A diamond in the rough – why you should include KLSE: SERNKOU in your portfolio

leafy_research

Publish date: Tue, 16 Nov 2021, 11:15 PM

A diamond in the rough – why you should include KLSE: SERNKOU in your portfolio

Executive Summary:

-

Sern Kou is an integrated timber and wood processing company with exposure to the booming furniture market in Malaysia, which gives the company a unique proposition in the market.

-

The company had displayed encouraging growth despite headwinds in the market, mainly due to their well-managed cost’s structure.

-

Mitigated impact in their furniture industry as the key revenue driver is coming from the timber and wood processing sector, while having increased demand from the furniture industry.

- Exciting growth prospects moving forward and is trading at a high margin of safety at 39.05% based on the current price of RM0.640.

The recent listing of Ecomate had piqued investor’s interest and created hype around the furniture industry, and while the furniture industry will be enjoying the backlog orders in 4th quarter of 2021, majority of the player will make losses in the upcoming quarter – which is the 3rd quarter of 2021.

But not for Sern Kou.

Incorporated in 1992, Sern Kou had a humble beginning in Muar, Malaysia, and was initially a pure furniture manufacturer. When the current MD, Mr Chua, took over the leadership of the company in 2015, he saw opportunities and swiftly expanded upstream to include processing and trading of rubberwood & timber, which consists of sawmill operations and plywood manufacturing, while maintaining exposure in the manufacturing of rubberwood furniture (downstream) market. For now, the company has approximately 3,000-ton of monthly production capacity in its sawmill operations, with a utilization rate of close to 100% based on our ground checks. In fact, with demand expected to remain strong, it has recently added another 1,000-ton of production capacity per month.

As for its furniture segment, the company is capable of delivering over 120 40-footer container per month, with exposure to over 52 countries.

That being said, the manufacturing and trading of furniture still contributed a relatively low top and bottom line for the company.

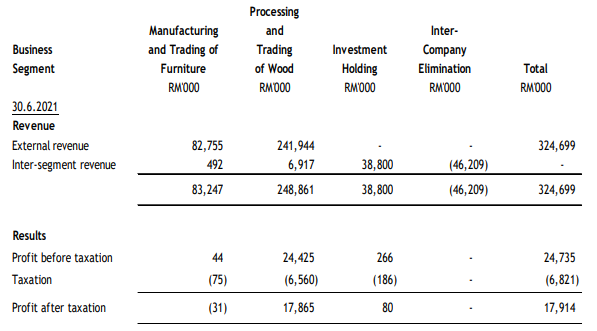

Most people would like to position Sern Kou as a furniture maker, but the matter of fact is, the company is not a “furniture maker”, but is being positioned as an integrated timber and wood processing company with certain exposure to the booming furniture market in Malaysia – albeit most furniture players will make losses in 3rd quarter of 2021. Also, I would like to point out that the company had a relatively low inter-company transaction based on the eliminated amount proportionate to the total revenue.

Which means, Sern Kou does not “create business” internally, but mainly deals with external market on its up, mid, and downstream business.

While we are aware that most investors generally perceive the furniture industry as a sunset industry due to lingering law material and labour shortage issue, Sern Kou had showed commendable YoY growth despite the external headwinds, and this was mainly contributed by their up and midstream division. We also expect that with increased backlog orders in the downstream furniture industry, Sern Kou is poised to benefit from the increase in demand for raw materials.

Oh, you must have noticed that they are the supplier of raw materials, but not the pure consumer of the raw materials.

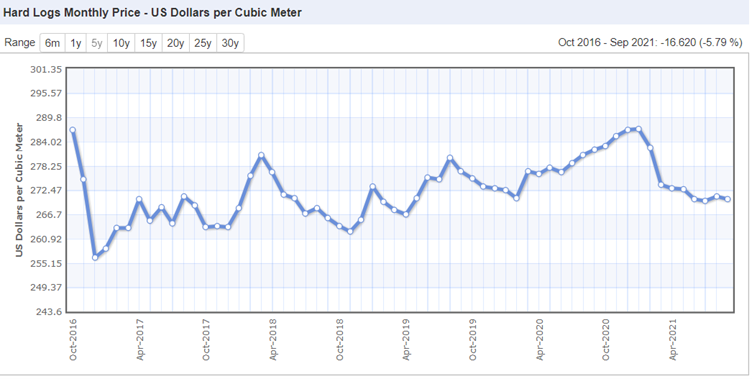

We would also like to highlight that there had been a reported shortage of logs in overseas market. And this should be beneficial for Sern Kou as they had just expanded their sawmill capacity in April this year. Over the years, Sern Kou had been delivery a revenue CAGR growth of 8.68%, and with the Trade War shifting the quantum of the furniture industry, more orders flowing to ASEAN countries is equivalent to better performance for the company.

Lastly, the company had RM17.56 million of net profit in 2021, assuming a 15% growth in terms of upstream demand and backlog orders in the meantime, a conservative RM21.07 million of net profit should be achieved in 2022. For Sern Kou, their unique proposition and strong financials had earned them a weighted average PE of 41.6 times, hence if we take the average, the market capitalization for the company should be RM876.5 million, or in other words, Sern Kou should have a share price of RM1.050 based on 803.93 million shares in circulation. But instead, the company is currently trading at the share price of RM0.640, which is equivalent to a discount of 39.05% at current level.

More articles on Leafy Research

Created by leafy_research | Jul 28, 2021