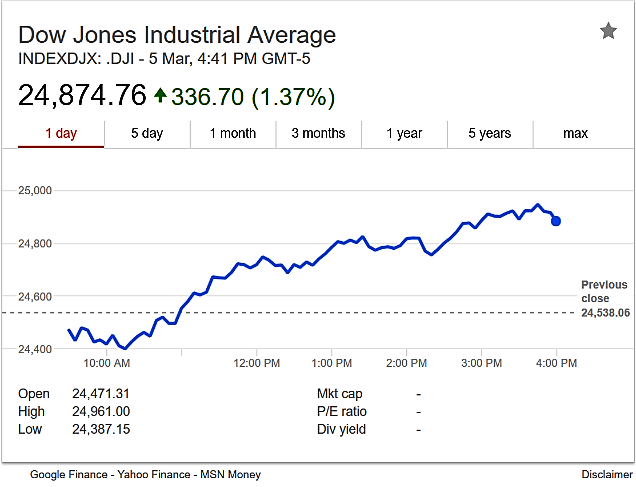

IT'S TIME TO BARGAIN HUNT? AS DOW UP 336.70 POINTS TO 24,874.76 in a Broad-based Market Rally...SIGNALLING AN UPTREND CHANNEL FOR WORLD STOCKS!!!

laulau

Publish date: Tue, 06 Mar 2018, 06:34 AM

IT'S TIME TO BARGAIN HUNT ON BURSA? As Dow Up 336.70 points to 24,874.76 in a Broad-based Market Rally Signalling an Uptrend Channel for World Stocks!!!

IT'S TIME TO BARGAIN HUNT BEATEN DOWN STOCKS LIKE HENGYUAN, BJCORP, BJLAND FOR POSSIBLE PROFIT$$$$

https://klse.i3investor.com/blogs/laulauramblings/147847.jsp

https://klse.i3investor.com/blogs/laulauramblings/147946.jsp

U.S. stocks closed higher Monday, with the Dow Jones Industrial Average bouncing back from a four-session losing streak, as investors looked beyond the threat of a global trade war and instead focused on positive economic data.

Strategists also cited rising oil prices and ebbing concerns after an Italian election for a relief rally in the three major U.S. equity indexes.

Investors started to eye Trump's threat as a negotiating tool after he tweeted that Canada and Mexico could avoid his proposed tariffs if they ceded ground in the North American Free Trade Agreement (NAFTA) talks.

A lack of specific retaliatory measures from other countries was also reassuring, said Mona Mahajan, U.S. investment strategist, Allianz Global Investors in New York.

Art Hogan, chief market strategist at B. Riley FBR in New York, said the administration "sees the stock market as a report card for success and markets have so far said this trade war is not a good idea."

The Dow Jones Industrial Average (.DJI) rose 336.7 points, or 1.37 percent, to 24,874.76, the S&P 500 (.SPX) gained 29.69 points, or 1.10 percent, to 2,720.94 and the Nasdaq Composite (.IXIC) added 72.84 points, or 1 percent, to 7,330.71.

Investors were also watching the aftermath of Italy's election which registered a strong showing for anti-establishment parties though with no group able to form a stable government.

All 11 S&P sectors rose, and the biggest drivers were information technology (.SPLRCT), which rose 0.9 percent and the financial sector (.SPSY), which gained 1.4 percent. Facebook (FB.O), Amazon (AMZN.O), Netflix (NFLX.O) and JPMorgan (JPM.N) provided the biggest boosts from single stocks.

The energy sector (.SPNY) ended up 1.1 percent as oil prices rose on forecasts for robust oil demand growth and concerns output from OPEC producers would grow at a much slower pace in coming years. [O/R]

The utilities sector (.SPLRCU) was the biggest percentage gainer with a 1.95 percent increase followed by the financial sector's (.SPSY) 1.4 percent gain.

Advancing issues outnumbered declining ones on the NYSE by a 2.82-to-1 ratio; on Nasdaq, a 2.20-to-1 ratio favored advancers.

The S&P 500 posted 12 new 52-week highs and four new lows; the Nasdaq Composite recorded 113 new highs and 20 new lows.

Volume on U.S. exchanges was 6.91 billion shares, compared to the 8.3 billion average over the last 20 trading days.

What did the main benchmarks do?

The Dow DJIA, +1.37% bounced back from an earlier decline to rise 336.70 points, or 1.4%, to 24,874.76.

The S&P 500 index SPX, +1.10% rose 29.69 points, or 1.1%, to 2,720.94, with all 11 subsectors finishing higher, led by utilities and financials. The Nasdaq Composite Index COMP, +1.00% added 72.84 points, or 1%, to 7,330.70.

What the Chartist Is Saying?

More articles on laulau's research

Created by laulau | Feb 09, 2018

.png)