laulau's research

PART 2: BJLAND COULD BE DUE FOR A HUGH WINDFALL OF 2.02 BILLION IN 2018? From Sales & Compensation...OF PROJECTS IN VIETNAM, KOREA & CHINA & MALAYSIA!

laulau

Publish date: Fri, 23 Feb 2018, 12:28 AM

BJLAND could be due for WINDFALL of RM2.02 BILLION in 2018? from SALES & COMPENSATION of PROJECTS IN VIETNAM, KOREA & CHINA & MALAYSIA!

BJLAND could be due for WINDFALL of RM2.02 BILLION in 2018? from SALES & COMPENSATION of PROJECTS IN VIETNAM, KOREA & CHINA & MALAYSIA!

Could this be the Answer to the Burning Question?

How Berjaya Group stored Wealth by Parking Value in BJLand from Prying Eyes?

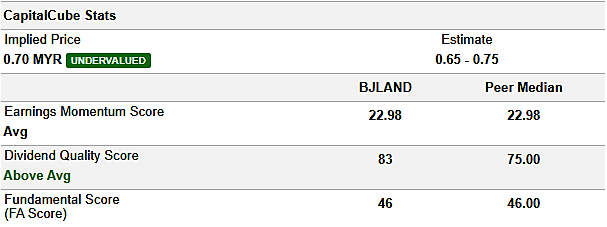

BJLand current price is only 32 sens...while the implied price is 67 sens...a potential Return on Investment of 109%....or even 1,240% if history repeats itself?

Refer Part 1 Here:

https://klse.i3investor.com/blogs/laulauramblings/147946.jsp

Predicted 2018 Lowest/ Highest Share Price

2018 - Lowest 31.5 sens / Highest 67 sens or much

More???

See BJLand's 52 weeks Lowest & Highest 5 years share price trend from 2013 to 2017

- 2017 - Lowest 36 sens / Highest 66 sens [Profit for the year RM 411,221,000]

- 2016 - Lowest 56 sens / Highest 76 sens [Loss for the year RM (165,024,000)]

- 2015 - Lowest 63 sens / Highest 83 sens [Loss for the year RM (161,828,000)]

- 2014 - Lowest 75 sens / Highest 88 sens [Profit for the year RM 309,213,000]

- 2013 - Lowest 76 sens / Highest 93 sens [Profit for the year RM 296,775,000]

By NST Business - January 22, 2018 @ 8:38pm

MARC affirm AAA rating on BLand - Noteholders are insulated from downside risks related to the credit profile of BJLand by Danajamin and OCBC Malaysia’s guarantees. MARC also noted that with the recent change in BJLand’s key management team, the group is expected to refocus its property development activities.

BJLand’s hotels and resorts operations have generally improved on the back of higher average room rates. Its hotels continue to benefit from the group’s long track record in domestic hotel operations and partnerships with large hotel chains on the international front. The group’s investments in hotel properties have also been a source of liquidity in the past.

https://www.nst.com.my/business/2018/01/327771/marc-affirm-aaa-rating-bland

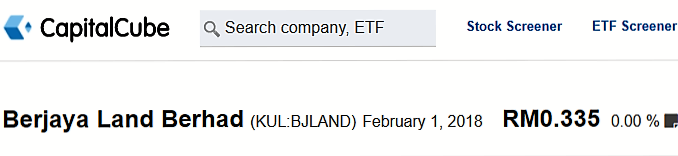

What Other Investment Analysts Say About BJLand's Current Relative Valuation & Company Overview...

According to Capital Cube Analysis as of 1 Febuary 2018, BJLand

is Undervalued with a potential upside and Implied Price of RM0.71 with a

price variation of RM0.65~RM0.75

- Earnings Momentum Score of 22.98 is Average compared to its Peer Median of 22.98

- Dividend Quality Score of 83.00 is Above Average compared to its Peer Median of 75.00

- Fundametal score of 46.00 is comparable to its Peer Median of 46.00

Summary Report on BJLand Sale/ Recovery of Money Due :

Total sum of windfall money due to BJLand in 2018 could reach RM65 + RM646 + RM598.97 + RM708 Million = 2,017.97 Million or RM2.02 Billion?

* Vietnam Long Beach Phu Quoc Resort Project Sale of RM65 million

* Berjaya Jeju Resort Project Compensation of RM646 million

* Great China Mall Sales Payment of RM598.97 million and,

* Ritz Carlton Residences, Kuala Lumpur Project Sales of 60% x 1.18 Billion = RM708 million

Not Including Property Sales in Malaysia Due in 2019

* Property Project Development in Bukit Jalil, Puchong and Georgetown (RM395.5 million)

1. Sale of Long Beach Phu Quoc Resort, Vietnam (RM65 million)

BJLand is currently disposing of its stake in Long Beach Phu Quoc Resort in Vietnam for RM65 million. Sale expected to take place in early 2018.

BLand still have a controlling interest in two large hotels in Vietnam after disposing of BLong Beach: the InterContinental Hanoi Westlake (75 per cent ownership) and the Sheraton Hanoi Hotel (70 per cent). According to BLand’s 2016 annual report, both saw increasing occupancy rates year-on-year, of 2.1 and 9.9 per cent, respectively, and increasing revenues.

BJLand also holds an 80 per cent interest in property developer Berjaya Handico 12 Co. Ltd., known for Hanoi Garden City, and a 75 per cent stake in Bien Hoa City Square in Dong Nai province. BJLand is also the 100 per cent owner of the Vietnam Financial Center and Vietnam International University Township in Ho Chi Minh City.with an estimated combined GDV of RM38 billion. These projects remain in the planning stage. http://vneconomictimes.com/article/business/berjaya-land-to-sell-stake-in-phu-quoc-resort

2. Berjaya Jeju Resort Project Compensation (RM646 million)

"Following the suspension of its RM1 billion residential development joint venture in Jeju, South Korea in 2015, the BJLand has partially recovered RM374.5 million from JDC (The Seoul Central District Court was accordingly informed of the abovementioned developments during the first court hearing of the JDC Lawsuit held on 7 March 2016 in 2016) with the remainder sum of RM646.0 million of its initial investment in the Jeju Island project (land appraisal report by court appointed valuer submitted to Korean court for consideration in December 2016) to be recovered through court proceedings by 2018? (within a 3 years period from first legal proceeding commenced on 6 November 2015).

In the meantime JDC has gone ahead with its Modified 2nd Comprehensive Plan for Jeju Free International City (dated Feb. 2017) without BJLand's original Jeju Island Development as the Jeju Land Project has been mutually terminated by BJLand & JDC in March 2016, with partial payment of RM374.5 million from JDC with the remainder sum of RM646.0 million of BJLand initial investment in the Jeju Island project to be recovered through court proceedings filed in Korea on 6 Nov. 2015). Subsequent to the earlier partial payment in early 2016 from JDC, the Korean court in Jeju has also cancelled Berjaya's Yerae Resort Construction permit issued by Jeju Province so the question of compensation to be awarded by the Korean Court is just a matter of time since the first filing of proceedings was on 6 November 2015...coming to year 3 already?

https://www.jeju.go.kr/group/part2/refer.htm;jsessionid=j4qc4qVK9qafqOBa6gSExMx0ezd2XMko6u7AaDlF63E2qIivMBT6j4GdbzxwFXui.was2_servlet_engine1?act=download&seq=1024889&no=2

3. China Great Mall Project (RM598.97 million)

China Great Mall Project Arbitration proceedings filed by BJLand on Jan.19, 2018 at Hong Kong International Centre for Arbitration (HKIAC) for repayment of RM598.97 million and other reliefs against Beijing SkyOcean & its Guarantors in Hong Kong. (Expected recovery of oustanding sum from Beijing SkyOcean through Arbitration Preceedings in Hong Kong will be very much faster (between 2018 to 2020) than the original anticipated period of 3 years for recovery through filing of proceedings against Beijing SkyOcean & its Guarantors at the Hong Kong Civil Courts of Law). http://www.hkiac.org/arbitration/what-is-arbitration

"KUALA LUMPUR (Jan 19): Berjaya Land Bhd's 51%-owned unit Berjaya (China) Great Mall Co Ltd (GMOC) today submitted a notice of arbitration against Beijing SkyOcean International Holdings Ltd to seek recovery of an outstanding payment of 974.07 million renminbi (RM598.97 million)." http://www.theedgemarkets.com/article/berjaya-land-unit-submits-arbitration-notice-recover-sum-china-mall-sale

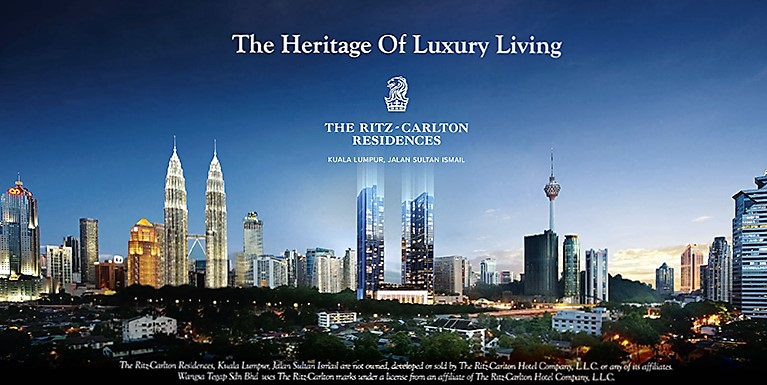

4. Ritz Carlton Residences Property Project Development in Kuala Lumpur (GDV RM1.18 Billion x 60% Sales = RM708 million)

We think the profit from sales of Ritz Carlton Residences will be reflected in BJLand/ BJCorp coming quarter result as according to Focus Megazine, Ritz Carlton Residences was only handed over to buyers on Dec 08 last year and so the sales figures and profits will only be shown in the coming quarterly result ended February 2018.

The total gross development value (GDV) is RM1.18 billion. Already 60% sold in Dec. 2017?

Quote "Berjaya Land reintroduces newly designed Ritz-Carlton Residences Kuala Lumpur - Berjaya Land Bhd has reintroduced its Ritz-Carlton Residences Kuala Lumpur, located at the intersection of Jalan Sultan Ismail and Jalan Ampang, with new interior design concepts. The luxury residences are designed by world-renowned, multi-award winning interior design firm Peter Silling & Associates.

“Buyers can now choose from three interior design concepts — Modern, Classic and Finesse — to match their own individual styles," said Berjaya Land CEO and director of Wangsa Tegap Sdn Bhd Datuk Francis Ng in his welcoming remarks at the media preview of the newly designed project.

The 48-storey project offering residential suites is developed by Wangsa Tegap, a wholly-owned subsidiary of Berjaya Corp Bhd. The total gross development value (GDV) is RM1.18 billion.

Sitting on a 2.7-acre freehold site and one of the two towers at Berjaya Central Park, the Ritz-Carlton Residences consists of 288 suites with unit sizes ranging from 1,023 sq ft to 4,284 sq ft. Prices start from RM2,500 psf while the maintenance fee is RM1 psf.

“Also, the tenant ratio is 50% foreigners and 50% locals. This development is targeted at high-net-worth individuals where 30% of our buyers are actually multimillionaires,” he claimed."

The total gross development value (GDV) is RM1.18 billion. Already 60% sold in Dec. 2017?

Quote "Berjaya Land reintroduces newly designed Ritz-Carlton Residences Kuala Lumpur - Berjaya Land Bhd has reintroduced its Ritz-Carlton Residences Kuala Lumpur, located at the intersection of Jalan Sultan Ismail and Jalan Ampang, with new interior design concepts. The luxury residences are designed by world-renowned, multi-award winning interior design firm Peter Silling & Associates.

“Buyers can now choose from three interior design concepts — Modern, Classic and Finesse — to match their own individual styles," said Berjaya Land CEO and director of Wangsa Tegap Sdn Bhd Datuk Francis Ng in his welcoming remarks at the media preview of the newly designed project.

The 48-storey project offering residential suites is developed by Wangsa Tegap, a wholly-owned subsidiary of Berjaya Corp Bhd. The total gross development value (GDV) is RM1.18 billion.

Sitting on a 2.7-acre freehold site and one of the two towers at Berjaya Central Park, the Ritz-Carlton Residences consists of 288 suites with unit sizes ranging from 1,023 sq ft to 4,284 sq ft. Prices start from RM2,500 psf while the maintenance fee is RM1 psf.

“Also, the tenant ratio is 50% foreigners and 50% locals. This development is targeted at high-net-worth individuals where 30% of our buyers are actually multimillionaires,” he claimed."

5. Property Project Development in Bukit Jalil, Puchong and Georgetown (RM395.5 million)

"Over the near term, its property projects remain limited to ongoing developments in Bukit Jalil and Puchong in the Klang Valley as well as Georgetown in Pulau Pinang. “These projects have a modest combined contracted sales value of RM395.5 million and are expected to be completed by 2019," MARC noted.

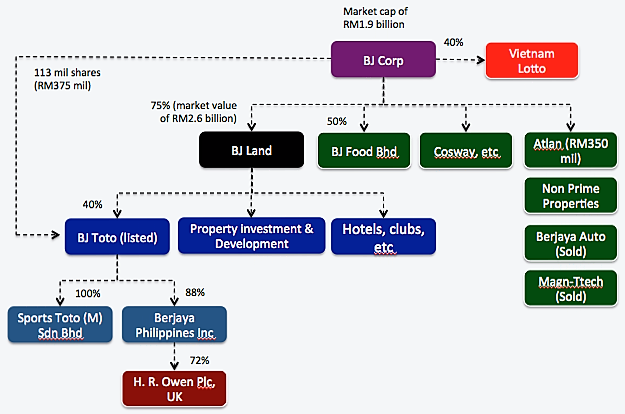

BJ Corp's core asset is >75% (now 78.8%) equity interest in BJ Land. Please refer to diagram below for details of BJLand 's implied market value.

Refer Part 1 Here:

https://klse.i3investor.com/blogs/laulauramblings/147946.jsp

Disclaimer: This is not a call to buy, always do your own research before investing in any stocks...

Sincerely Yours,

laulau :)

More articles on laulau's research

As the US Stock Market is officially in a CORRECTION... HERE'S WHAT USUALLY HAPPENS NEXT?

Created by laulau | Feb 09, 2018

.png)