIVE!...in the year of the Earth Hound...AS DOW, S&P 500 BOOK 6TH STRAIGHT GAIN AS STOCKS POST BEST WEEK IN YEARS!

laulau

Publish date: Sat, 17 Feb 2018, 01:33 AM

The Bull market may not play dead in the Year of the Earth Hound. MAN’s BEST FRIEND COULD BE GOOD FOR 2018! AS DOW, S&P 500 BOOK 6TH STRAIGHT GAIN AS STOCKS POST BEST WEEK IN YEARS!

Lunar New Year arrives on Friday, and with the change of the lunar calendar starts the Year of the Earth Hound. As many investors often use new calendar years as a chance to assess their portfolios and make decisions about their allocations, it’s tempting to ask what history says about market performance in past years of the dog.

Michael Hewson, chief market analyst at CMC Markets, referring to years of the dog. Per his data, which goes back to the lunar year ending in 1947, the S&P 500 rose an average of 9.72% in past such years, which occur every dozen years.

CMC’s data covers six such cycles and it shows four of the six past years of the dog were positive, and in each of those, there were double-digit gains, including a 33% advance in the year ending 1959. In the most recent one, ending in 2007, the S&P rose 11.37%, marking the final stage of a rally that would lead into the start of the financial crisis.

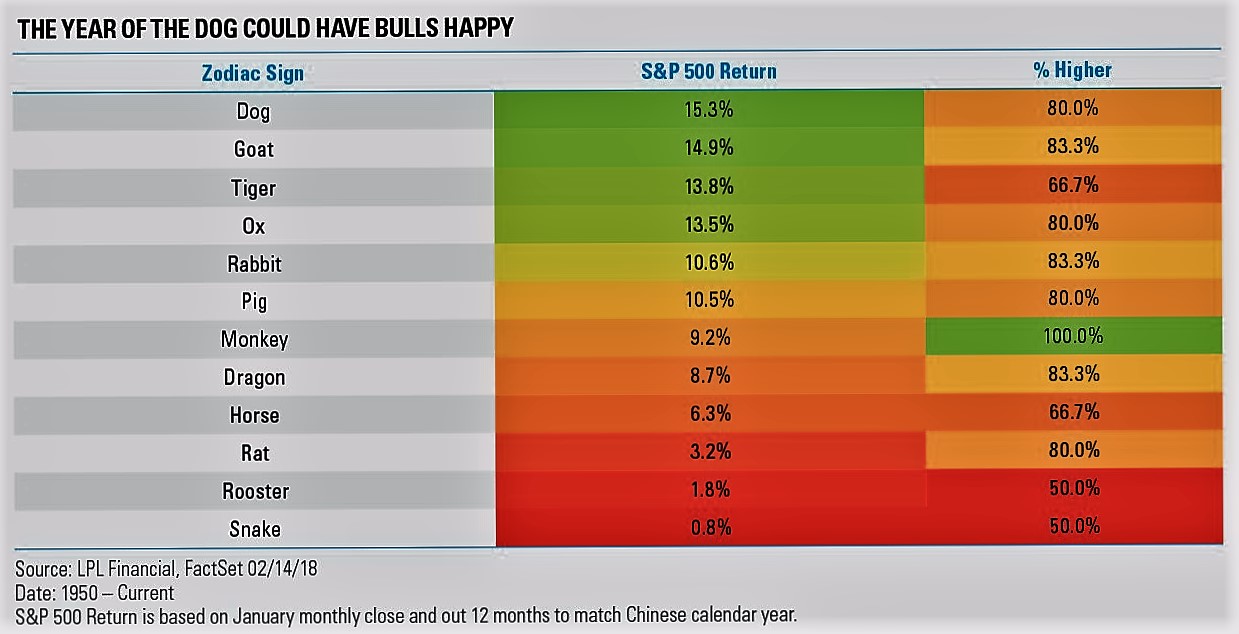

“The Chinese Zodiac says that 2018 will be a year of happiness and rest; but, it also looks like it could be a good year for equity bulls, as the S&P 500 tends to do very well during the Year of the Dog,” said Ryan Detrick, LPL’s senior market strategist”

Years of the Dog are the best for the S&P 500

DOW, S&P 500 BOOK 6TH STRAIGHT GAIN AS STOCKS POST BEST WEEK IN YEARS!

U.S. stocks rose in a broad advance on Friday, with major indexes poised for their biggest weekly gain in years as a continuing uptrend was poised to deliver the sixth positive session for Wall Street a row. According to FactSet data, the Dow is up 4.8% thus far this week, on track for its biggest one-week percentage rise since November 2016. The S&P 500 is up 4.8%, in what would be its best week since December 2011. The Nasdaq is set for its best week in more than six years—with a gain of 6%, it is on track for its best week since December 2011.

For the week, the Dow rose 4.3% in its biggest one-week percentage rise since November 2016. The S&P 500 also gained 4.3% in its best week since January 2013, while the Nasdaq ended up 5.3% in its best weekly percentage gain since December 2011.

What is driving markets?

Gains were broad, with all 11 of the primary S&P 500 sectors up on the day. The rally was led by health-care and industrials, both up 0.7%. So-called defensive sectors were also sharply higher: telecommunication stocks rose 1%, while the real-estate sector was up 0.8%.

Signs that the economy is growing, but not in any danger of overheating, helped stocks to move ahead this week and take the sting out of last week’s losses. Alongside that recovery, bullish sentiment jumped, according to a weekly survey, nearing “unusually high” levels.

https://www.marketwatch.com/story/dow-ready-to-hold-above-25000-as-us-stocks-line-up-best-week-more-than-a-year-2018-02-16

More articles on laulau's research

As the US Stock Market is officially in a CORRECTION... HERE'S WHAT USUALLY HAPPENS NEXT?

Created by laulau | Feb 09, 2018